The collection of key calls below have been on the right side of markets - meaning mostly USA and global stock indexes, and also selected bonds, currencies and commodities - for much of the year. At nearly every point, The Pivotal Perspective has been long the market leaders early in the move, and locked in gains near the highs. The Pivotal Perspective has been bearish when correct to be bearish - on stocks in January, $USD in March and April, TLT and GLD in Q4. And it has been bullish when correct to be bullish - TLT and GLD in January and well beyond, stocks since March through Brexit and TrumpIt, $USD in Q4. Please see for yourself by reading the real time comments made on the day of entries, not after the fact, all documented below.

Most usually I go with trends - buying and rotating into strength, and avoiding weakness (except as occasional shorts). Only three "speculative" ie pure counter-trend positions were recommended all year. All others required the index to be at least above a monthly pivot to be long (and most usually more than that, ie, above 2, 3 or 4 pivots); or below a monthly pivot to be short (again, most usually more than that, ie, below 2, 3 or 4 pivots). But these were the three - and only three - pure counter-trend plays:

DIA long 2/12, one day off re-test low of year 2/11

Oil long 2/12, one day off low of year 2/11

TLT short triggered by level specified in advance on 7/8, high of year within .02

Is there anyone else out there in the market commentary universe - or for that matter, any algo - who (or that) told you to buy stocks and oil both one day off the low of the year, and short bonds on the very top? And without buying on any drop, and shorting bonds the whole way up? Three for three on the biggest turns of the year? I don't think too many people or programs can match what I did this year in this regard.

An assessment of the calls below leads to only one conclusion - despite all the current hoopla about passive indexing, an intelligent active approach is possible. Perhaps a bit less so for the very largest institutions who are less flexible in maneuvering, but if major players like Druckenmiller and Icahn can unwind significant positions in a day, then most of us can too.

Funny, hedge funds are suffering huge withdrawals due to pathetic performance. And yet there *is* a different way which I have demonstrated from the start of this site - it just takes some fresh synthetic thinking. I hope to continue to demonstrate this in months ahead.

January

Turned decisively defensive USA stocks 1/6-7 and bullish TLT 1/6 as well.

SPY to 186.25 from 1/6

Bear for real from 1/7

TLT buy from 1/6/2016

Targeted TLT at 134 when it was at 125.

TLT target 134.42 from 1/13

Highlighted gold at the end of January and recommended to add in early February.

GLD posts 1/27 & 2/1

February

Started buying back stocks and oil 2/12.

INDU / DIA speculative buy from 2/12

Oil speculative buy or short cover 2/12

Recognized this as possible low of year.

Spotted Brazil, Russia and EEM out-performance early in the move. All three, especially Brazil, continued out-performance into November.

RSX & EWZ long ideas from 2/13

March

Turned back to bullish USA stocks 3/12.

"Bull alive and kicking" with INDU above 17138 from 3/12

Recommended Dow Industrials and Semi-conductors on the way up. Semi-conductors among best USA sectors to hold for most of the year.

DIA and SOXX longs on the way up

While being bearish $USD.

DXY weak from 3/16

April

Bullish USA stocks.

Bullish throughout April...

Until 4/19-20.

Top calls 4/19-20 and 5/1

May

Spotted 5/19 as decent pullback low.

June

Bullish after Brexit.

Critical day 6/27, very bullish from there through early July.

July

Shorted bonds at the top!

Bond short at the high!

This remains the only speculative (ie above pivots) non hedge short I have recommended on this site - ever.

August

Stayed long early August when several prominent names were all saying sell.

"Long and strong" in August so far...

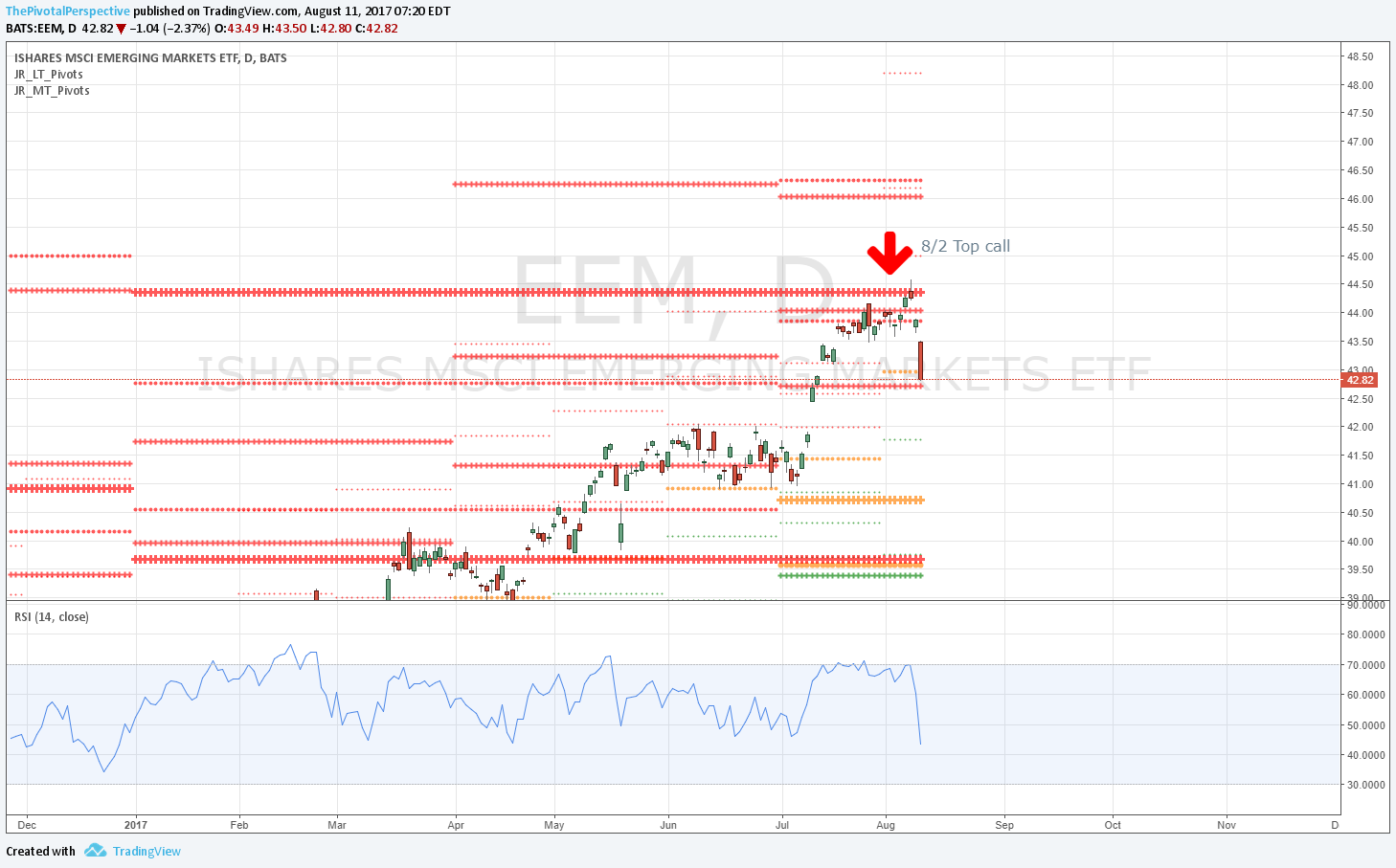

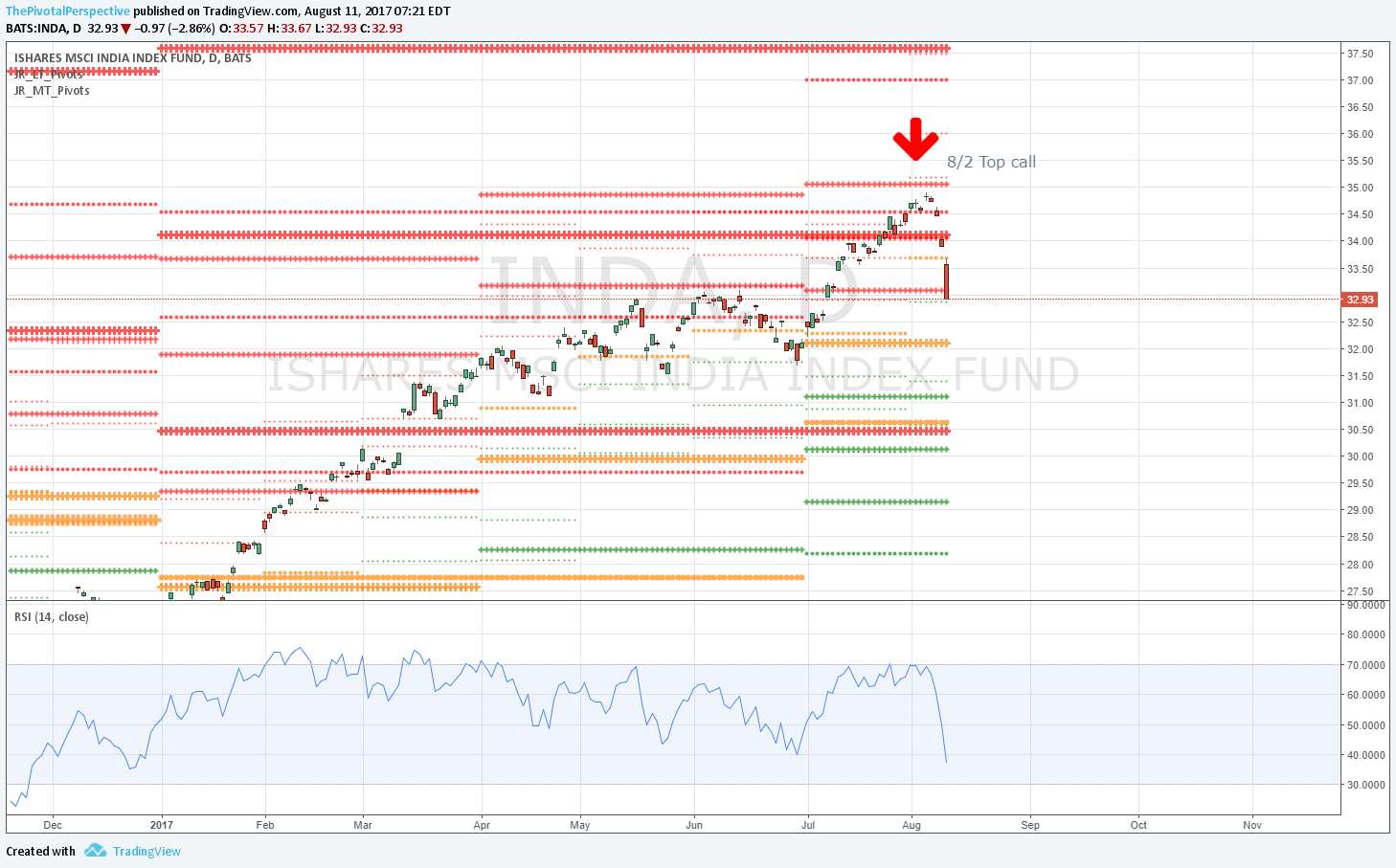

And added a top performing EEM early in the month.

EEM long 8/3

Until turning more cautious and saying upside limited later in August and early September.

Caution comments last several weeks!

Started thinking about a big jump in rates that would benefit financials - written with TNX at 1.57 (TNX currently about 100 bps higher, and XLF up more than 20% since then).

Big picture thoughts

September

Expected "stiff resistance" to hold 9/6 (market agreed with a 9/7 key high)

October

Was clearly bearish TLT and GLD early in October.

Not surprised at TLT and GLD slam

And massively bullish $USD.

Long both $USD and oil for Q4

While ducking out of the way of a stock pullback later in the month.

Caution alert 10/27, lifted 11/7

November

Was accumulating financials in October, specifically recommended early 11/5, and proclaimed new sector leader 11/9.

All over financials before the jump!

Clearly bullish USA stocks after the election, and continued bearish safe havens TLT and GLD.

Bullish comments from 11/9+

December

Suggested partial portfolio hedge right on RUT / IWM highs.

12/11 Total market view

And got the FXI short! (The only non-hedge short since 12/7)

Caught China short!