Sum

The market continues to power up above resistance levels without any difficulties. Two weeks ago, SPX cleared YR2. Last week, IWM cleared YR1 and VTI also joined SPX above YR2. Only NDX having some trouble at YR3.

Additionally, all 5 USA main indexes tested and held DecPs on Friday in impressive fashion with a massive intraday comeback. While I thinks some buying climax and consolidation likely after tax cut, and NDX offering an interesting hedge against YR3, all trends are up.

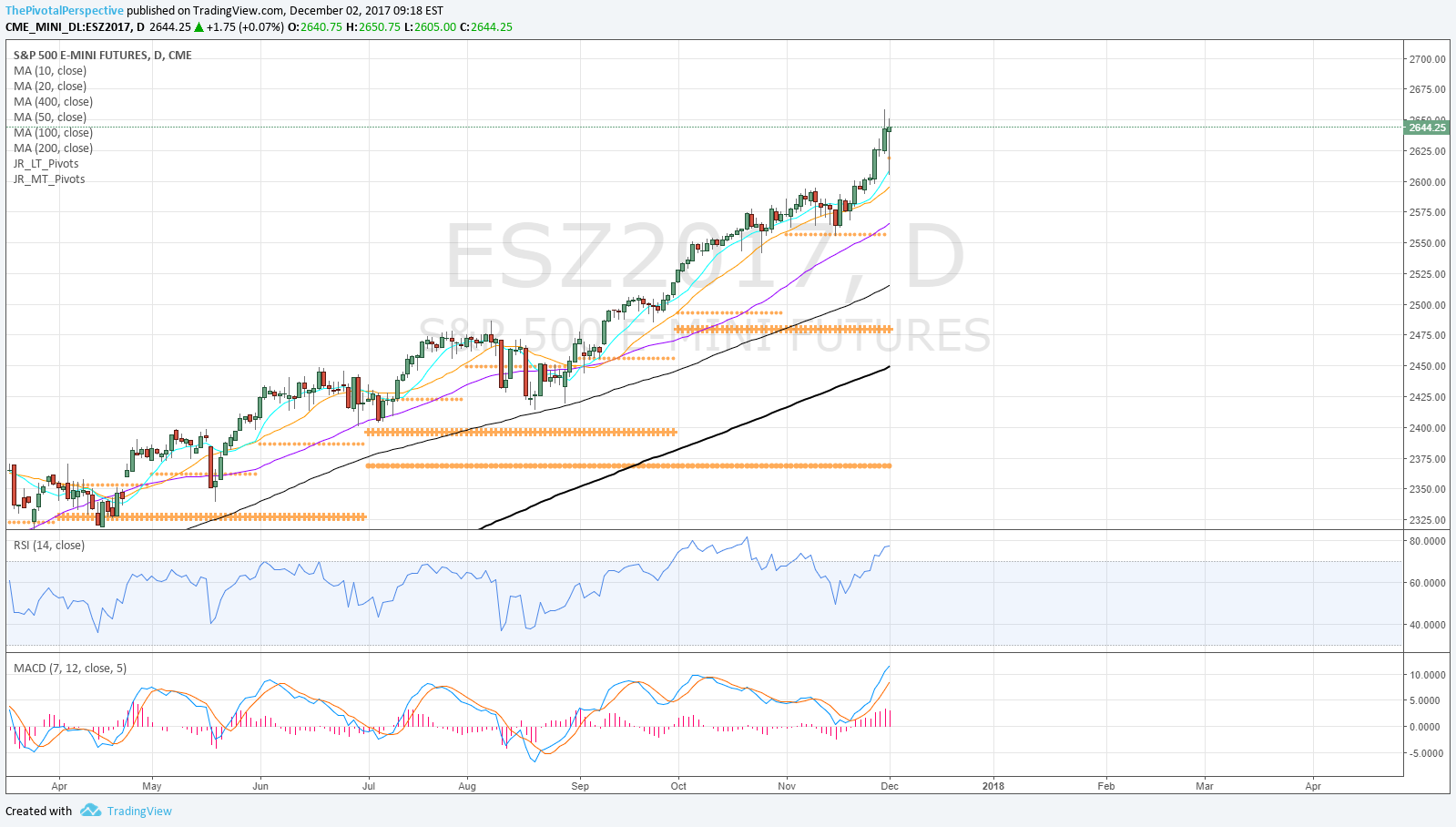

SPX / SPY / ES

SPX W: Powerful move from August lows. Minor shuffles around YR2 then it turned into support 2 bars ago. Buying climax likely to lead to some consolidation.

SPY D: High on NovR3; so far DecP holding as support.

ESZ : 11/15 low bang on NovP looking more and more important; Still above 10MA and DecP.

SPX sum: Powerful uptrend continues with major lift above YR2 area after NovP held on the pullback low. DecP tested and holding so far. Next resistance above is Q4R2 near 11/30 highs.

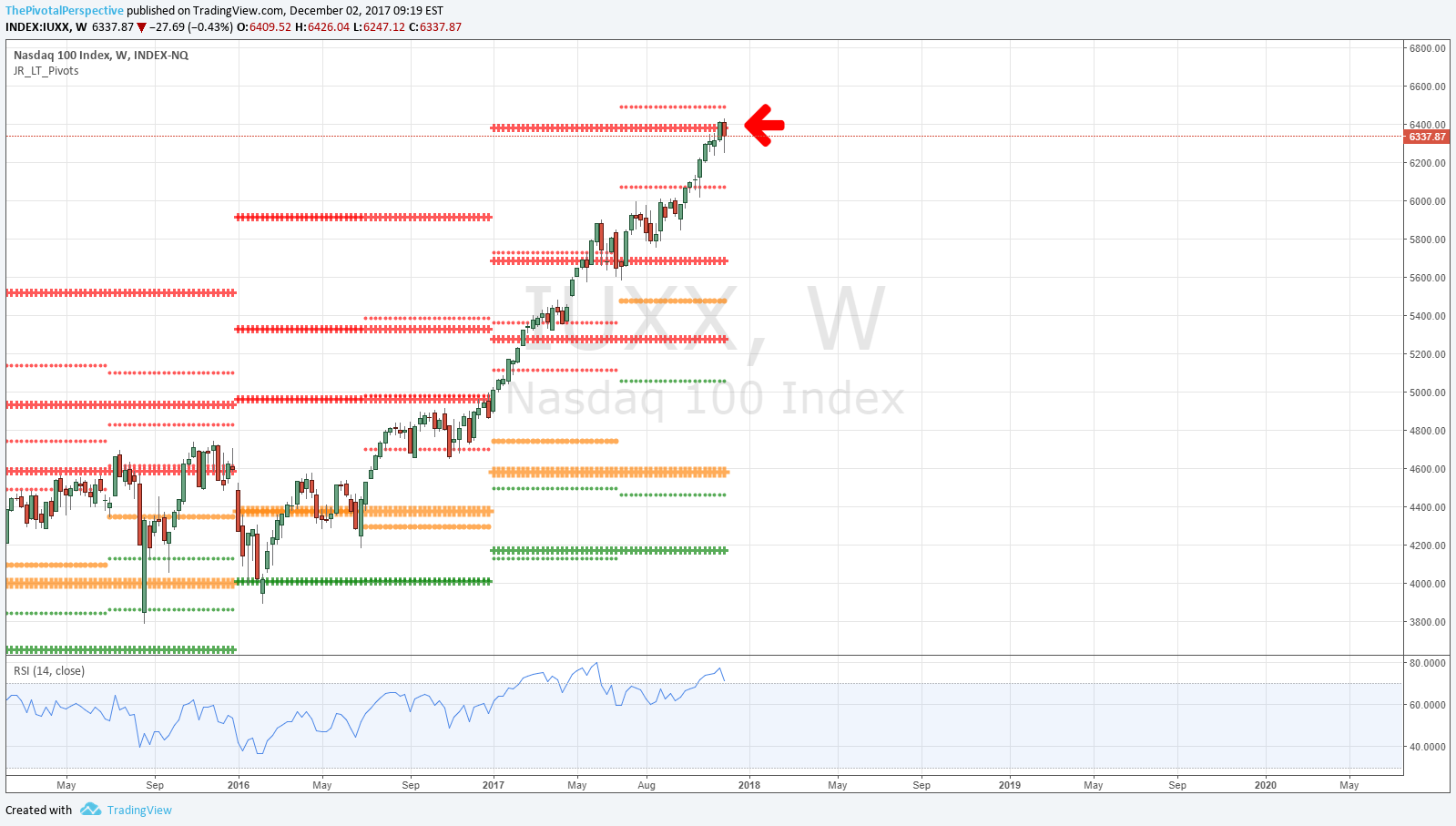

NDX / QQQ / NQ

NDX W: Fade back under YR3!

QQQ D: Daily action on YR3.

NQZ D: Still above all pivots though.

NDX Sum: Possible key high forming on YR3. Important level to watch.

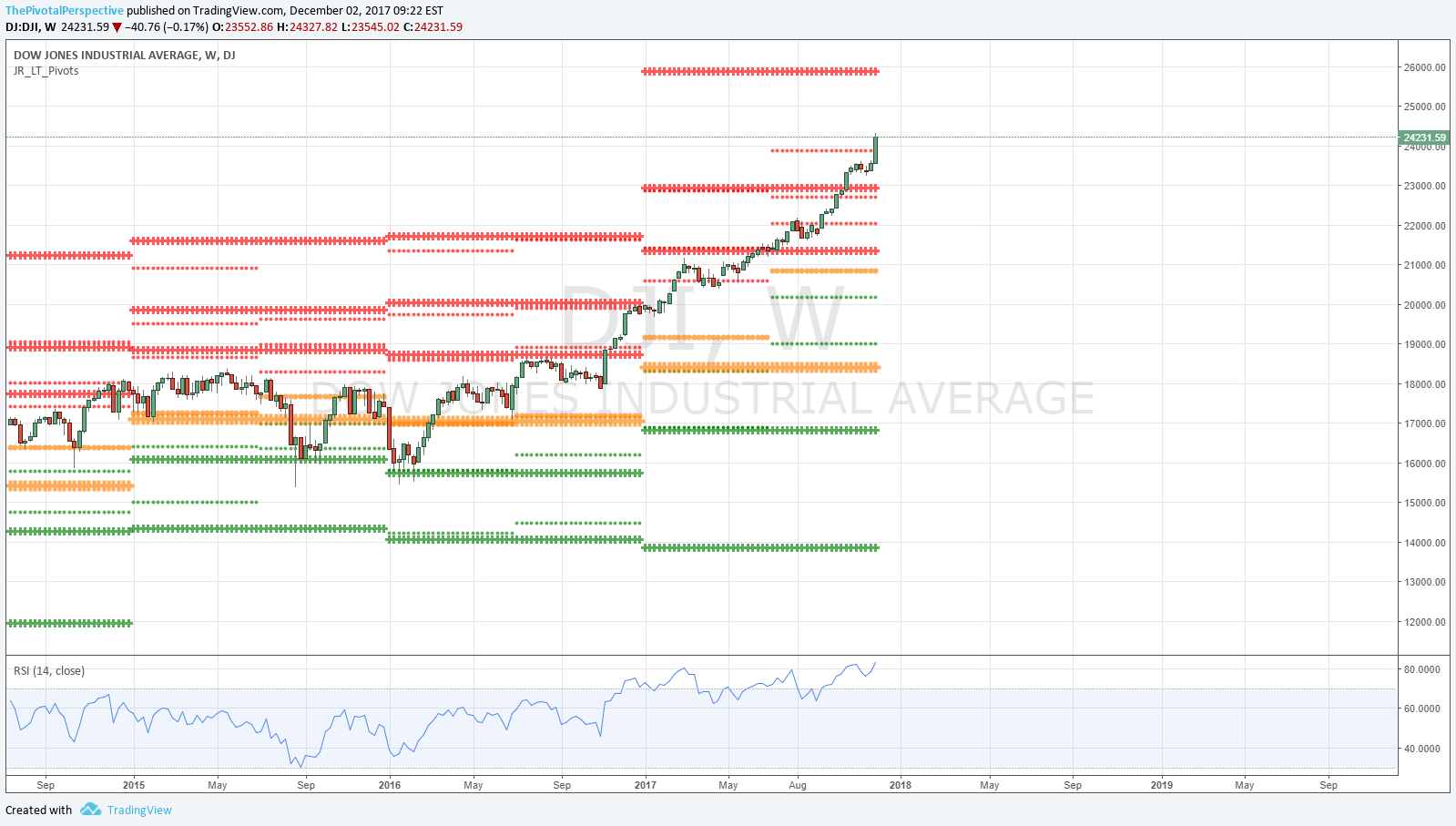

INDU / DIA / YM

INDU W: Amazing move.

DIA D: Keeps powering above levels without any trouble.

YM: Last tests of monthly pivots 12/1 and before that 9/11.

RUT / IWM

RUT W: Above YR1 but testing 2HR3.

IWM D: Amazing comeback.

RUT Sum: Could have broken under YR1 on Friday but came back. Near Q4R1 but the yearly level hold is more important, along with maintaining above all pivots.

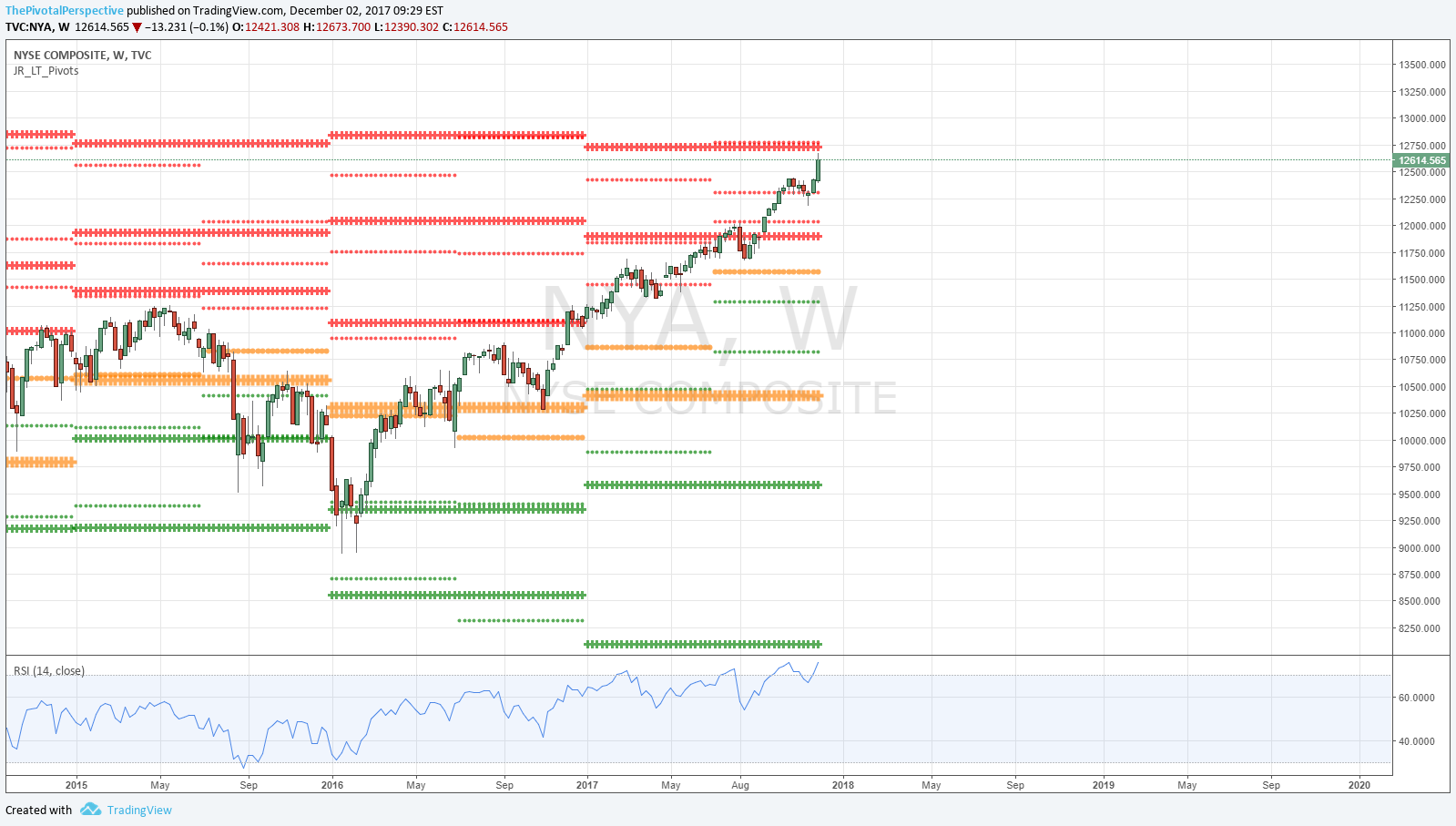

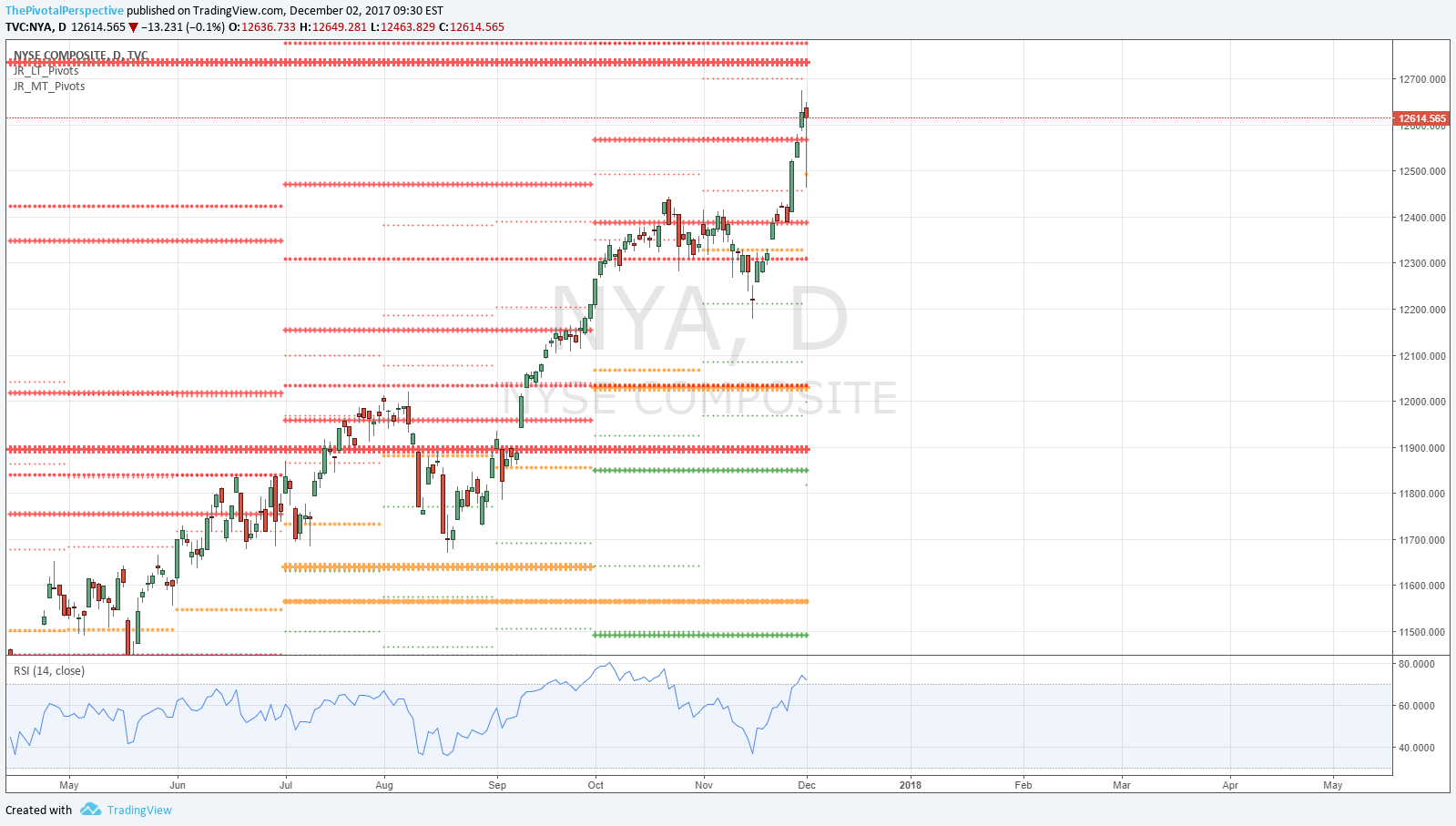

NYA & VTI

NYA W: Near YR2 with 2HR3 just above.

NYA D: Massive rally from DecP.

VTI W: Joined SPX above YR2.

VTI D: Friday test of both DecP and YR2, fantastic hold.