REVIEW

9/8/2018 Total market view: “Typically pullbacks to support in larger up-trends are bought. Both SPX SPY and RUT IWM are testing MPs, which along with rising moving averages, would be good places for a bounce. … Bottom line - playing for a bounce from SPX and RUT MPs. But NDX along with both SMH and XBI have already broken MPs, and NDX is showing a bearish move from long term resistance YR2 HR1 so this must be respected. If the bounce doesn't happen, I'll move further to cash and watch for the next setup.”

Result - SPX and RUT both held MPs on close. SPX had a better move up towards highs by last week while RUT is struggling a bit more.

SUM

All USA main indexes are above all pivots. The recent test of SPX and RUT MP held, and NDX recovered its MP as well. DJI seems like it could be hit from resistance but hasn’t. In addition, VIX closed under its YP. All these are bullish signs.

We could also point to lack of frothy sentiment, SPX forward p/e reasonable in 17s and weakness in other safe havens as reasons to go higher for risk (SPY/TLT ratio all time highs, SPY/GLD ratio highest since 2005).

But here are the things that concern me:

NDX YR2 selling, along with SMH and XBI weakness

DJI HR1 and weak advances invite door for bears

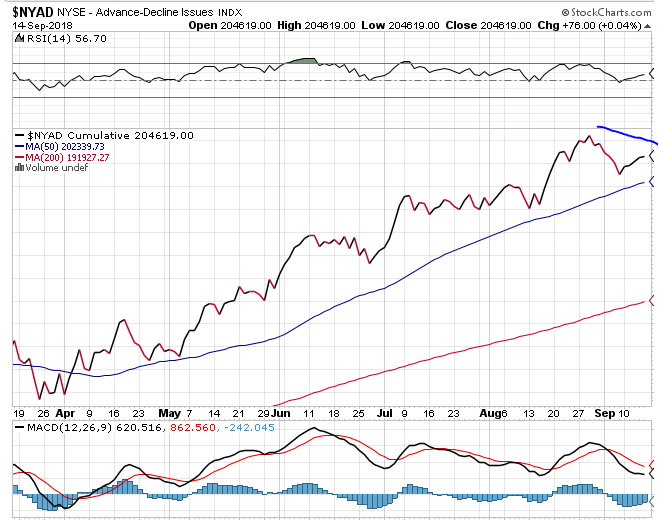

Cumulative advance decline showing bit of bearish divergence

RUT struggle to lift back towards highs (reflected in the cumulative advance-decline)

Daily new lows picking up

Heading into quarter end, possibility to some profit taking in leaders (More broadly, NDX and RUT; specifically, tech, internet, small cap growth, health care tech, etc.)

Last week I said ready to take defensive action should the anticipated bounce from SPX and RUT not occur. It did so mostly long the market. But it would not take much to generate a major sell signal. If all these happened:

NDX break of MP along with further rejection of YR2

DJI rejection of HR1

VIX lift from YP

RUT break of MP - keep in mind it has already topped on QR1 8/31

SPX high test and rejection or best case QR1 at 2925 then down

Then a lot would be checking off on the TPP top checklist. I’ll post on this in detail should this occur.

But all this is conjecture as monthly pivots are holding and main indexes are moving back to highs.

That said the leaderboard and long positions have thinned out compared to all the long positions in August. That’s OK - often good to have cash ready for next good setup as quarter end approaches.

Bottom line - TPP shifted emphatically bullish near the beginning of July. Played for gains and even correctly hedged for 7/25 top, and quickly moved back bullish. At the end of August said pullback was due. Last week expected monthly pivots to hold. In sum comments have been on the right side of the market for much of the quarter, so I’ll try to keep going :) Current take is moderately long but watching carefully if a defensive adjustment is needed. If NDX clears YR2 along with SMH and XBI perking up then can be fully long again.

PIVOTS

USA main indexes - At this point NDX and RUT MPs are having a lot of sway. If they break likely clues to get defensive.

Sectors of note - XBI below MP since 9/6 and also dropping below YR1. SMH just held HP, QP and D200 again but could not really lift above MP. KWEB in bear market. All these point to more chance of NDX YR2 top.

Developed - N225 looking strong, DAX technical bear (weekly close below YP, below falling W50MA).

Emerging - All local currency indexes looking better than USA denominated ETFs. But $USD is what I buy and sell so those are the charts of more interest. ACWI held long term support last week, and INDA rebounded from QP test (INDA gave back gains of July and Aug in a hurry though). But SHComp, FXI, KWEB, EEM, RSX, EWZ all below all pivots.

Safe havens - VIX slightly below YP actually bullish for risk, but a jump back above turns that around. VXX also approaching levels to watch. Bond weak excepting HYG which is still strong (another larger bullish big picture point). GLD trying to hold YS1 but bounce quickly gone and looks like another move down is underway.

Commodity - Oil more range bound in 2H so far. CL1 cont contract has not closed above all pivots since early July highs.

Currency - DXY still under YP as last week’s drop 9/10-13 from YP MP area helped stocks to rally.

Crypto - BTCUSD below all pivots but hasn’t gone lower than the Feb low. Bounces less and less, so would like to see one more drop to 5K or under. ETHUSD reached YS1 so recovering is some positive. LTCUSD YS1 may be too far to see. Not following others.

OTHER TECHNICALS

New lows increasing.

Cumulative advance decline a bit of bearish divergence.

VALUATION

SPX forward P/E of 17X (green line) has acted as resistance since April. Currently 2920 and most importantly, still rising.

SENTIMENT

Put-call jumped back in a hurry compared to the relative low near the end of August.

TIMING

See this recent review.

August dates (posted 7/22 Total market view)

8/2 - Stock pullback low

8/6-8 strong - "Seems like setting up for high"

8/17-20 - 8/21 minor high and mild pullback

8/27 (added) - Missed top by 2 days so not close enough, non event.

September dates

9/6 - Stock pullback low 9/7 and TLT bounce high

9/13 - So far non event unless this week starts lower, will turn into trading top

9/20-21 - Prefer up for risk