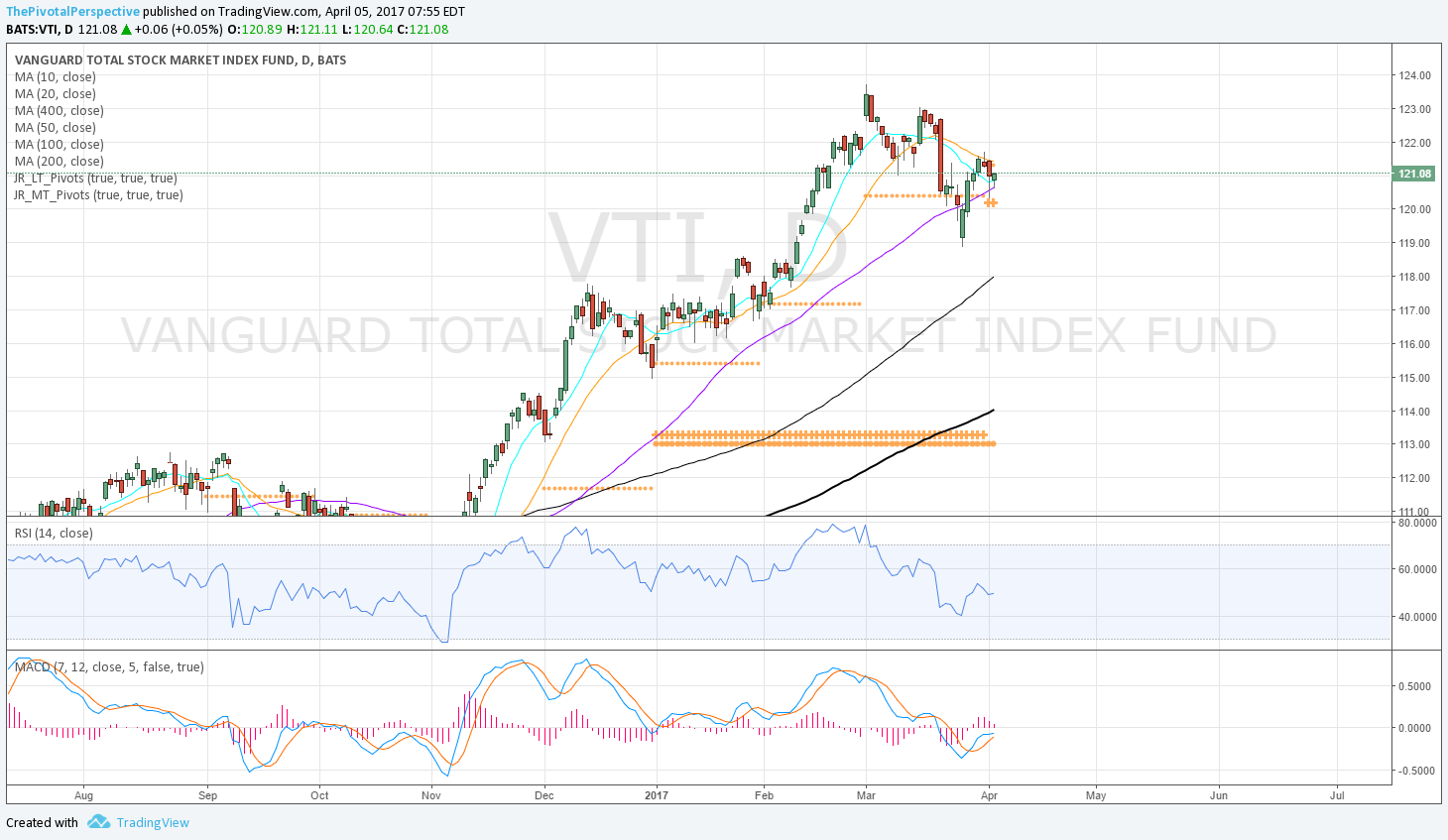

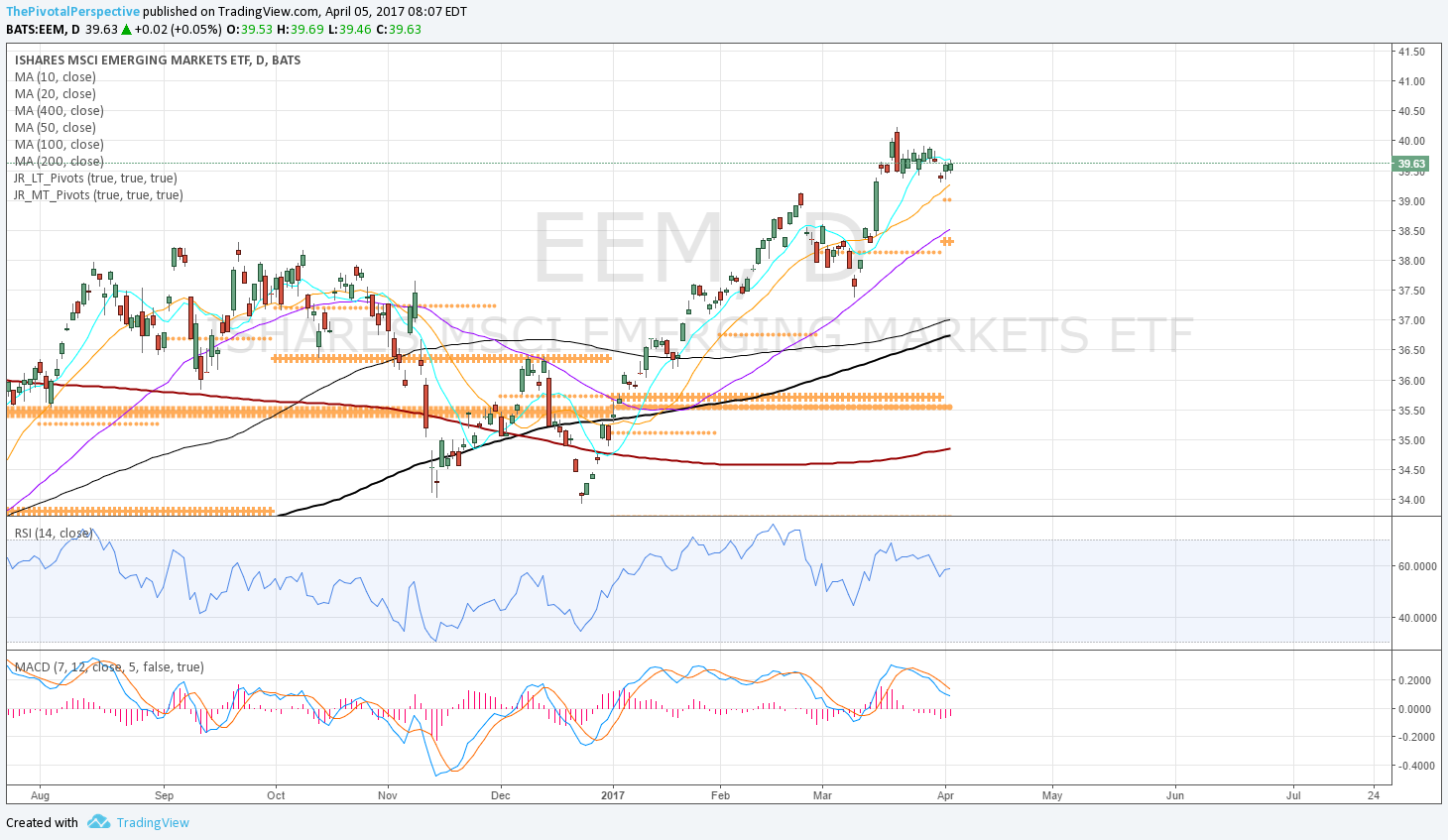

Quick rundown of the charts frequently mentioned on this site. These are "pivot only" charts meaning no support (green) or resistance (red) lines, to focus on the new Q2 (in crosses) and Apr (dots), as usual in orange.

Including the typical MAs to help with trend analysis. Keeping it simple here with ETFs only, though in reality indexes and futures levels should be factored in for full reliability.

USA mains - SPY QQQ DIA IWM VTI

In some cases below a monthly pivot after being above for 4+ months would be more a threat, but I'm weighting the successful test or near tag of Q2P and rising D50MAs.

Safe havens - TLT AGG GLD VIX XIV

TLT & AGG above Q2P first time in months is a factor, and could be a considered as a small longs (not full since still below YP and 1HP).

GLD looking good above all pivots and nice recent hold of YP.

At same time, VIX and XIV could not be clearer, green light for risk.

Dollar

Huge hold of YP and near D200MA test - what a setup on 3/28. Now above YP & 1HP, below Q2P and AprP. DXY stall has allowed global stocks to rally so the global longs want to see DXY stay under Q2P and better under AprP as well.

Global stocks - ACWI EEM FXI SHComp FXI RSX EWZ

On a tear, all above all pivots! Hard to remember seeing this when most USA indexes have not met this condition. Really I was late to this move as rotation began in January when already fully long USA stocks but at least in INDA before the big pop and currently global overweight.

USA sectors - XLF SMH XBI XLE

XLF below Q2P

SMH above all but looking a bit tired

XBI below AprP

XLE just held YP potential positive, but under D200, 1HP, Q2P, falling D50, and testing AprP - i'd rather be long EWZ or RSX