Earnings estimates picked up nicely last week, turning slope from flat-ish trend since March to decently positive.

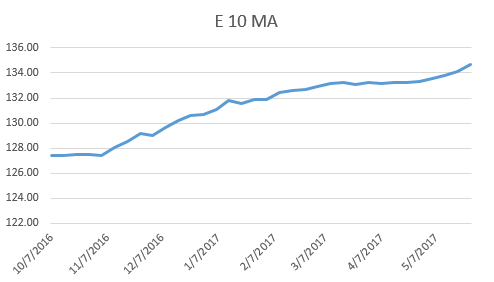

The 10 period moving average of forward earnings estimates.

This level multiplied times 18 gives us implied 18x P/E, smoothed by a 10 period moving average.

And here is that same level with SPX price in orange.

So this is the third time near this valuation, though the first two tries were at 2400 and this time a bit above. Rising slope means the market can gain without getting truly more expensive. I still think this level is worth watching for professional reactions. Still, due to rising slope, on a scale of -5 to 5 I am upgrading this to 2.

*

But economic data is a real drag here. Scoring this -3 since below last low.

Combined score still negative. This increases the chance of a fade back into recent range for SPX.