Sum

The most important event was that after several weeks of consolidating at yearly resistance levels, these turned into support for a decent launch. SPX YR1, INDU YR1, NDX YR2 all turning into solid support and clear lift-off. Now we can watch for a move to higher targets, starting with SPY, DIA and VTI Q3R1s and then ideally longer term levels at some point in the second half.

Near term levels to watch are NYA YR1, QQQ JulR1, and the VTI close high area. A fade from those may indicate a short hedge on IWM. NYA joining YR1 party would be bullish and confirm high chance of quickly seeing the higher level targets, meaning Q3R1 on SPY, DIA and VTI.

SPX / SPY / ESU / ES1

SPX W: 8th bar above the YR1 and finally a decent launch. 2HR1 2503, YR2 2576. This does kinda look like w5 division of W3 that has been running from 6/2016 fwiw.

SPY D: Near term target Q3R1 247.03 along with JulR2 just above.

ESU D: Another buy signal on pivots with MACD and nice hold of D50MA and launch.

ES1 D: Pushing outside the BB sign of strength; that divergence low on 7/11 that fractionally cleared the pivot was interesting tell.S

SPX sum - all looking good here, decent new high with daily RSI not yet overbought. Should reach higher targets starting with Q3R1 and then 2HR1 is above that.

NDX / QQQ

NDX W: Also lifting above YR2, very bullish. 2HR2 is above 6000.

QQQ D: At JulR1, level to watch.

NDX sum: Watching JulR1 and then if above that should test highs.

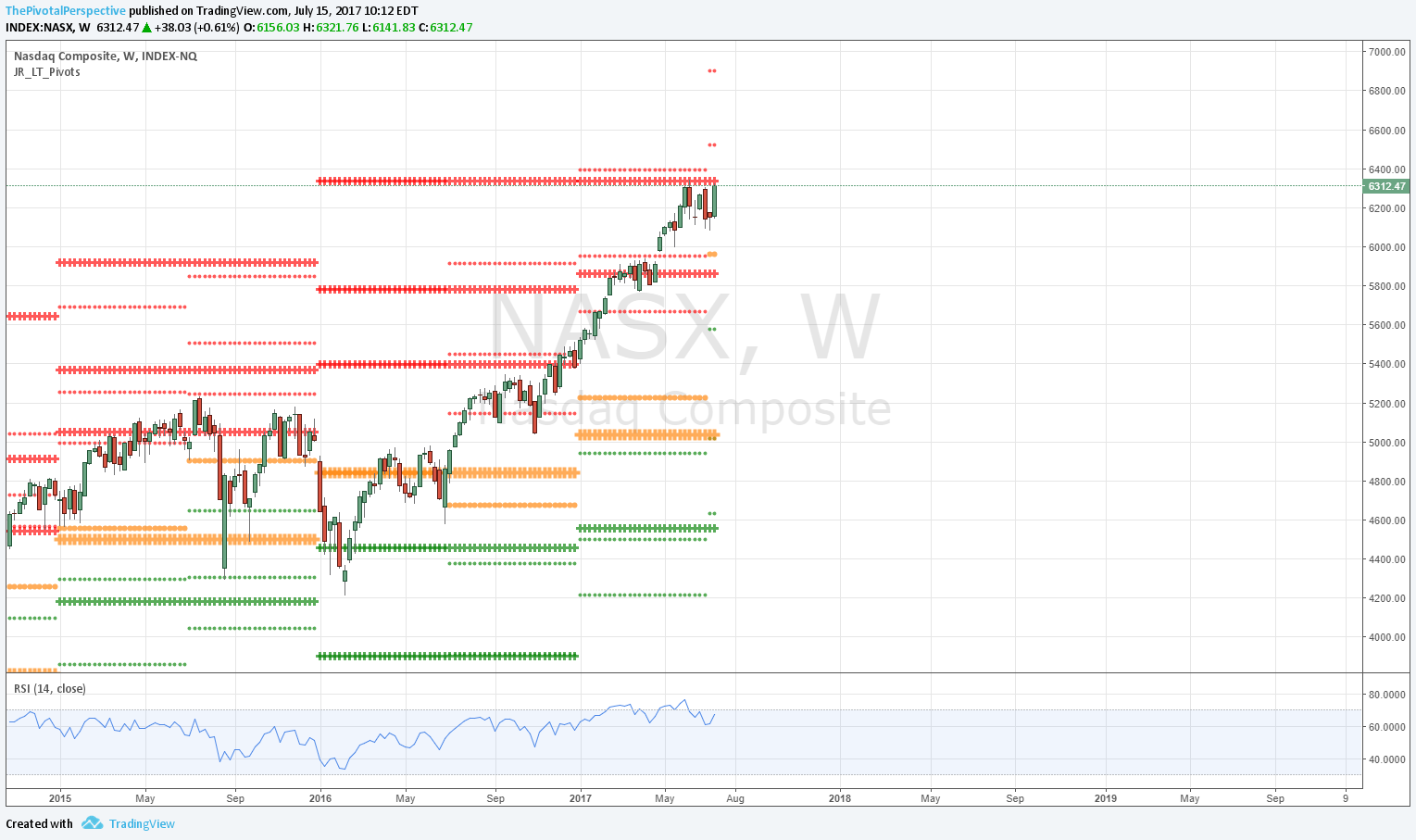

COMPQ

Also might be worth watching this level too - COMPQ (broader than N100).

INDU / DIA

INDU W: Look at that YR1 turn into support - no selling pressure for several weeks then blast-off.

DIA D: Q3R1 higher like SPY.

INDU sum: Should reach higher targets starting with Q3R1.

RUT / IWM

RUT W: Lift above 2HP is good, but still not really getting in gear.

IWM D: Lift above all pivots bullish, but reluctant rally. Due to wide range of June, JulR1 decently higher and may not tag.

RUT sum: Reluctant, still can be considered as short hedge candidate though we may not see JulR1.

NYA & VTI

NYA W: YR1 11895 only fractionally above - still to watch.

NYA D: Hold of JulP was key on 7/11!

VTI W: Some struggle at YR1 then clear.

VTI D: Looks more like 2x top from 6/19H.

Sum: NYA YR1 level to watch for next week; VTI appears going for Q3R1 like SPY and DIA.