This is a summary of the key highlights from 3 years of daily market comments and weekly reviews on this site.

If you want a more extensive version, please see the featured posts item on the menu bar.

2015

Recognized the low 9/30/2015

2016

Shifted completely defensive 1/7/2016, declaring bear for real

Then starting buying back stocks one day off the major low of 2/11/2016

And EWZ & RSX shortly after (massive years for both from there)

March 2016 turned back to full bullish mode on stocks

Recognized semiconductors in early stage of massive parabolic move

Called the all time bond top & yield low at the decade turn, one shot

Long and strong in August 2016 despite skepticism by big names on the street

Long financials before the election jump

Massively bullish after election

2017

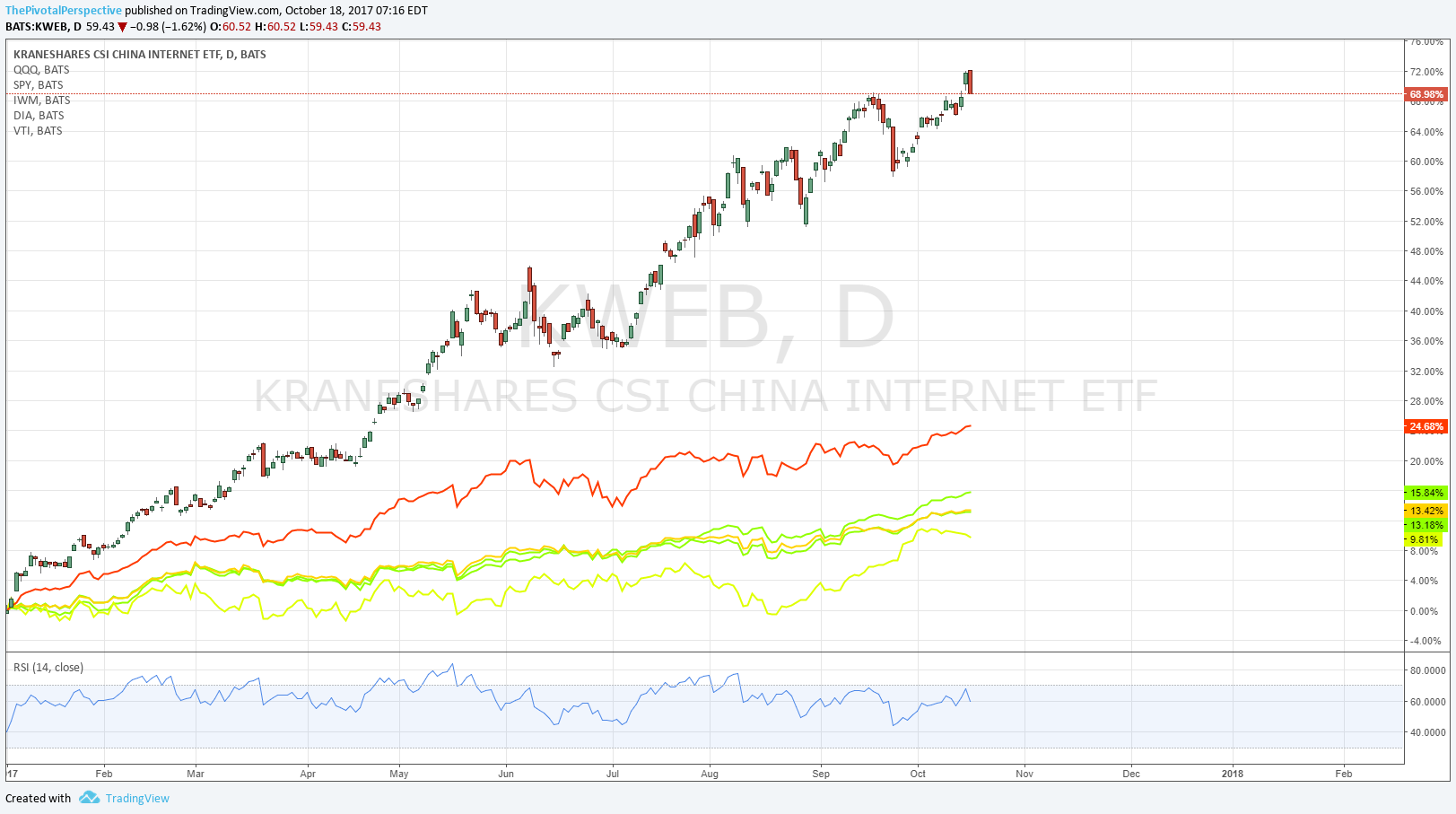

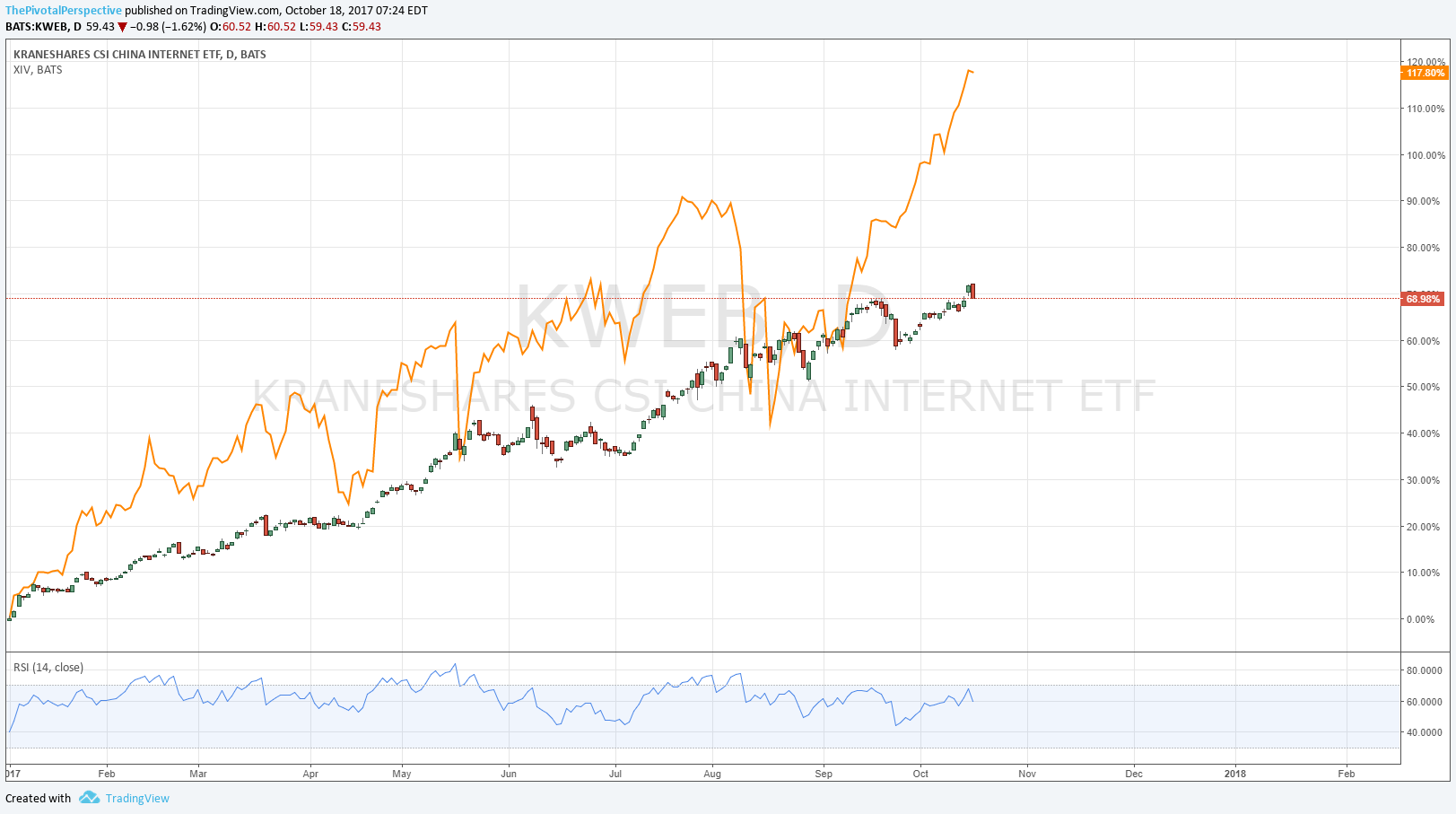

Called for China tech to be leader for 2017 in Dec 2016 (3rd best category of 2017 after cryptos and short volatility)

Bought the dip in April after showing mild caution before

Remained bullish after August mini pullback

2018

Year started strong as expected

While noting that the asset class to avoid was bonds from mid January

Then nailed the stock top and volatility spike with VIX spiking as called in advance!

Twitter timestamp on volatilty call to spike 1/25-2/15 made on 1/24

Expected commodities to outperform in 2018

Noted emerging market weakness from April and beyond (one of many examples)

Caught the bond low and main rally of the year

And then nailed the October stock drop in advance with call of larger cycle weakness from 10/10 which played out exactly as called!

Twitter timestamp #1 calling for October down with tech most at risk for drop on 9/20

Twitter timestamp #2 on October 10/10 risk off from late Sept

Twitter timestamp #3 on next move -5% down on day of DJI high

Twitter timestamp #4 on immanent breakdown to happen 10/19-26 made on 10/22

PS: Bitcoin rec 406

As impressive as this list is, there are many many more good calls on the featured posts. I didn’t pick out the medium term trading tops and lows, currency moves, etc.

Throughout these years I have stayed mentally flexible and committed to my process and system. As it turns out I have spotted the many of the major moves in markets each of these years, despite their vary varying nature:

Turned bullish stocks and oil from 2/12/2016, including focus on oil, EWZ & RSX

Recognized semi-conductors in early stage of massive move up

Spotted the bond turn

Long financials before election jump, and bullish from there in general

These were most of the biggest moves in 2016.

Stayed bullish 2017

China tech was the 3rd best trade of 2017, after crypto and short vol (bitcoin rec from 406 kind of takes care of #1). Yes emerging markets were hot but it was China tech that was the leader of this theme.

In 2018, nailed both the Jan-Feb volatility spike (Twitter timestamped!)

and the October drop (Twitter timestamped!)

Among the two biggest moves in the shortest time of the year, while being largely bullish from the beginning of 2018, especially May and then July.

Is there any other analyst that compares?

I would love to pursue my passion full time at a fund or wealth management company. I have made all of these calls on a very part time basis while maintaining a busy day job, combining my system of technicals and timing. How is this possible? Because I performed many years of research for many years on what really moves the market in a way that is truly unique.

If you want to dig into the details and perform due diligence, 3 years of daily comments are on this very site. Recently I have shifted to 100% Twitter for more interaction. Thanks for your interest in my work, and I hope to be able to be in a position to do this full time in a role of more consequence in the near future. Thank you.