Yesterday, I noted that the market wasn't yet speaking with a unified message. My larger view remains 'upside limited along with risk increasing' due the topping nature of several quarterly and monthly charts.

In addition, several indexes now have long term pivotal weakness - something we have not seen since early 2016. Specifically, DIA and NYA among USA mains and XLF and SMH in the sectors I track are now below 2HPs. This is happening as there is widespread weakness in international indexes and especially in $USD denominated ETFs.

Today:

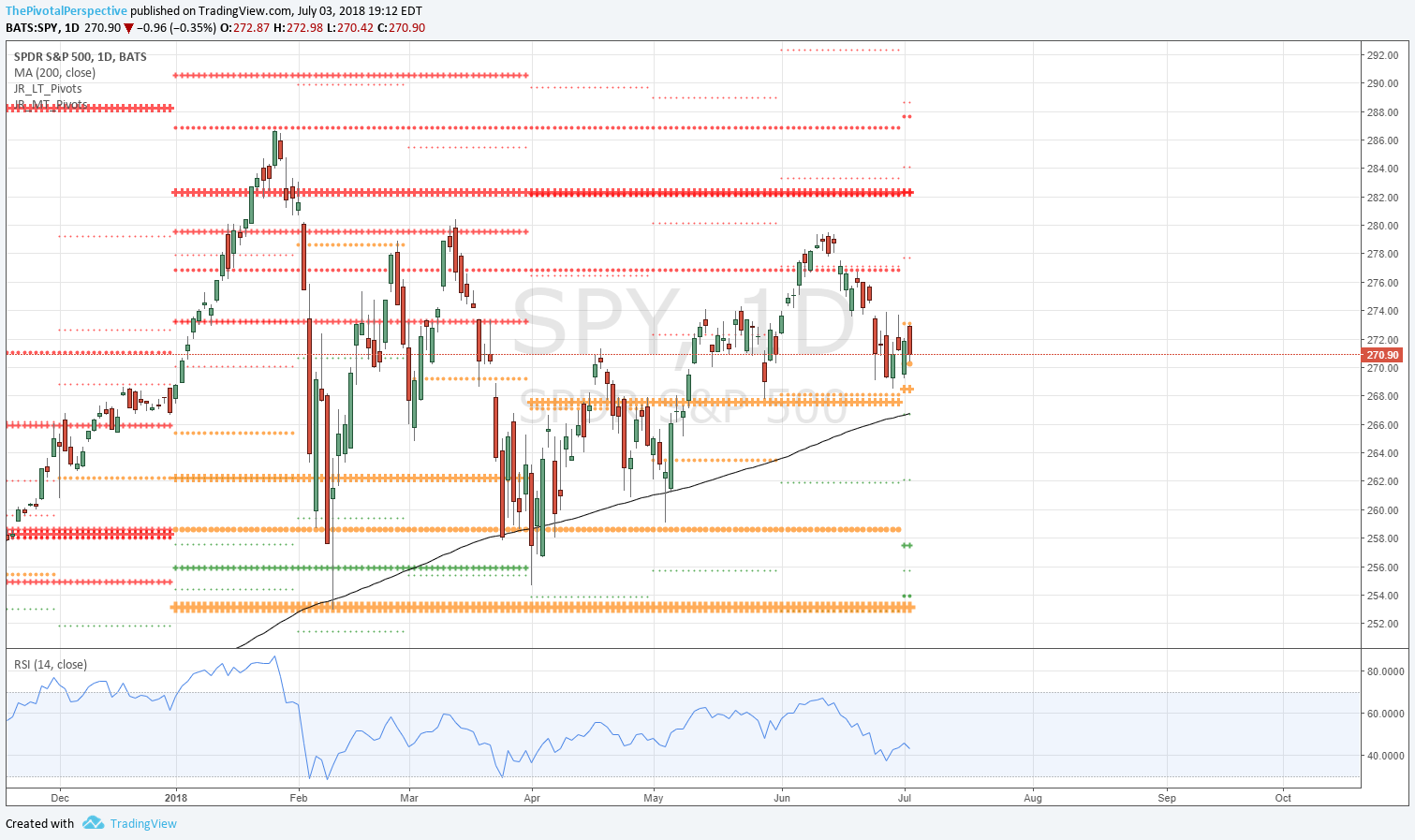

SPY JulR1 rejection, still above 2HP

QQQ JulR1 rejection

DIA QP rejection, below HP and JulP - and D200MA selling

IWM JulR1 pause

NYA JulP rejection and QP slight break

VIX JulP hold

So this doesn't sound terrible, but today the leaders could have rallied above all pivots then didn't. DIA could have recovered above its QP but didn't. I'll be watching the SPY / SPX / ES 2HP combo, because anything below that tips the scales on the USA mains from 2/5 weak to 3/5.

TLT has already decided, moving back above its 2HP today so that is the first long term strength since the end of 2017.

PS: Despite the BTCUSD bounce from about 5800 to 6600+ in 4 trading days, it remains below all long and medium term pivots.

SPY, QQQ, DIA, TLT and BTCUSD below.