Sum

Q4 has started in impressive fashion with power moves up for USA indexes. But several of the long term targets I mentioned last week have already been reached. All 5 USA main indexes are at resistance levels with enough long term levels (Y & 2H) to make a real turn possible. In addition, Bollinger band overthrows and RSI overbought likely to fade. However, first drop off highs usually not the big move so projected path is some drop, back up to test and then we'll see.

SPX at Q4R1 2556, with YR1 2576 likely to trade by year end.

NDX at 2HR1 now, bang on 6068.

INDU at Q4R1 22789, slightly above 2HR 222711 with YR2 22937 above.

RUT at YR1 1518.

NYA at 2HR1 12307; VTI at Q3R1.

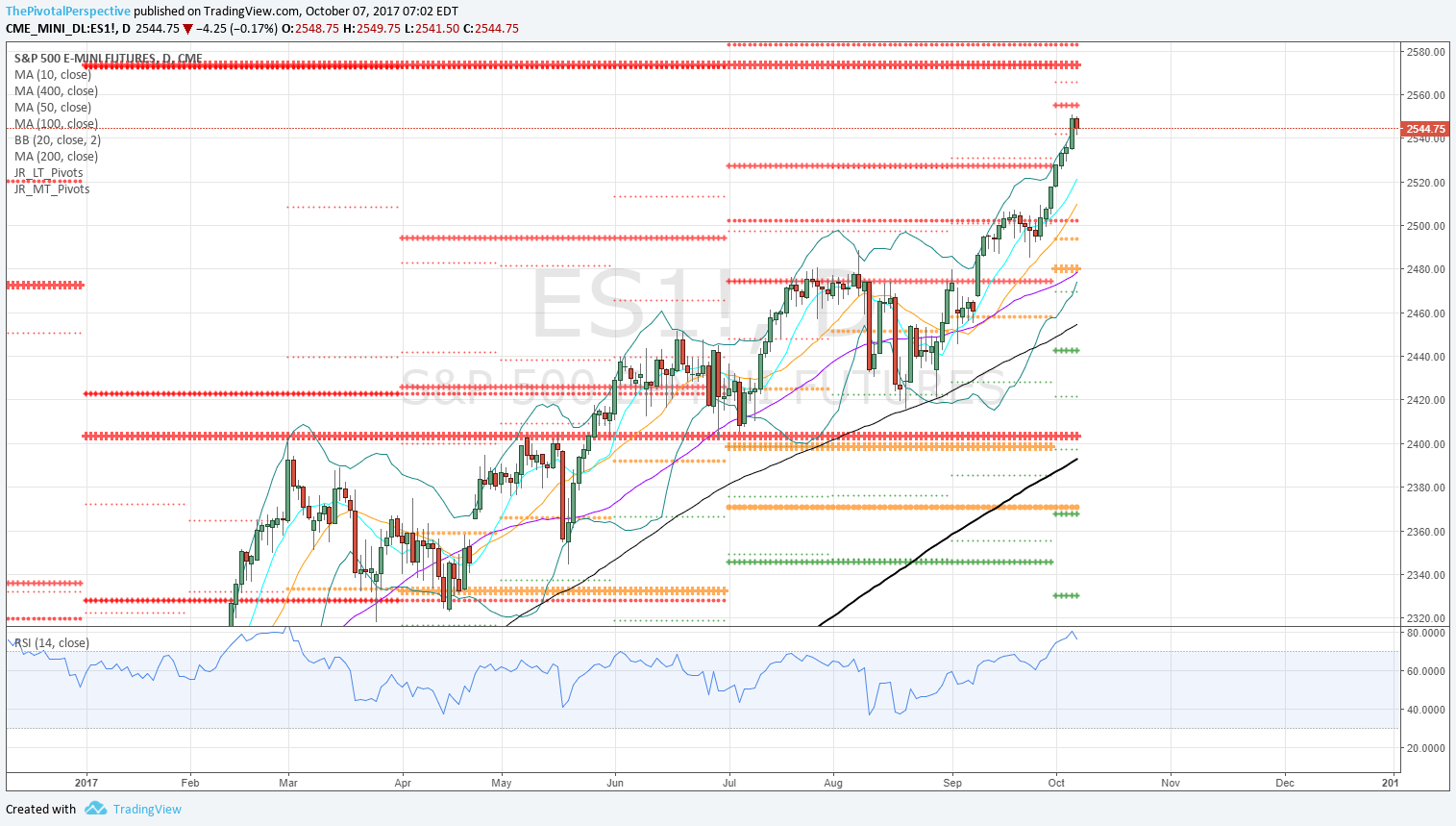

SPX / SPY / ES

SPX W: Strong, but BB overshoot more likely to fade soon.

SPX W: YR2 2576 within reach.

SPY D: For now Q4R1 decent resistance especially after test.

ESZ D: Nice results after going back on buy 8/30-31; entirely above all pivots since then, above all MAs excepting 9/25-26.

ES 1 D: Q4R1 just a bit higher.

Sum: SPX looking great and fast move to Q4R1 which should be enough for a pause and some shakeout. Still Expect to see YR2 2576 by year end.

NDX / QQQ / NQ

NDX W: Healthy with another lift from W20MA, but has been laggy in 2H as others have taken over leadership.

NDX W: Testing 2HR1.

QQQ D: QQQ Almost at 2HR1, slightly above OctR1.

NQ: Unlike ES, actually fell under AugP and D50MA on last drop.

NQ: 2HR1 slightly above.

NDX sum: Careful observers already know that NDX hasn't been too zippy in 2H. Q4 is starting OK with move to new highs but at major resistance already at 2HR1. Recent longs should watch to take gains and this may even turn out to be the hedging vehicle for USA mains compared to IWM in 1H.

INDU / DIA

INDU W: Blast off.

INDU W: Slightly above 2HR2; YR2 not far away.

DIA: Like SPY, already at Q4R1.

INDU Sum: Expect to see YR2 by year end, but for now Q4R1 enough for a pause.

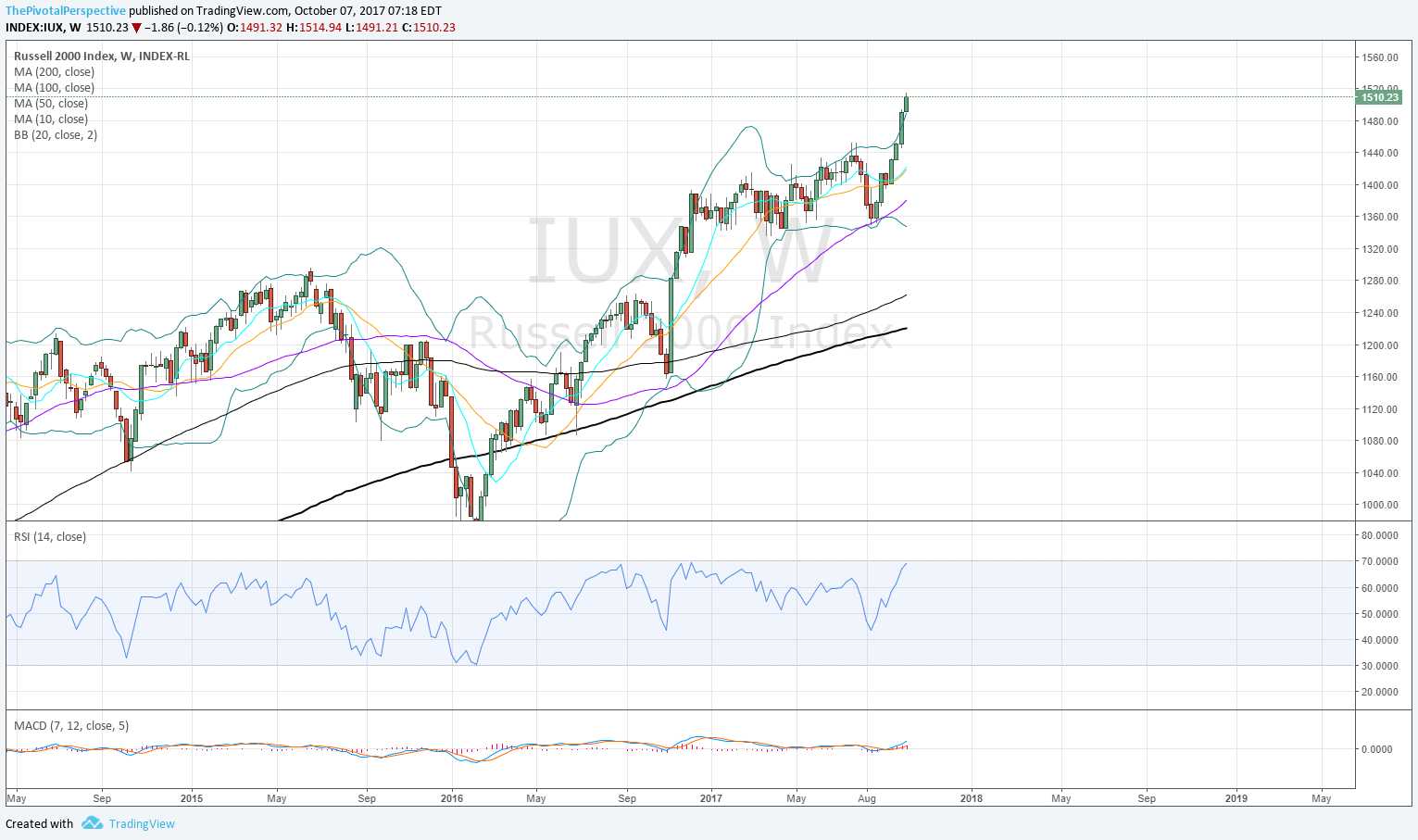

RUT / IWM

RUT W: Power move up after holding W50MA and lower BB in August. 2 weekly closes outside the BB.

RUT W: At YR1!

IWM D: Above 2HR2, but just under YR1 on this version. Cash index was 4 points from tag of level.

RUT: What a move from August lows. But YR1 should be enough for some drop as next move.

NYA & VTI

NYA W: At 2HR2.

NYA D: OctR1 on exact high, for now maintaining above 2HR2.

VTI W: Between levels.

VTI D: At Q4R1 or near enough.