Sum

VIX has been quite correct to be warning of trouble from 1/29 on. Considering the USA main index top was 1/26 (Friday) that is pretty awesome.

Due to 2017 low range, the higher VIX is bouncing around yearly levels quite often since the spike. 1/24 YR3 rejection, 2/26 YR1 test, 2/27 YR1 launch, 3/1-2 YR3 test, 3/2 YR3 rejection. Currently VIX below MarP but still well above YP, HP and QP.

Bonds are all weak, with a multi-week run below all pivots for most. So far the TNX high very near YR2 but back above all pivots on 3/2.

Metals are mixed. GLD looks like it could recover above all pivots easily, and this would likely get GDX and SLV in gear.

VIX

D pivots only: Leap above all pivots 1/29 was the risk off screaming sell. Above all pivots 1/29-2/28; still above YP, HP and QP. Below MarP gives bulls a shot at bounce.

D: 3/2 YR3 rejection and close under YR2 also helps the bull side.

TLT

D: Bond bloodbath continues, some bounce from oversold levels but could not recapture YS1 on close. MarP resistance so still under all pivots as it has been since 1/18.

TNX

High on YR2 so far, but back above all pivots on 3/2.

AGG

Stabilizing near HS3 but still under app pivots. Weak. Under all pivots from 1/9.

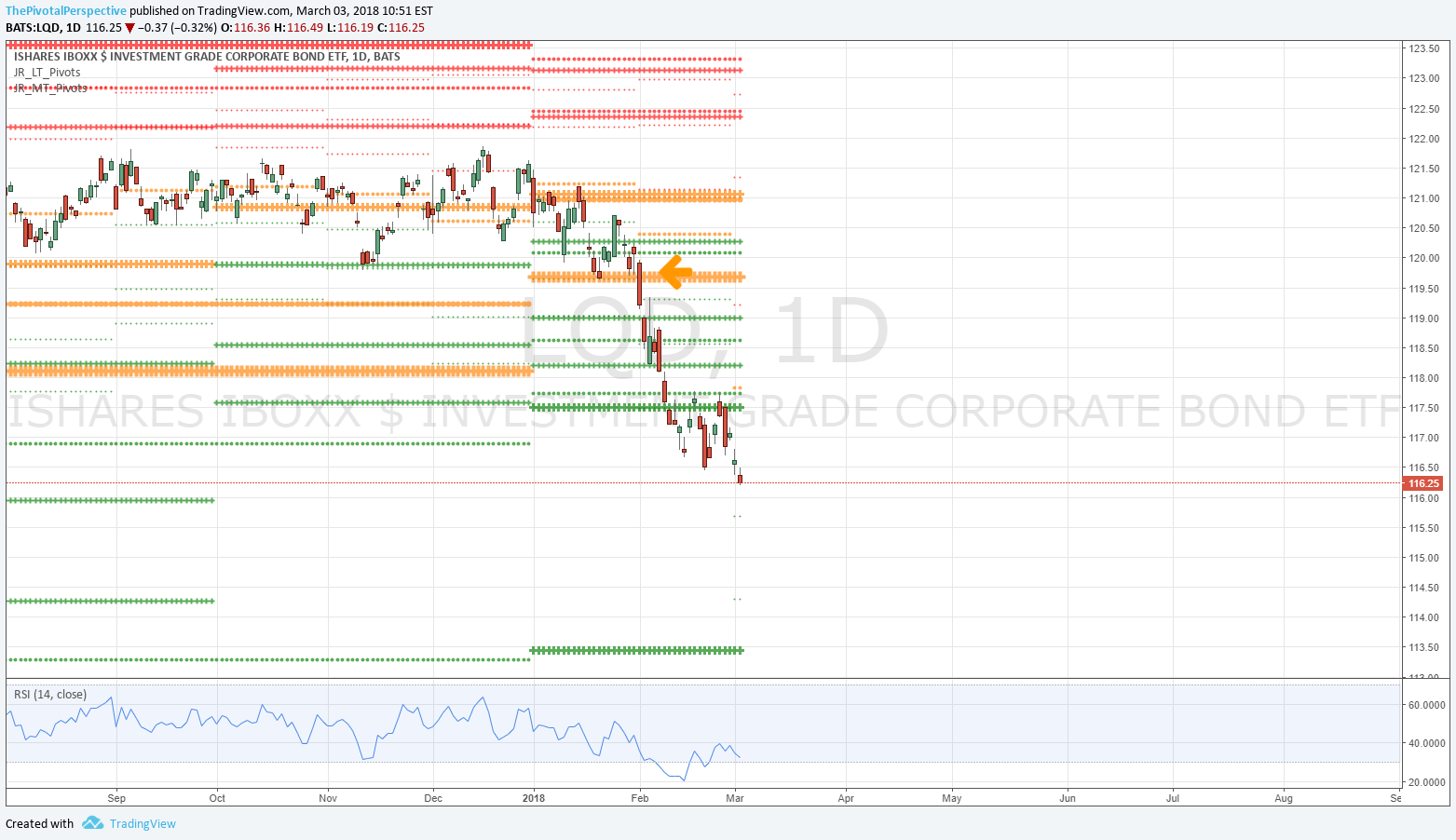

LQD

YP break on 2/1 and from there below all pivots.

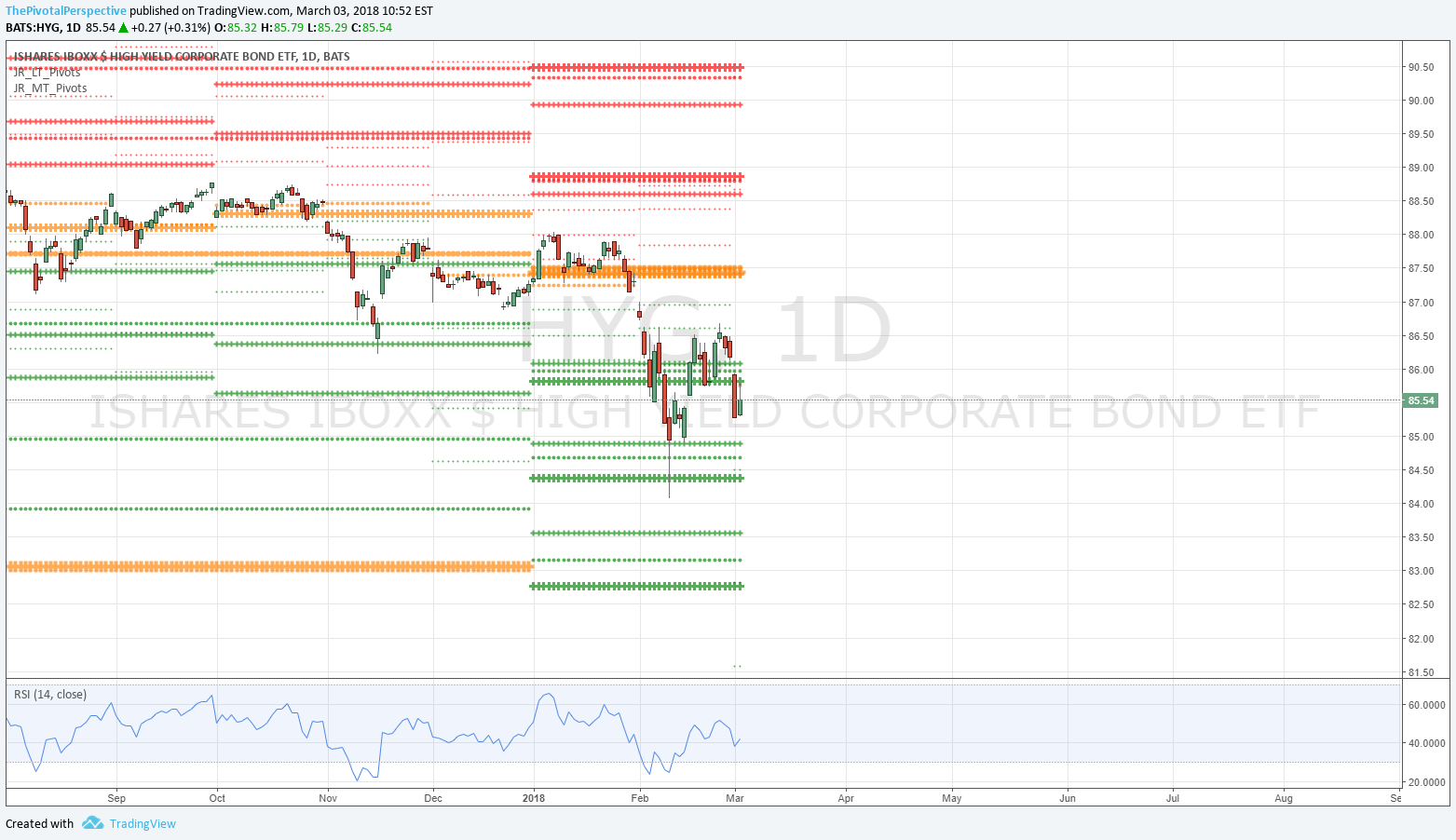

HYG

Break of YP 1/30 and from there below all pivots. Under MarP and under YS1 so far this month.

GLD

D: Wouldn't take much to recover above all pivots. Nice rising D50MA as well.

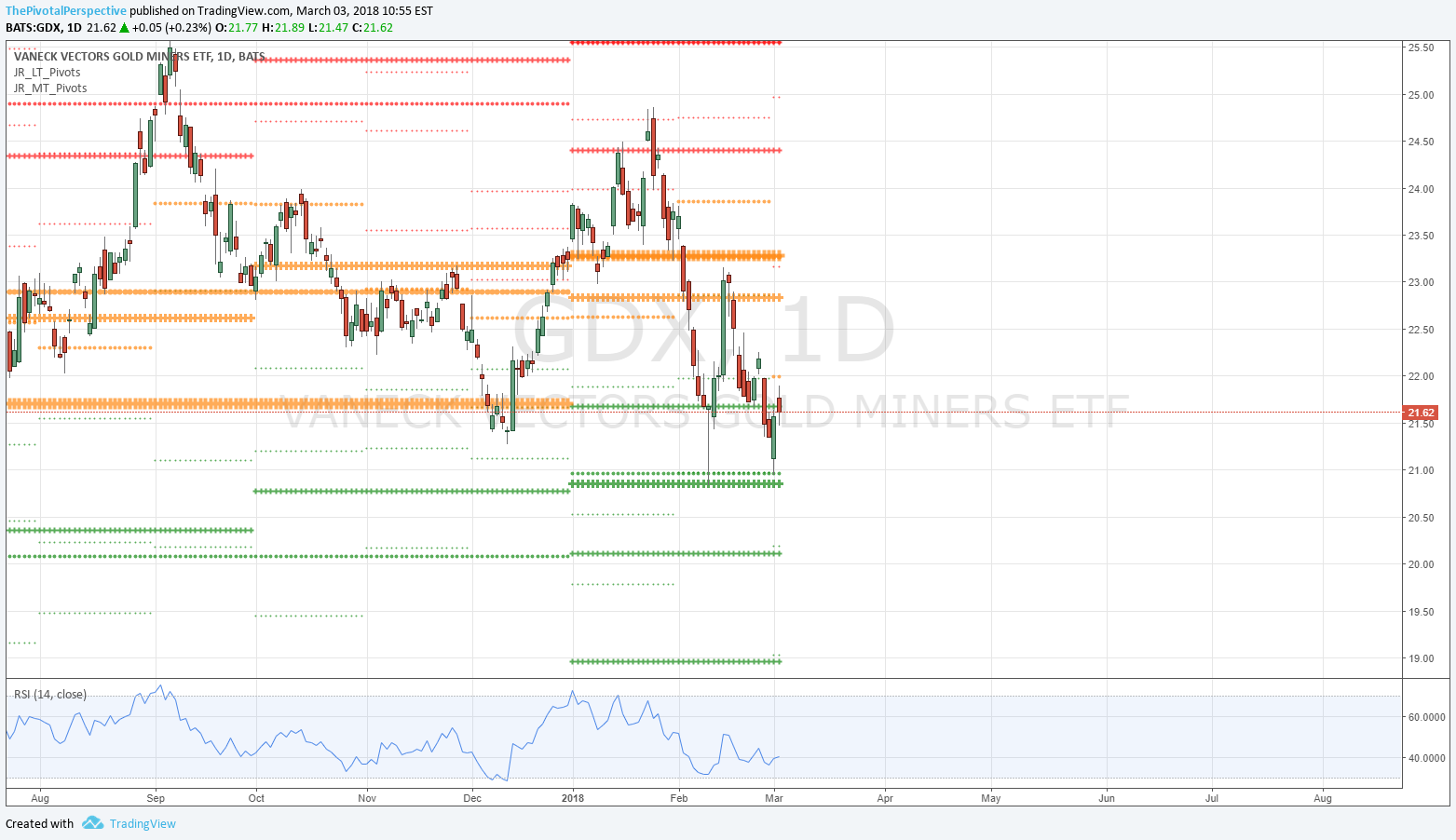

GDX

2nd low near YS1 / HS1 combo. Still under all pivots though.

SLV

Under all pivots but would not take much to clear one or more of those levels.