Very bullish action today, with both DIA and NYA reclaiming status of above all pivots. DIA was fractional so better to see that maintain above.

In addition, no slowdown at SPY, QQQ or IWM MR1s.

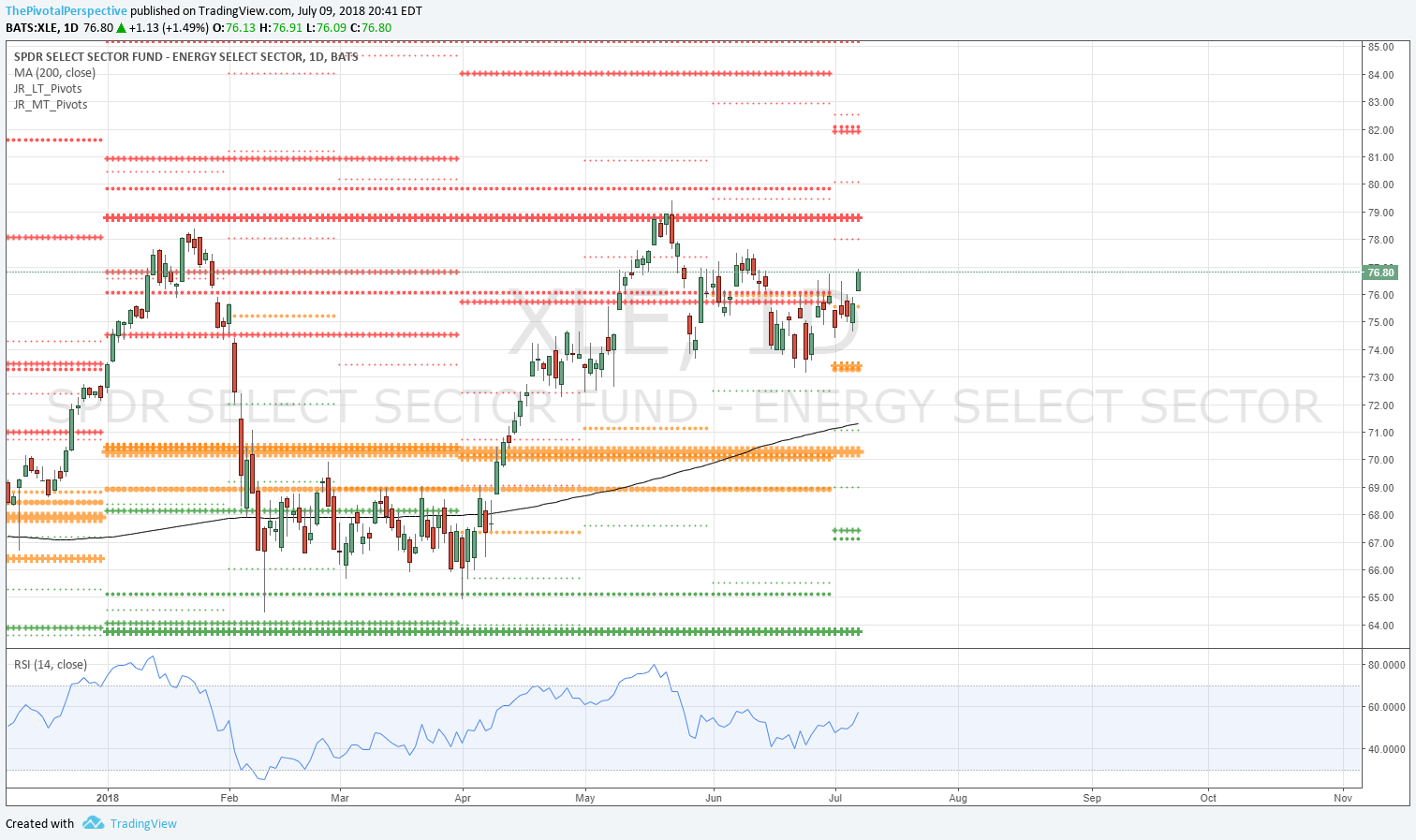

These are all encouraging signs to be holding fully long and waiting for higher level targets. The XLF, XLE and INDA setups I mentioned on the blog were great additions to any buys last week. Further, EEM added to risk-on signaling by recapturing its YP as well, and FXI seems will have a chance at that tomorrow.

The next levels to watch are IWM YR2 and VIX YP - given the pace I expect that these to resolve in bullish fashion. But if IWM YR2 has major rejection, DIA fades back under its HP, and VIX holds YP, then I may lessen long exposure with a volatility hedge or DIA short.

DIA, IWM, XLF, XLE and VIX below.