8/6/2016, SPX 2182. "I think we can see 18x-20x forward earnings in this latter stage, but not has high as the late 1990s when new technology was so completely changing everything."

8/20/2016, SPX 2183: "Both measure show P/E getting into high area of 2015, which itself was the bull market high. If we are in euphoria stage of the bull market I think we can see 18-20x on the Thomson numbers which currently means 2300-2550, but the extremes of the late 1990s are just not going to happen in this decade."

12/3/2016, SPX 2191: "Ultimately I'd like to see euphoria highs near 18x forward earnings in 2017-18."

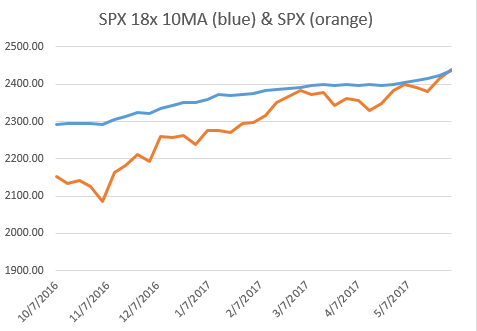

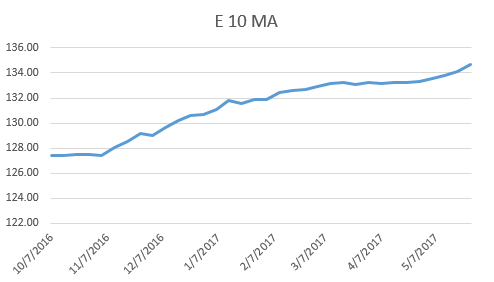

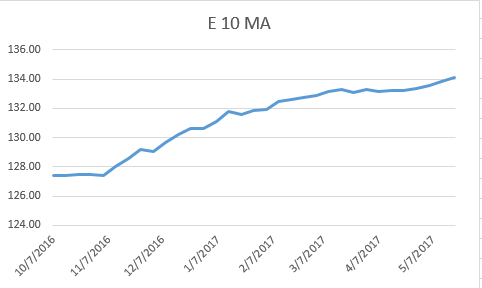

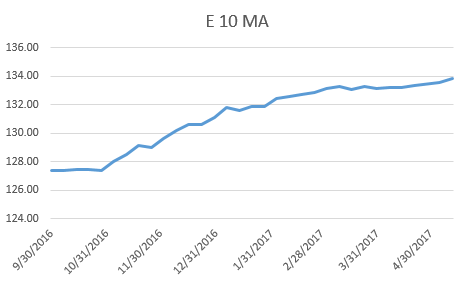

12/10/2016: "I don't understand the curve fitting of the model but Thomson Reuters P/E went *lower* last week. I think the solution here is a moving average so I am just going with a 10 period MA. This will cut out this noise and have smoother valuation areas to watch as support or resistance."

12/17/2016, SPX 2258: "There you have it, a continually updating target range for SPX at 18x - 20x forward earnings. I don't think the market is going higher than that. Based on 12/16 close, this means SPX about 4-15% upside from here, although it is possible that the 10MA will continue to climb and this shift the target range higher as well.

12/24/2016, SPX 2263: "This site has consistently maintained that I expect to see 18x-20x forward earnings for a real bull market euphoria high. Currently, 18x 10MA is 2350 and 20x 10MA is 2612. These may continue to increase, but for now this is my target range which is an admittedly wide +3.9% to +15.4% upside from current levels on SPX."

1/7/2017, SPX 2276: "The 10MA of 18x-20x valuation target are up to 2360-2622, or 3.6% to 15.2% upside from current price levels. These will continue to change as earnings and the 10 week moving average also change.

1/14/2017, SPX 2274: "I'm beginning to have doubts about anything higher than 19x. Smart money will gladly leave the remaining 5% on the table to protect themselves against a -20% drop. If I change the target range to 19x, then this means current 2514, 10MA 2503, % upside to 10MA = 10%."

2/4/2017, SPX 2297: "Using 10MAs to smooth the data: 18x target 2374, 19x target 2506, Or 3.3% - 9.1% upside."

2/18/2017, SPX 2351: "Every week I have pointed out target of 18x forward earnings; the current value is 2440 and 10MA is 2386. I think 19x is a cap, because I don't think smart $ will wait for 20x forward earnings to sell. This is currently 2576 and 10MA is 2518. Thus, 10MA target range of 18x-19x forward earnings of 2386 to 2518 is 1.5% - 7.1% from current SPX levels."