Bulls winning.

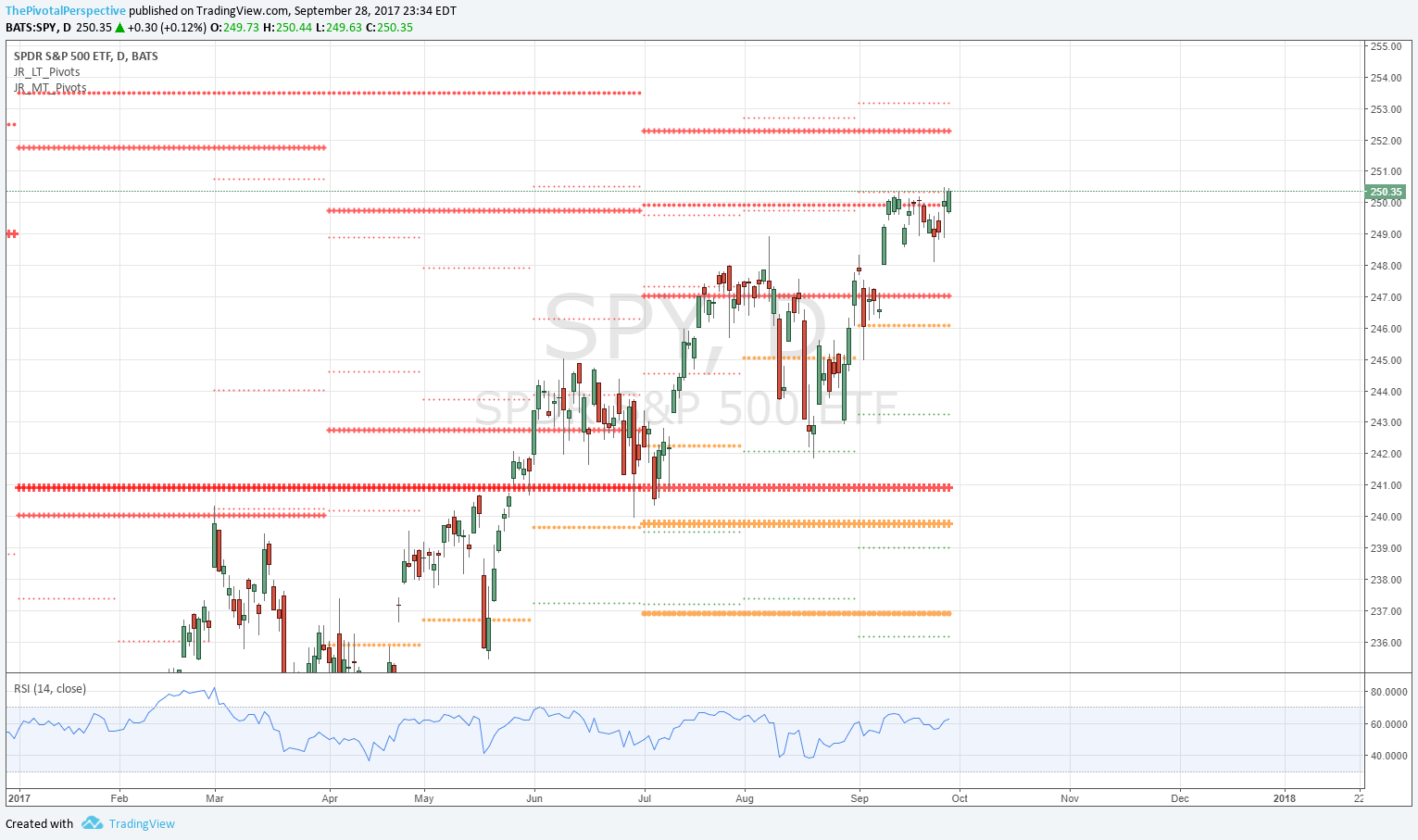

SPY above 2HR1, and SeptR1 for that matter; RSI not overbought

QQQ above SepP, slightly - but at least above all pivots

DIA lifting from Q3R1 support, not at resistance

IWM blast off above 2HR1, tagging Q3R2

VTI like SPY, and NYA lifted above Q3R2

VIX below all pivots from 8/22 on; XIV above all pivots from 9/11 on, and today fractionally cleared YR3. TLT sharp breakdown and GLD looks weak.

In others words, risk on. To emphasize, SPX very bullish above 2503 because it opens the door to 2576.

Global indexes haven't fared as well with the sudden $USD strength and rate jump. I recently emphasized XLF for additional capital but didn't hop on IWM.

Oil is perhaps the trickiest; i have mentioned this as candidate for upside surprise in the last few weeks which indeed delivered (most especially on XLE), but today it tagged its YR1 on USO which was soundly rejected. It may come back, but at least partial profits is right move and time will tell on the rest.

Lastly, consider that we are looking for definitive moves near the end of Q3 and beginning of Q4, and so far that looks to be USA indexes up, global indexes and perhaps tech weaker, rates up, metals down.

SPY, SPX, XIV, USO below.