I don't regret buying yesterday because the days that multiple indexes hold or recover pivots along with VIX screaming confirmation have just been too many fantastic buys over the past few years. But I'll admit that Tuesday did not deliver everything I wanted to see in terms of follow through.

+s

SPY, DIA, VTI all held Q2Ps - could have broken

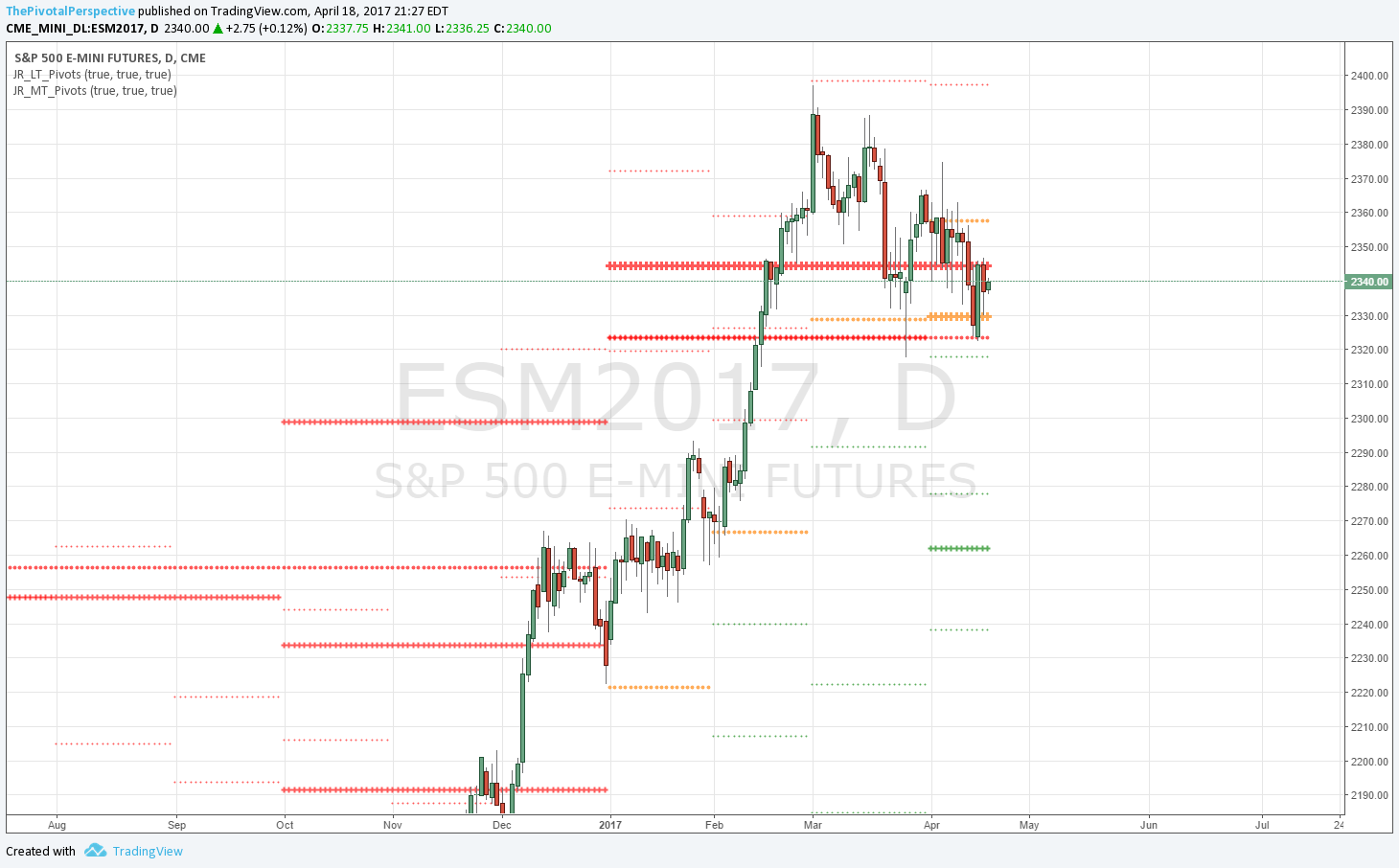

ES held Q2P exact FWIW

IWM held + for 2017 (not pivotal but still)

VIX lower!

XIV recovered Q2P

-s

EEM & INDA slammed

small up bars on SPY & VTI suggest weak buying, vulnerable

TLT big up above Q2R1, AGG above YP / 1HP above all pivots! I don't think any benchmark bond index was supposed to be above all pivots in 2017 ;)

GLD higher too

So this is a mixed bag. But the main idea for the returning fully long was USA indexes recovering Q2Ps and VIX massive rejection of 1HP. Those haven't changed, though NYA didn't deliver I'll attribute that to global component. EWZ did close slightly under its Q2P but I'm going to hold it one more day. Not thrilled with EEM, who would be? Did best on the market drop thus far, on the verge of clearing YR1 and today whacked. But still above all pivots so have to hold. But that YR1 was one of the reasons I opted for EWZ add yesterday instead of a 3rd EEM.

SPY, ES M, VIX, EEM below.