Yesterday's daily comment:

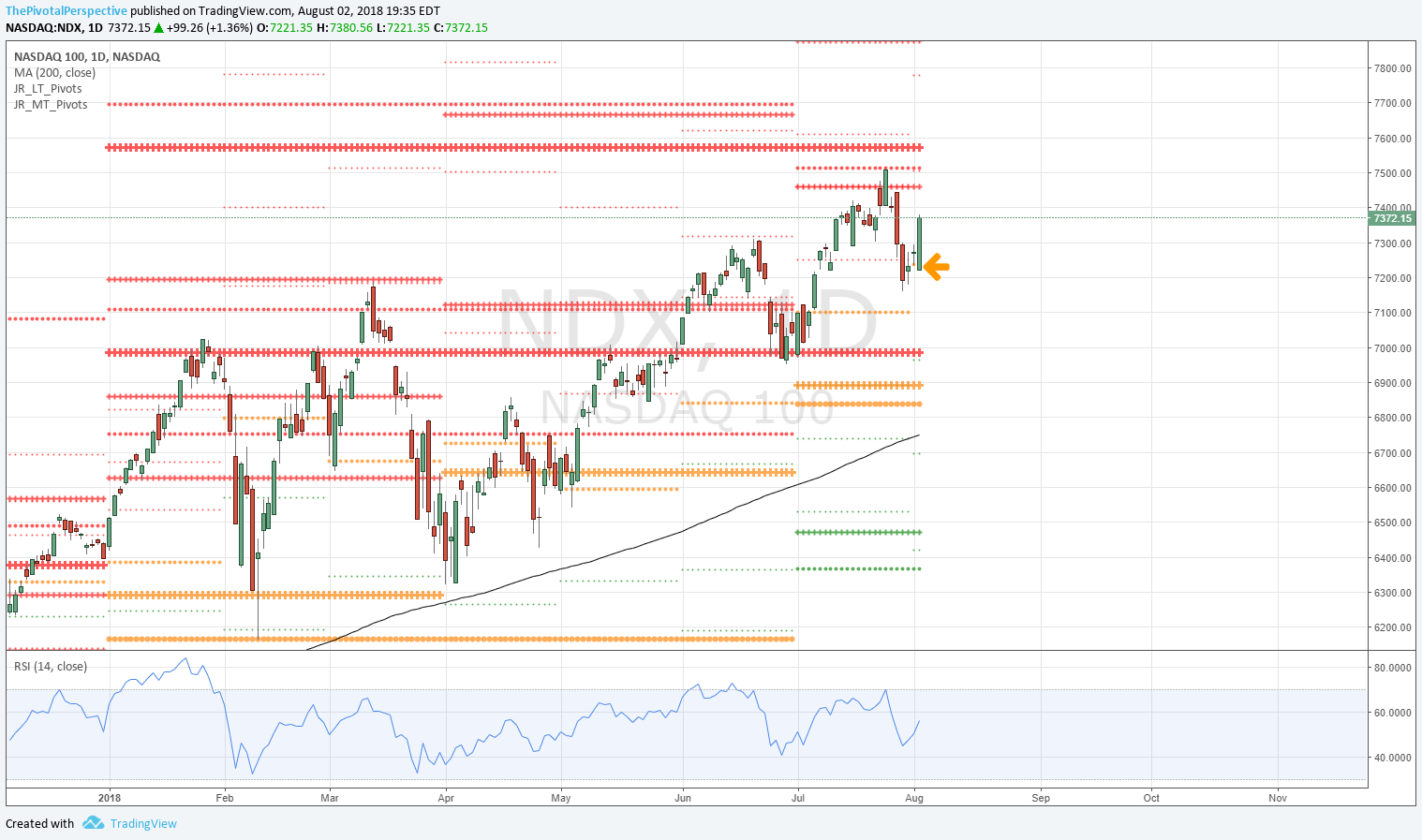

"Interestingly, momentum RUT and NDX are faring the worst as SPX and DJI are doing relatively better. So far SPX is acting like it will clear YR1. This would imply buyers soon stepping in for RUT and NDX. At this point I think worst case is a test of SPX AugP 2787 but that should be it. If RUT cleared its AugP then all 5 USA mains above all pivots and regular readers know I don't tend to argue with that kind of condition."

Today's SPX low was 2696 before a decent rally.

SPX SPY did not reach AugP, but ES futures did and the result was a massive hold. Similarly, NDX QQQ NQ opened a bit below AugP but had a massive move up. RUT IWM was below its AugP yesterday, but that too recovered. Simply stated today could have been completely different with monthly pivot rejections and breaks, but it wasn't - it was holds and recoveries. The day finished with all 5 USA mains above all pivots.

Additionally, VIX had a big rejection from the AugP. These VIX pivot rejections tend to bullish for stocks not just for one day but for several days ahead. If you examine the chart of this year you will see many examples.

The only things that would add to the party would be SPX clearning YR1, VIX more clearly below YP, and USO above all pivots.

SPX NDX and VIX below.