All 5 USA main indexes continue above all pivots, and none of them are at any major resistance levels.

RUT IWM has been the weak link of late, and that held AugP today. To be clear, both of these are bullish points.

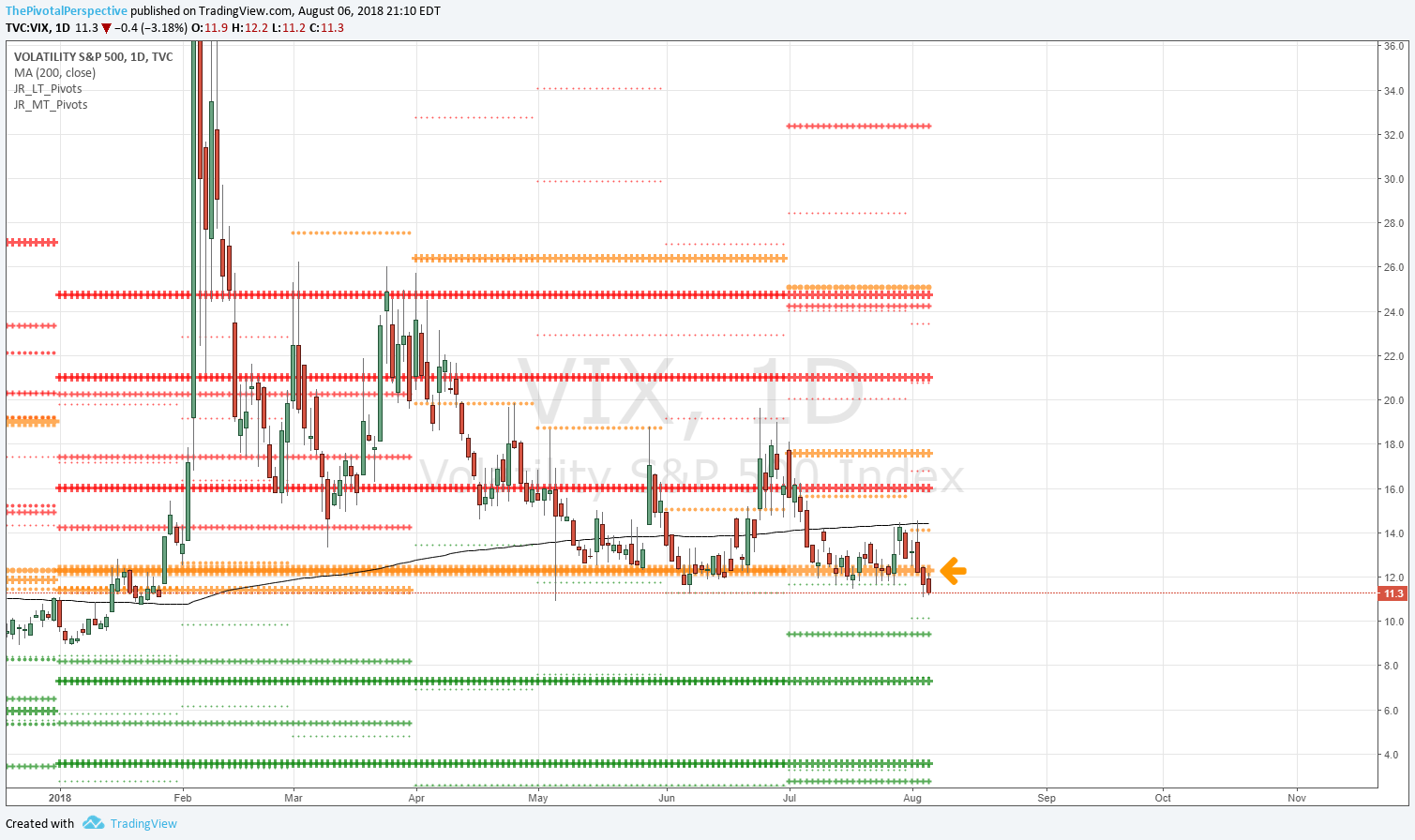

VIX collapsing below YP is especially positive, because if the smart $ were thinking drop they would be buying VIX as SPX crept higher. Instead we are seeing the opposite, a mild up day in SPX and -3% in VIX. According to the smart money, indexes are going higher.

The only thing that concerns me is very low volume, which could mean the market doesn't have enough juice to reach the intended target. But with everything lining up bullish I'm giving the trend the benefit of the doubt.

SPX, RUT and VIX below.