I'm looking for clear setups and while there are in some cases the market isn't speaking with a unified message yet. Close, but not quite.

DIA and NYA opened below HPs! This the first long term weakness in any USA main index since early 2016.

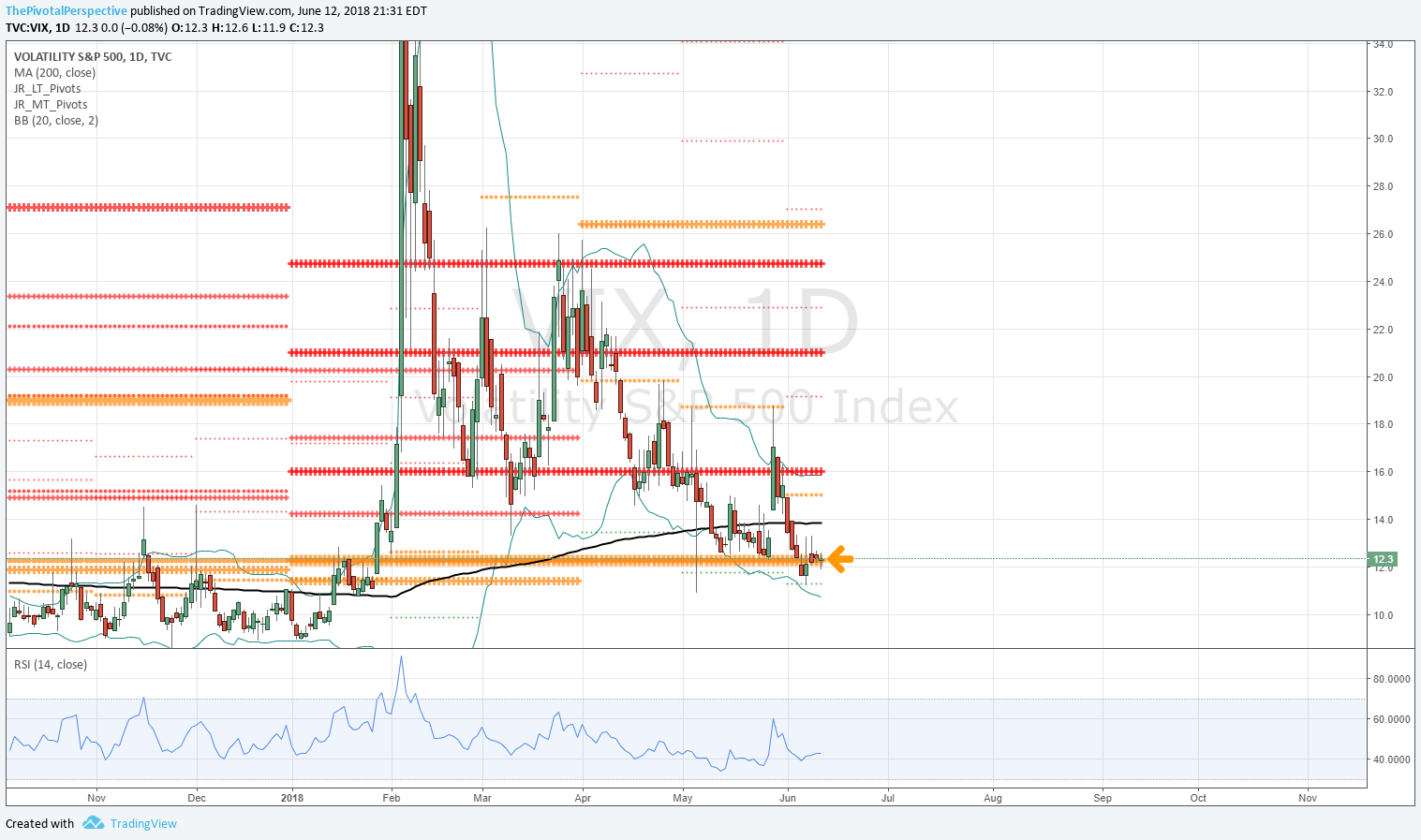

However, SPY could have broken HP but rallied instead to stay above (arrow at 2HP in chart below). In addition, VIX dropped from QP and finished slightly below MP as well.

Leaders QQQ and IWM look strong would recover above all pivots with one more push higher.

The bifurcated market still in play with leaders QQQ and IWM about to go full on bullish, while the more internationally influenced DIA and NYA are pivotally weaker than they've been in about 2.5 years.

These are the levels to watch - QQQ MP, IWM MP, DIA QP, and VIX MP.

This site has played bonds very well this year but I didn't think Friday was the long exit. For now TLT less strong than could be since a finish below HP when it could have held. Still above QP and MP though.

This is echoed by XLF huge hold of YP.

Bottom line historical tendencies of the July 4th week so far playing out. A bit higher in indexes and lower in VXX would look like bullish resolution and the kind of setup I am looking for. For now, somewhat more long (and taking gains on some speculative shorts) seems like the right approach, and ready to add further if leaders close above all pivots tomorrow.

SPY, QQQ, IWM and XLF.