Very odd day.

+s

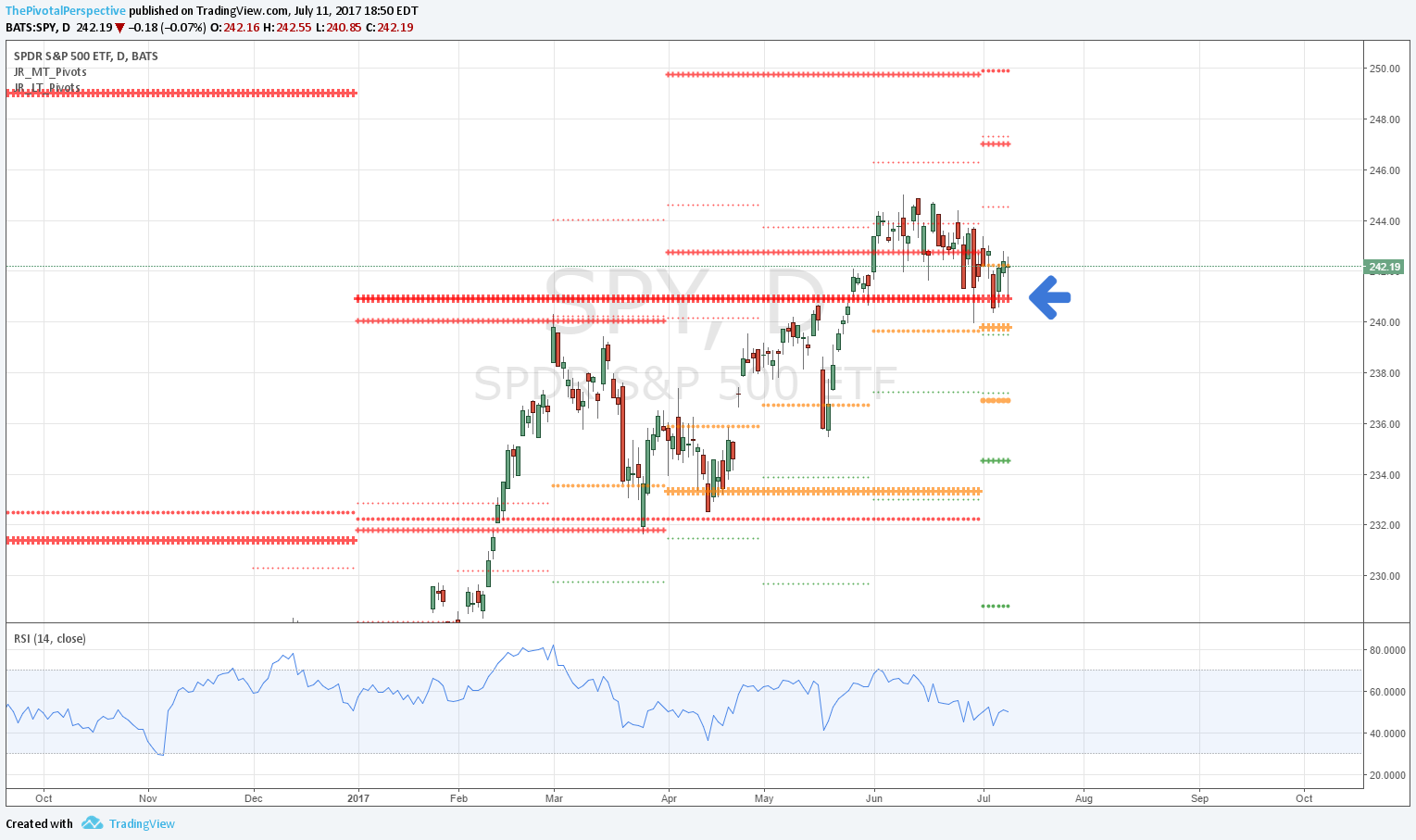

SPY held YR1 as support

DIA held YR1 and JulP on exact tag

IWM back above all pivots

NYA above all pivots

SMH also above all pivots

INDA, FXI, EEM, KWEB above all pivots

XIV above all pivots

-s

SPY JulR1 resistance

QQQ also still under JulR1

VTI under YR1 and JulP

ISEE 216! 3rd highest this decade!

Luckily put-call and other recent sentiment meters are not at extremes, but even so, this is really worth watching. The highest reading of the decade of December 2010 a non event; but #2 on 5/14/2015 was just 4-5 trading days away from a major trading top! The high made on 5/20-21 (5/20 price high, 5/21 close high) held until 7/2016 with a real deal correction in the middle of that period!

In addition, daily range has been increasing in recent weeks. Increased volatility with market near highs is more usually prelude to a larger drop.

I am now back in the skeptical camp.

Portfolio is 100% long, yesterday shifting out of IWM into EEM which did pay off today. IWM back above all pivots, but not adding leverage on day after such a high call reading. Instead I think will add +2 GLD, and may add GDX if that clears its YP tomorrow. This is an interesting low cost hedge against political turmoil with clearly defined risk reward (daily clsoe below GLD YP).

Given that sentiment reading I am ready to further reduce longs, revisit UVXY, or add to GDX if above its YP as mentioned.

SPY, QQQ, IWM, GLD, GDX below.