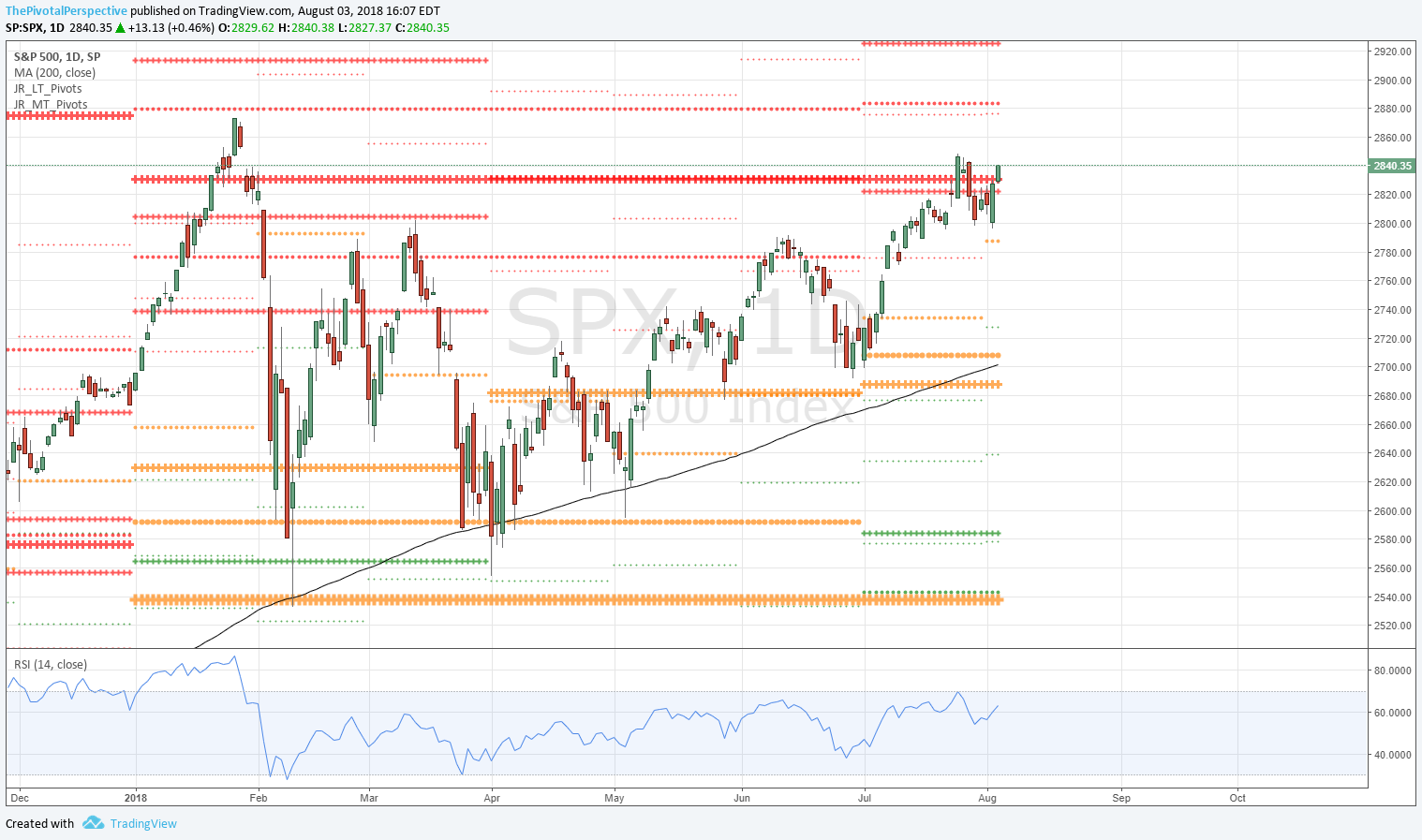

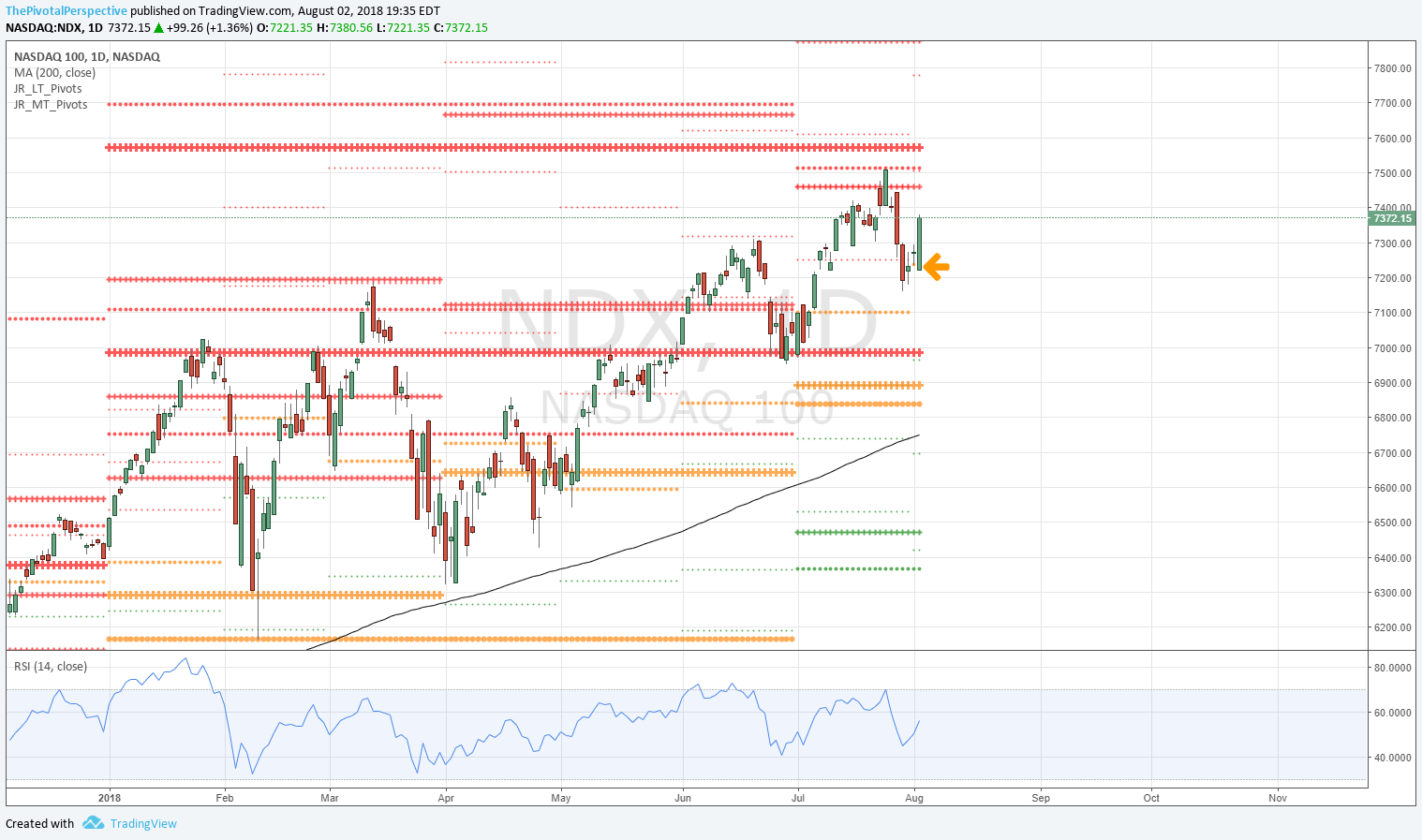

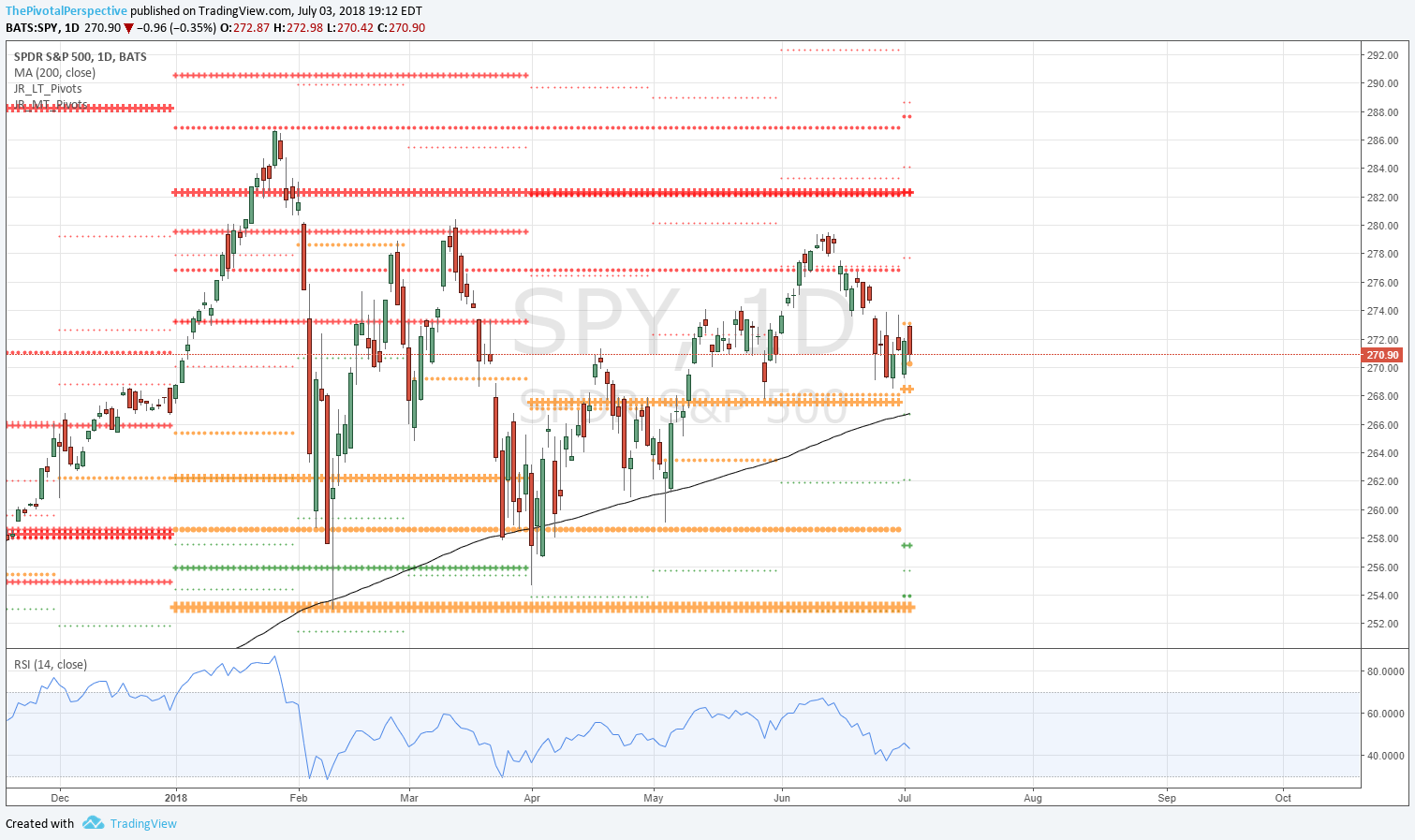

Today the target areas I have been mentioning for most of the month tagged on SPX and NDX. SPX in particular was kind enough to top within 1 point of the YR1, actual level 2830.67 and the high today 2829.99.

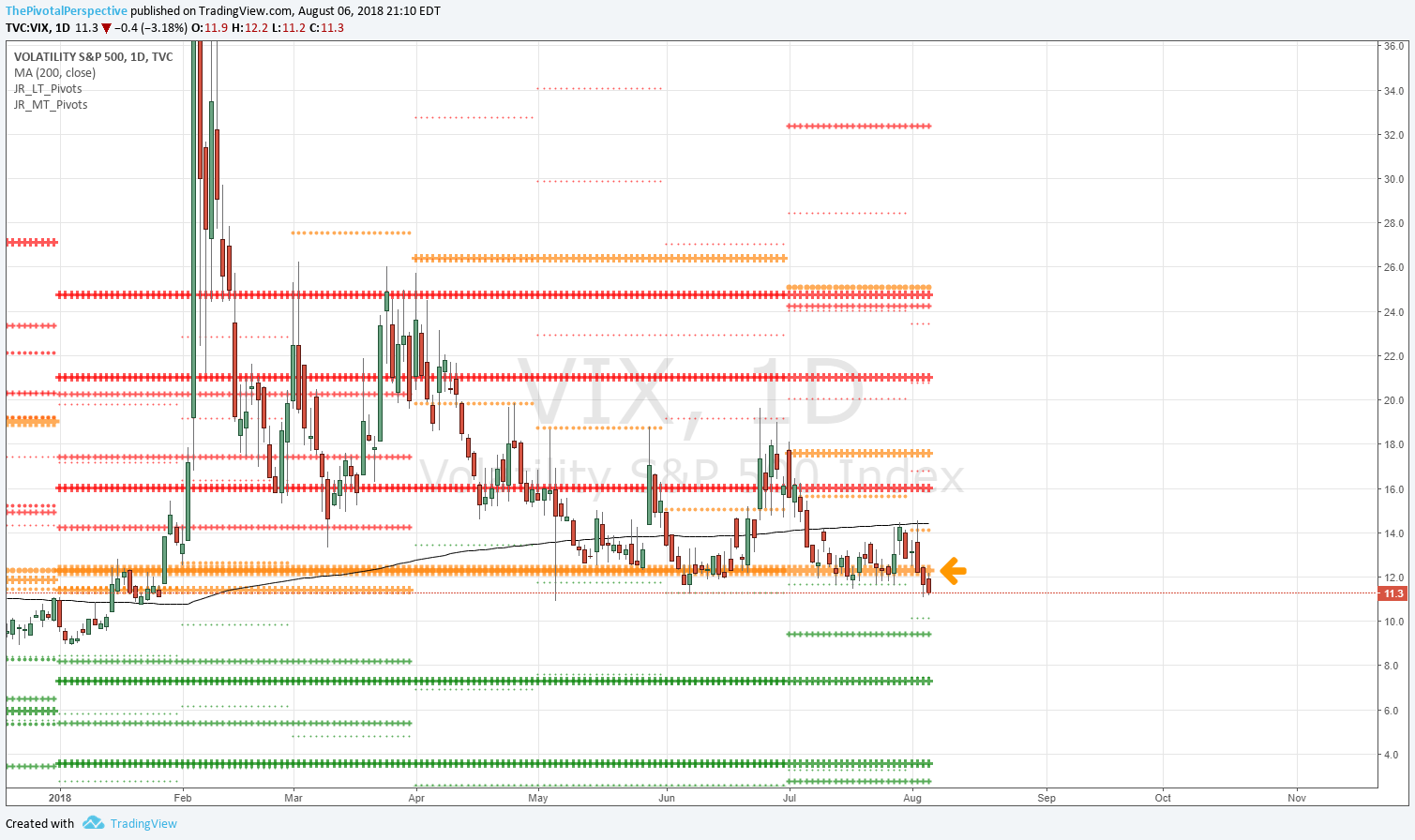

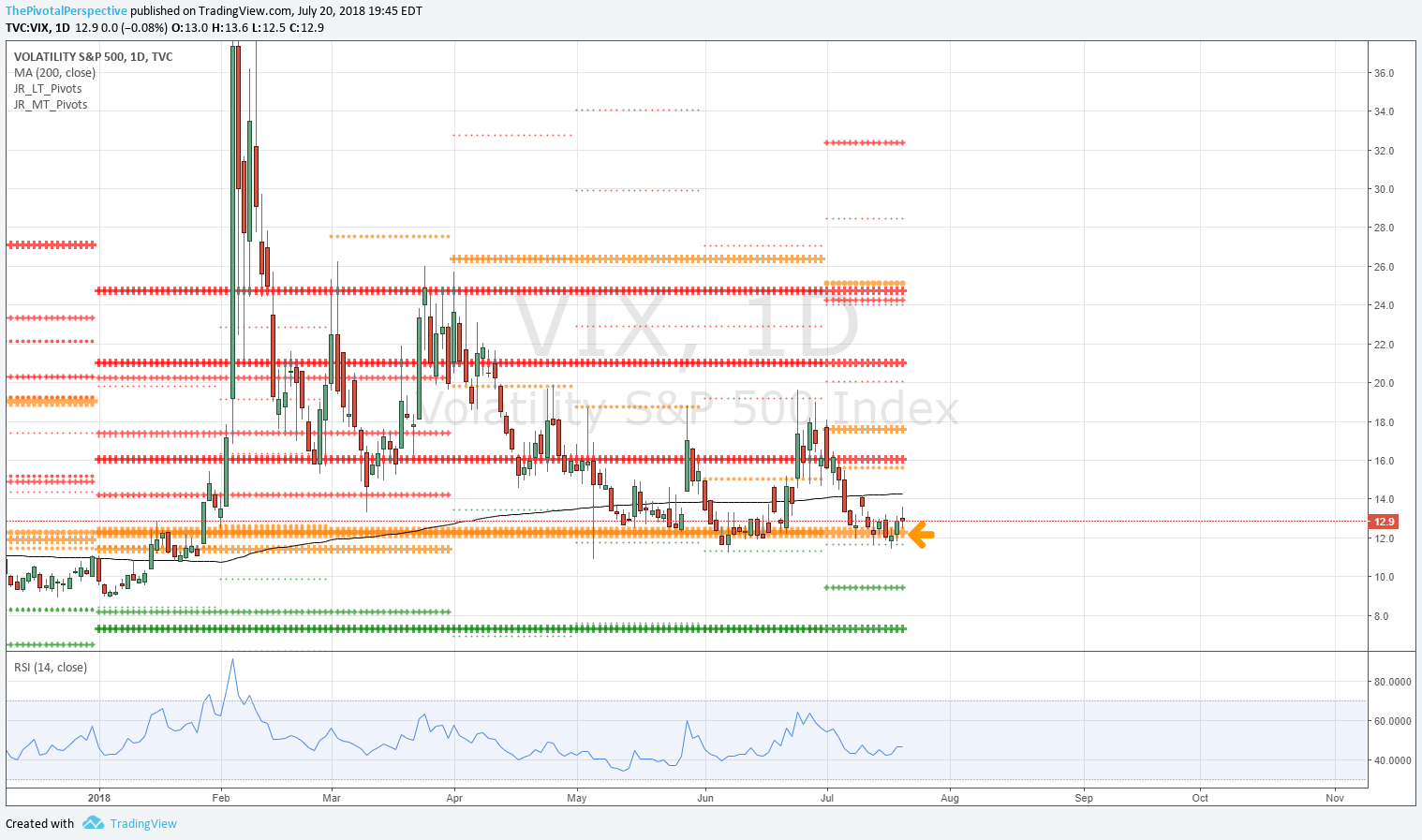

However, RUT got slammed with a massive rejection of YR2 for the 3rd time this year, and VIX held its YP. The other earlier leader this month, XBI, also gave back gains.

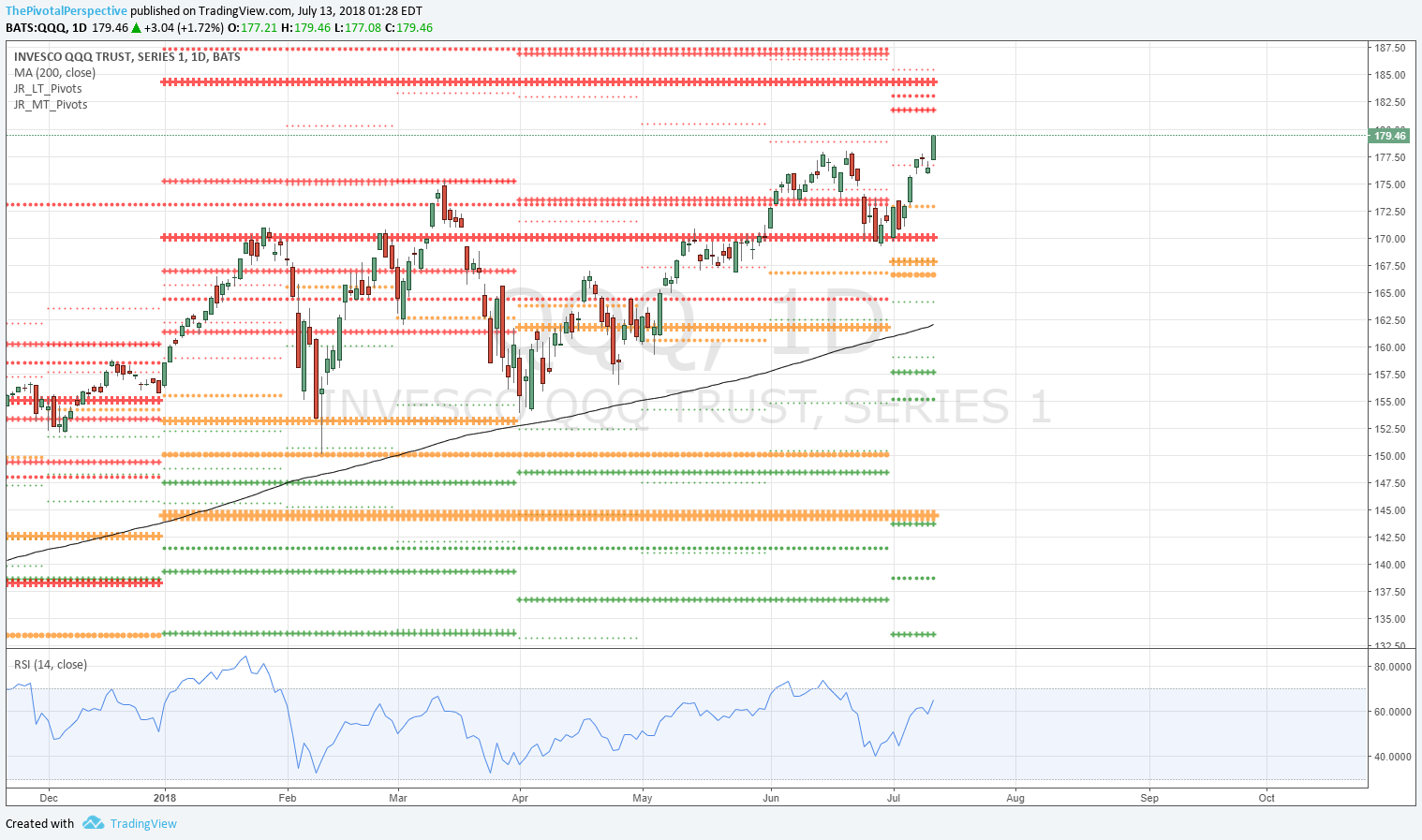

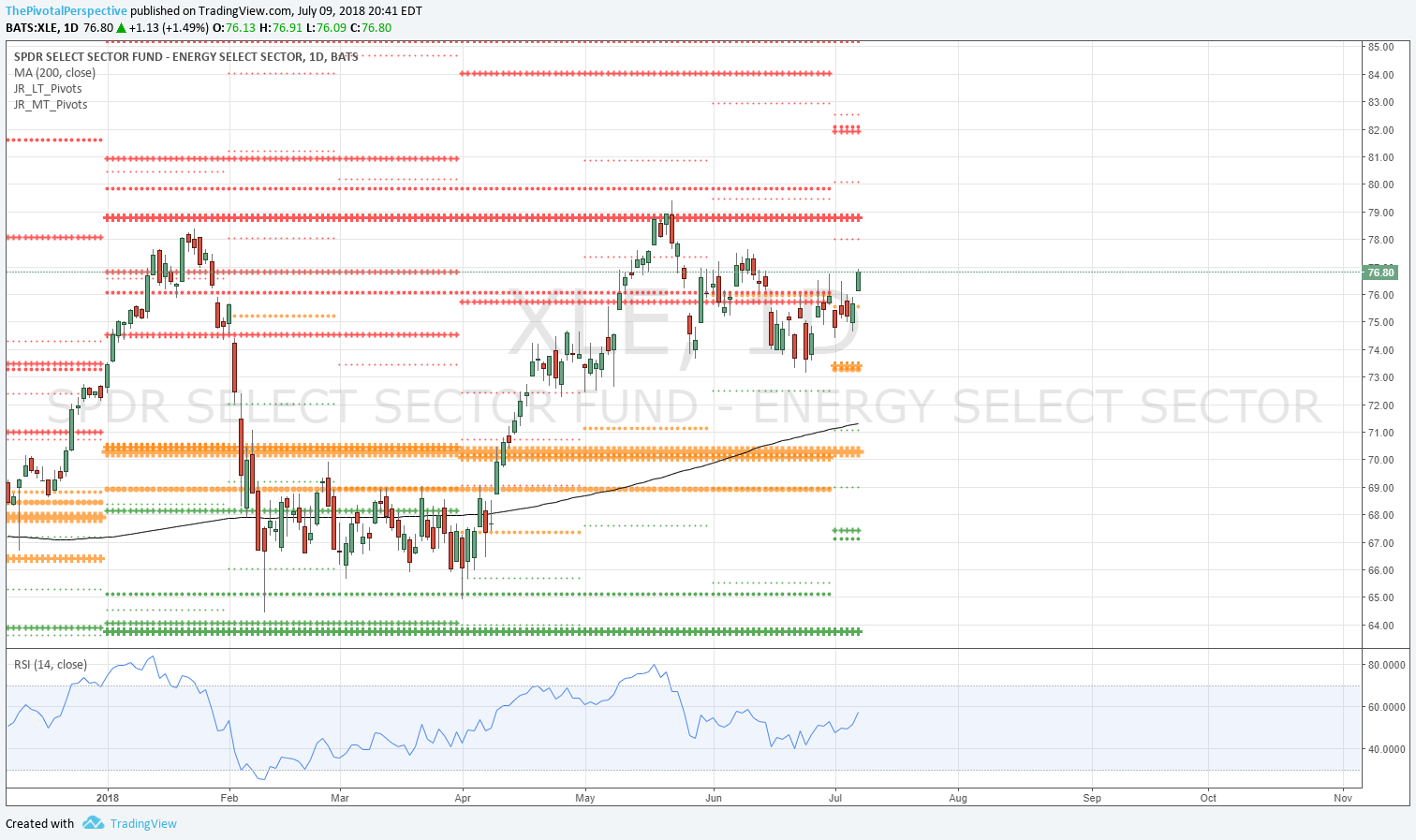

If you have taken all the longs I have mentioned at least QQQ, SPY, XLF and INDA helped make up for this. If you were sharp it was clear that both IWM and XBI weren't rallying early in the day.

I have also mentioned that if we saw VIX plunge through its YP then it might just be better to hold all longs. But if that didn't happen, then I'd be taking action to take profits or hedge.

Sometimes it can be hard to tell what is a pause before a blast through or what is a real turn. Regardless the better thing to do here was reduce long exposure by protecting on IWM and/or XBI; hedging via VIX longs; or hedging on IWM shorts if you spotted that move fast enough.

If you are doing less in and out, and simply holding long with a minimum of action, you might want to give this room and hold above AugPs as sentiment isn't that toppy and daily & weekly charts aren't overbought. However, let's be clear - 3 yearly levels in play, SPX, RUT and VIX. Also, both NDX and NYA tagged QR1s, and DJI was a just a small miss. 4 of 5 USA mains on resistance plus VIX is enough for a trading turn.

SPX, NDX, RUT and VIX below.