Sum

Last week, SPX/SPY dropped from its YR2 as NDX/QQQ continued lower from its Q4R1 top to fall under its 2HR1. Then on Friday, indexes came back powerfully - NDX cleared both levels, and SPX raced back to resistance. Current leader Dow has slowed a bit but already paved the way by clearing YR2, then Q4R2.

Given the move back up, I must conclude that the market has decent chance of going higher but still worth watching SPX/SPY resistance cluster 2576-82 and 258.00-259.75. Another big level that could come into play soon is RUT/IWM YR1.

SPX / SPY / ES

SPX W: Ordinarily I'd say small up bar outside the BB invites selling, but there have been 2 others like that in the run from August lows. RSI very powerful.

SPX W: In resistance area YR2 2576 / 2HR2 2582.

SPY D: At YR2 / 2HR2 combo, with Q4R2 slightly above those as well. Cluster 258.02-259.75.

ES Z: Above all pivots from 8/30, with rising 10 & 20MA holding as support.

ES 1: At YR2 / 2HR2 combo.

SPX sum: Amazing run; testing resistance area YR2 / 2HR2 2576-2582. First reaction down from 10/23-25 came very powerfully to again test level; decent chance of getting through.

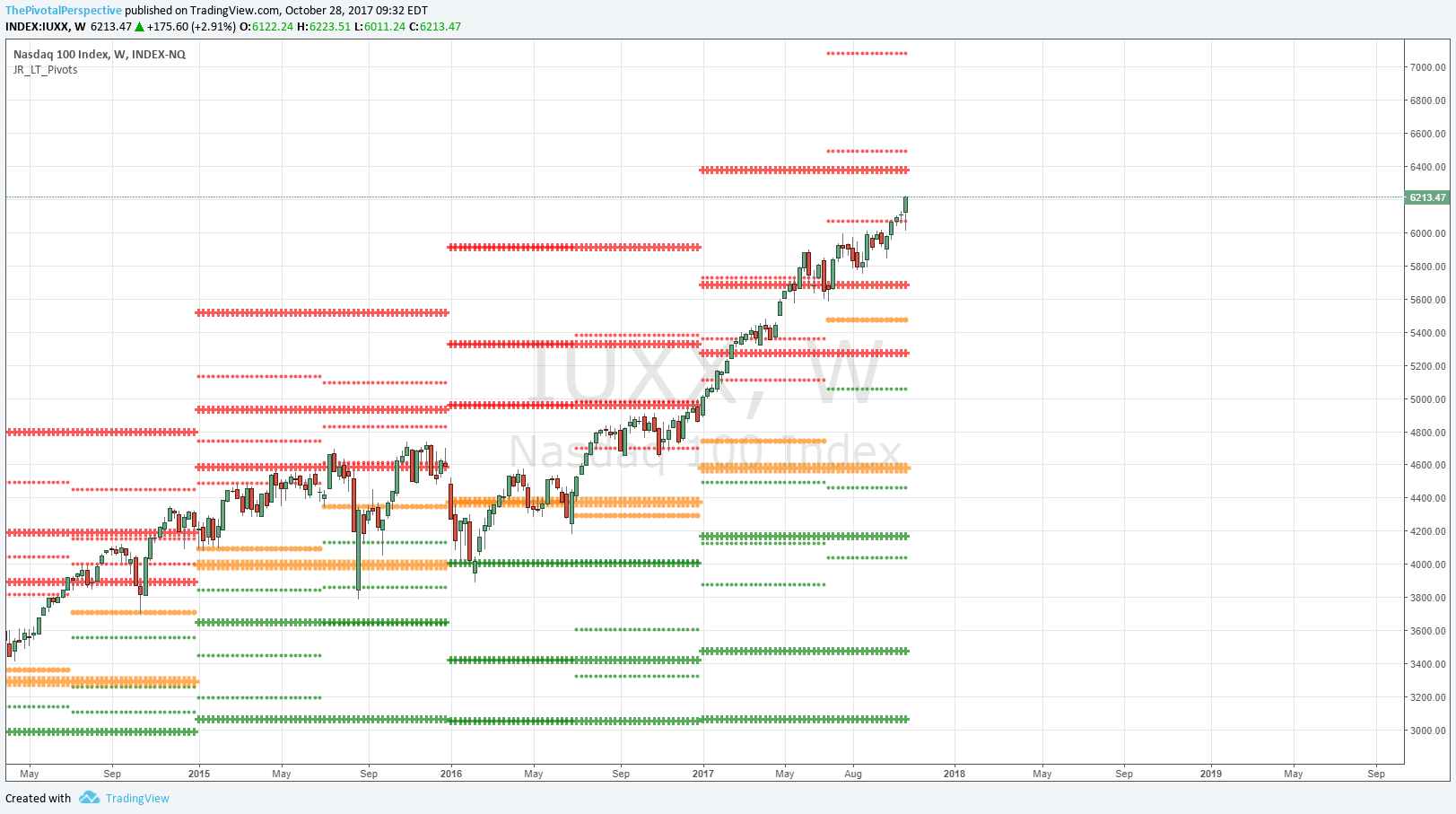

NDX / QQQ

NDX W: RSI reaching overbought like the others.

NDX W: Launch above 2HR1, bullish.

QQQ D: Launch above Q4R1, bullish.

NDX: NDX had looked like a decent top with selling from Q4R1 that then broke 2HR1; Friday's powerful rally came back to clear both of those levels. Bullish.

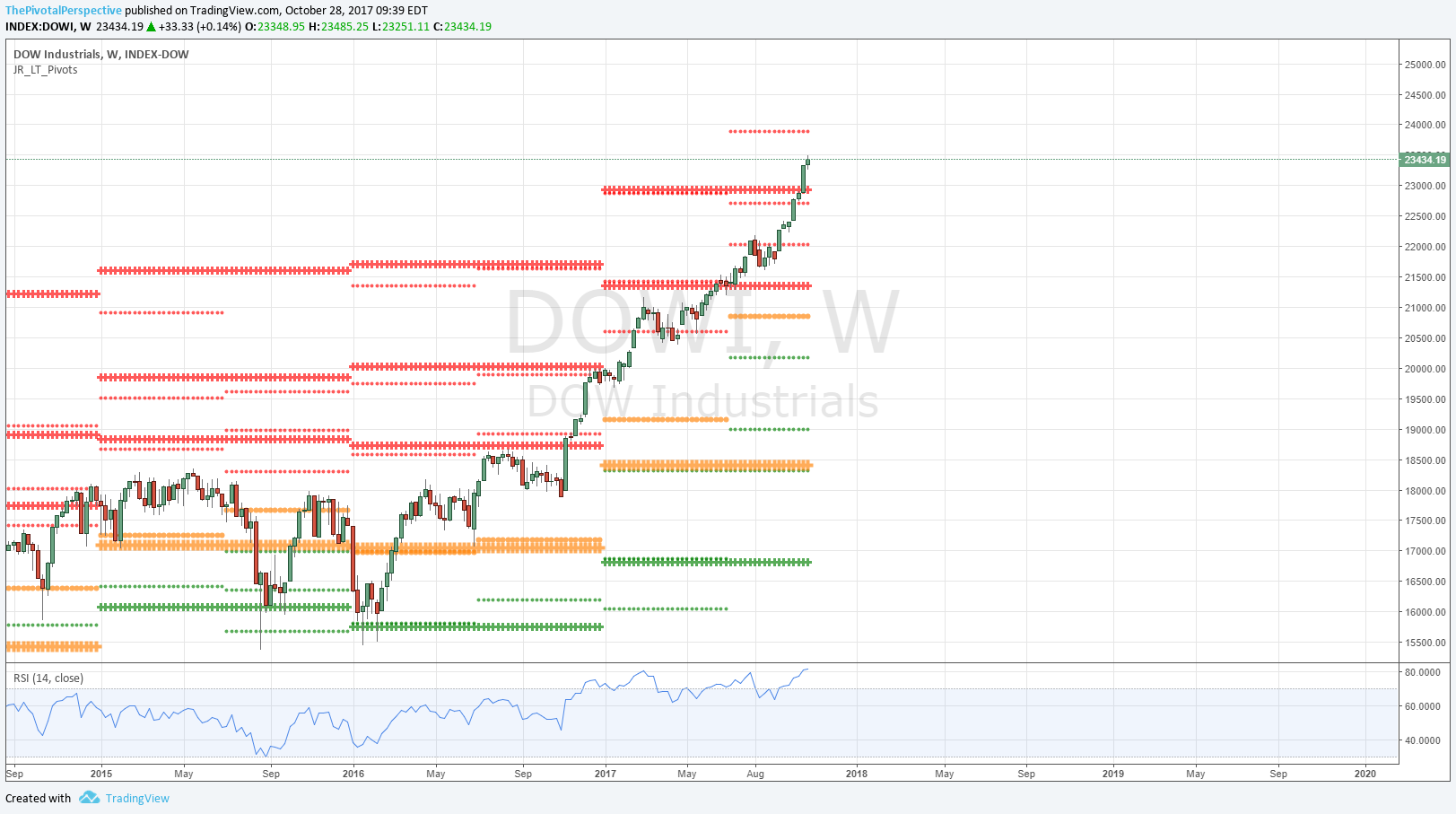

INDU / DIA

INDU W: Already powered above YR2.

DIA D: Buying slowing but above all resistance levels (OctR3, Q4R2, YR2) with next quite a ways up.

INDU sum: Slowing but maintaining gains after strong move up above YR2 and then cleared Q4R2 without any trouble; currently above OctR3.

RUT / IWM

W: Stuck under YR1 for 4 weeks.

D: Above 2HR2; room to test YR1.

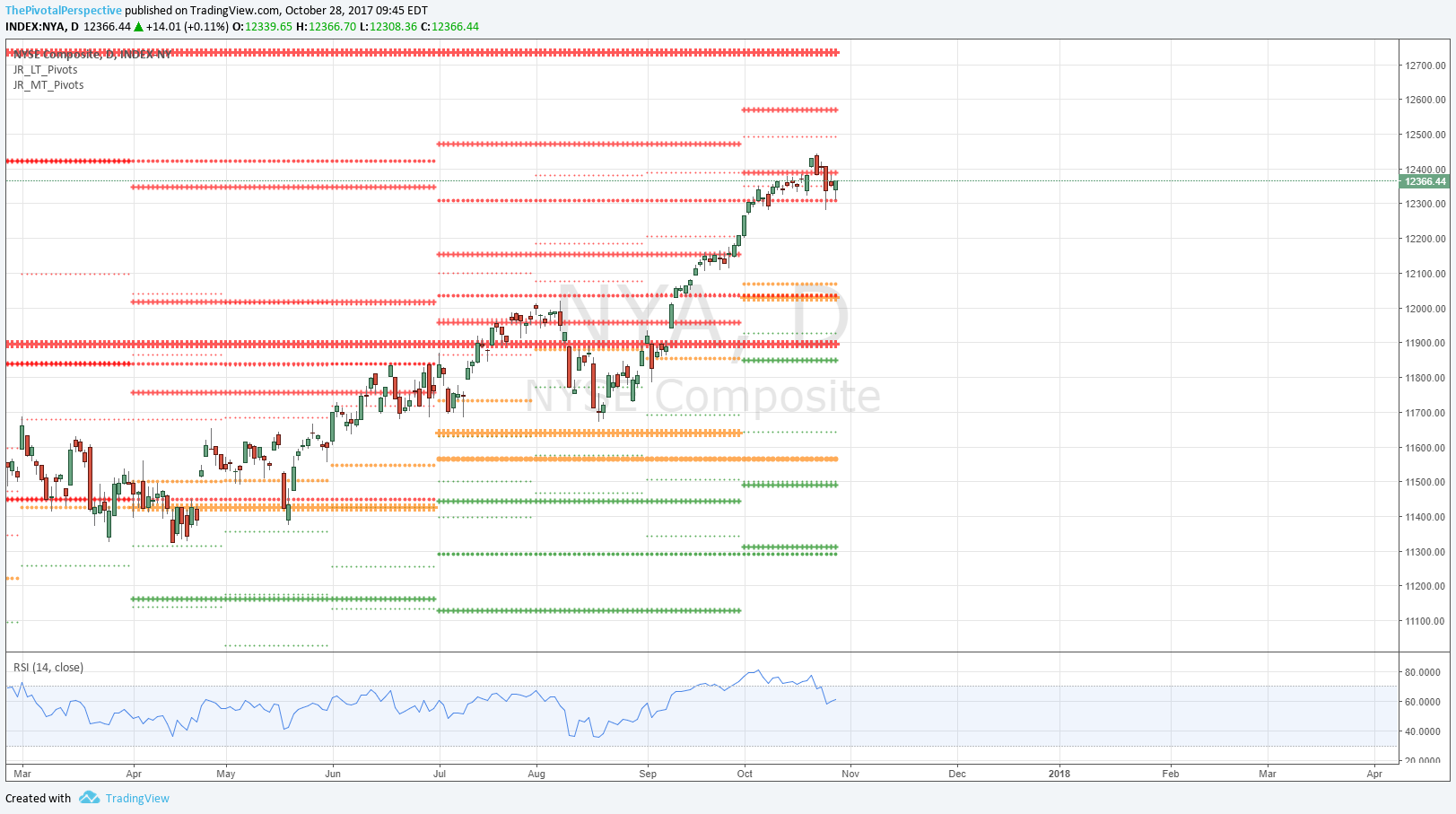

NYA & VTI

NYA W: Above 2HR2 is bullish.

NYA D: 3 days above Q4R1 then fall back below.

VTI W: Near 2HR2.

VTI D: Lifting above Q4R1.