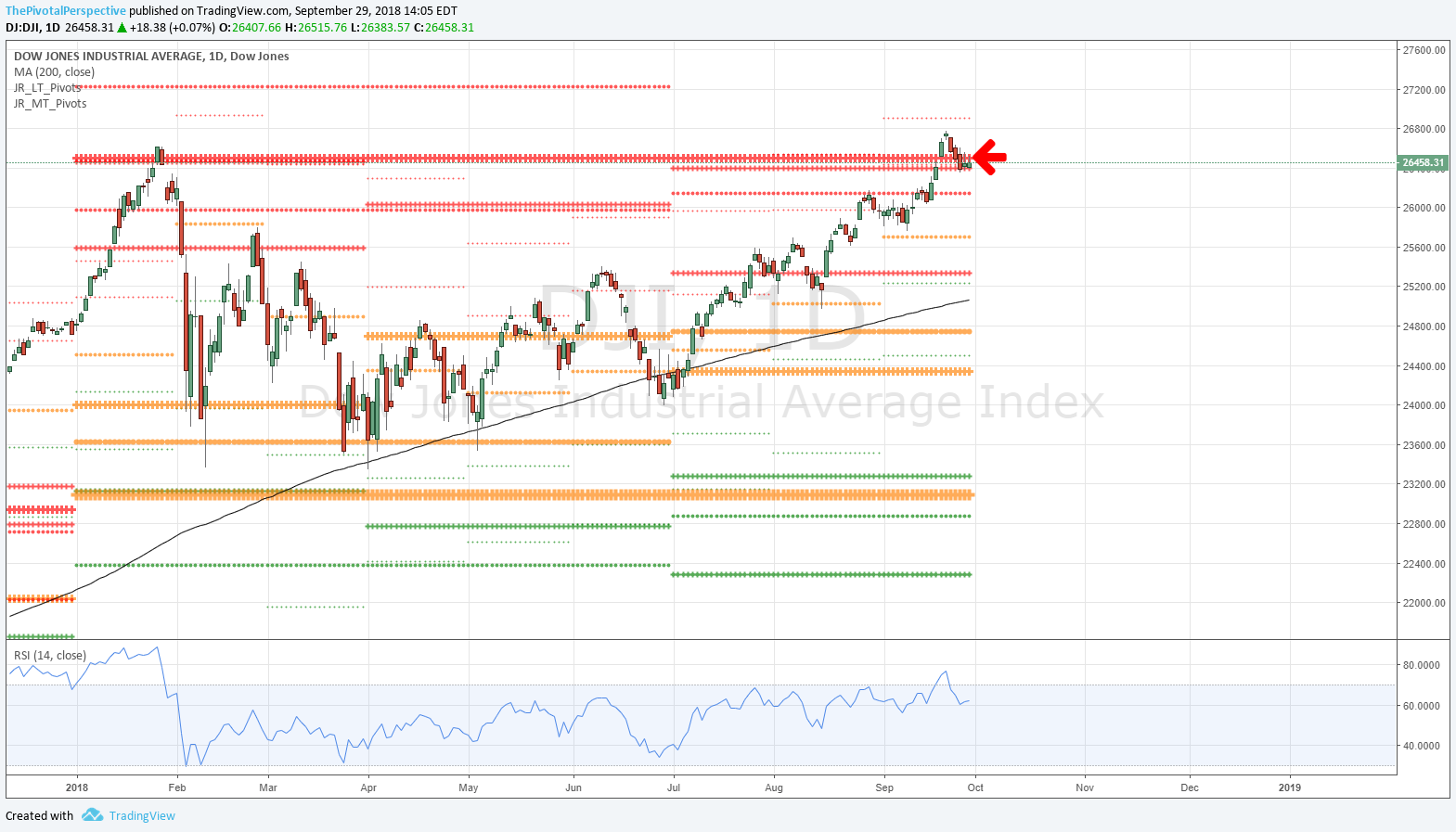

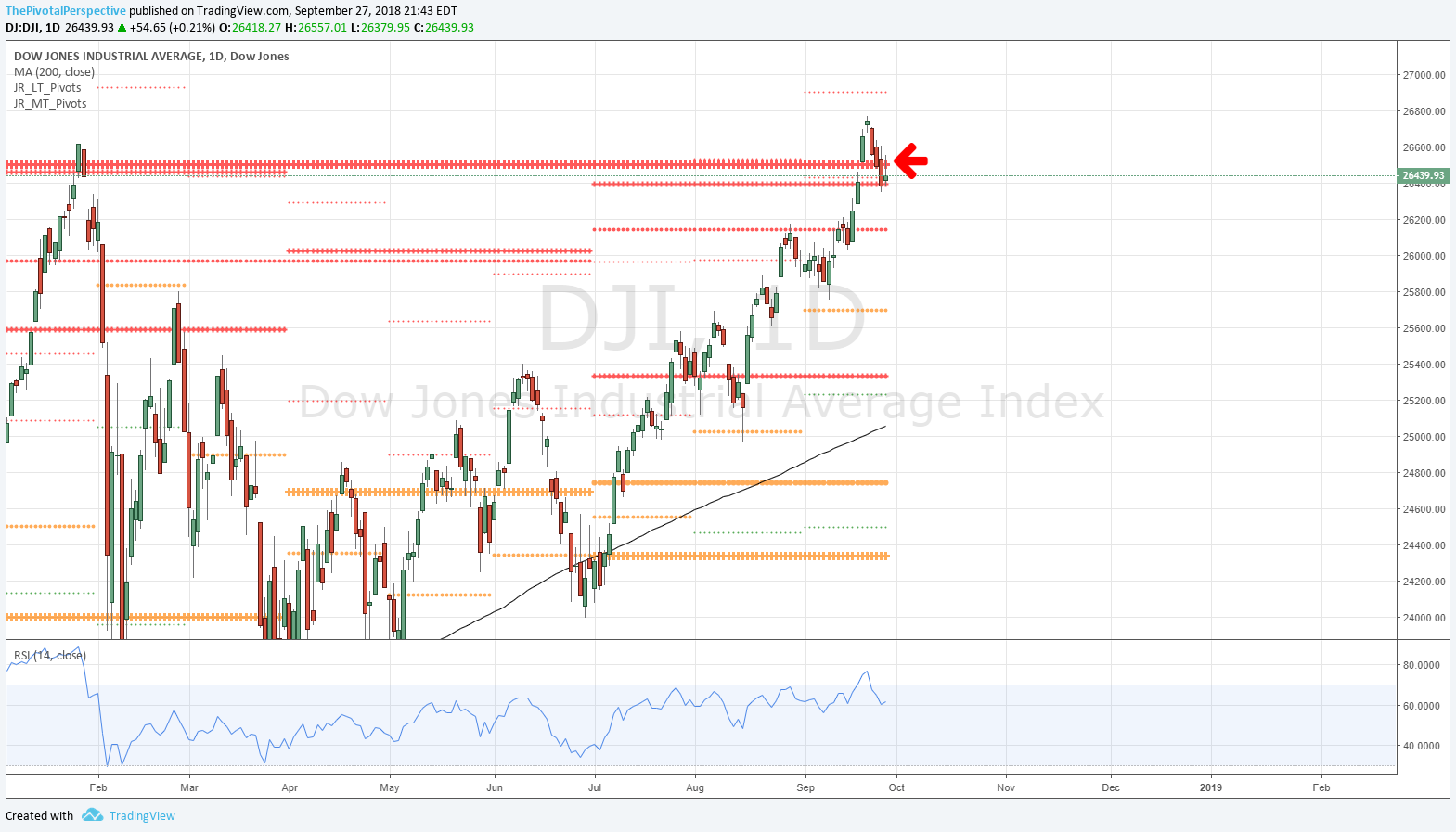

I came into this week expecting a pullback. Per the latest Total market view on the blog:

"Bottom line - Often DJI pivots give the definitive tells. The market just stopped at DJI HR1 so taking steps to lock in some gains, or play for a bit of downside while holding longs, should work or will have low cost at worst. In addition, September is known for weakness followed by a strong Q4 especially in bull markets, so a strategy for near term weakness but likely higher highs seems to fit the market here."

Lock in gains, playing for downside, near term weakness, all check, check, check. That said, this week has unfolded differently than planned. NDX, last week's technical leader, has dropped the most. What seemed to be ready to drop, DJI, has been steady. VIX / VXX have done OK, but not great, as a hedge. FXI short did work if you got in last week, but this just helped avoiding some, not all, losses on INDA longs.

In sum a lot was right in last week's Total market view, but it would have been better just to take profits on longs instead of trying to hedge.

OK now what? As usual lets run through the main USA indexes and key safe havens:

+s

SPX held MP on test

RUT still above MP, though gains of yesterday gone

DJI and NYA still above all pivots

-s

NDX break of MP, so first USA main index below a monthly pivot in several weeks

VIX above MP for the 2nd day in a row

VXX fractional close above its MP

TLT fractional close above QP

So it is about even here with two of the -s fractional events that could easily change. If SPX and RUT can hold their MPs then that is still 4 of 5 USA mains above. But if they break, then it will be 3 of 5 below, inviting more near term weakness.

Right now I think odds favor bounce Friday - but this is not a lock.

SPX, RUT and VXX below.