Not comprehensive, just the ones I like to track and trade.

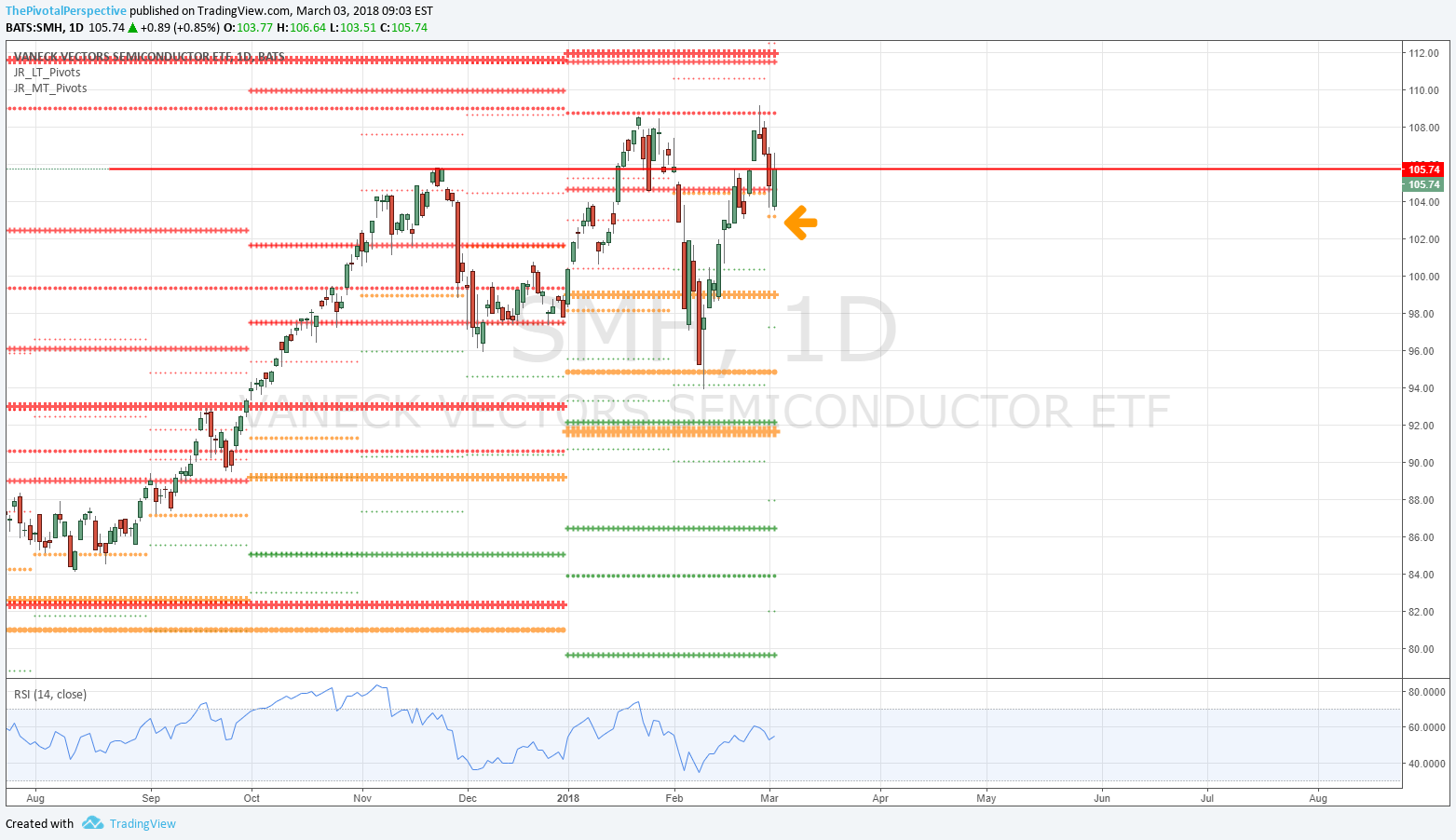

SOX

W: A few moves down from 2000 top but now 3rd time above.

D: Sox mentioned as buy in 5/5 Total market view; now can hold above HR1 and watch what happens at the YR.

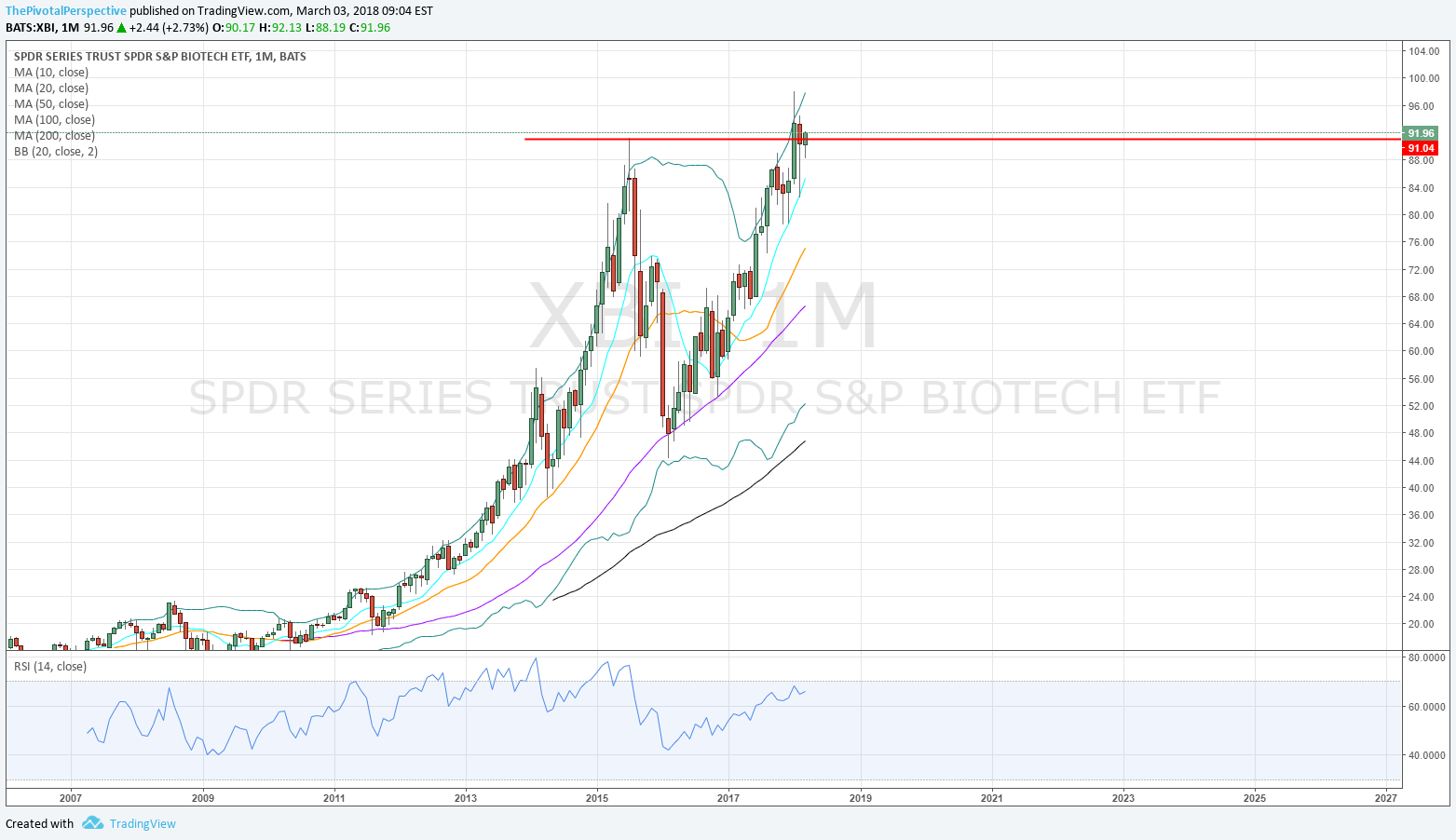

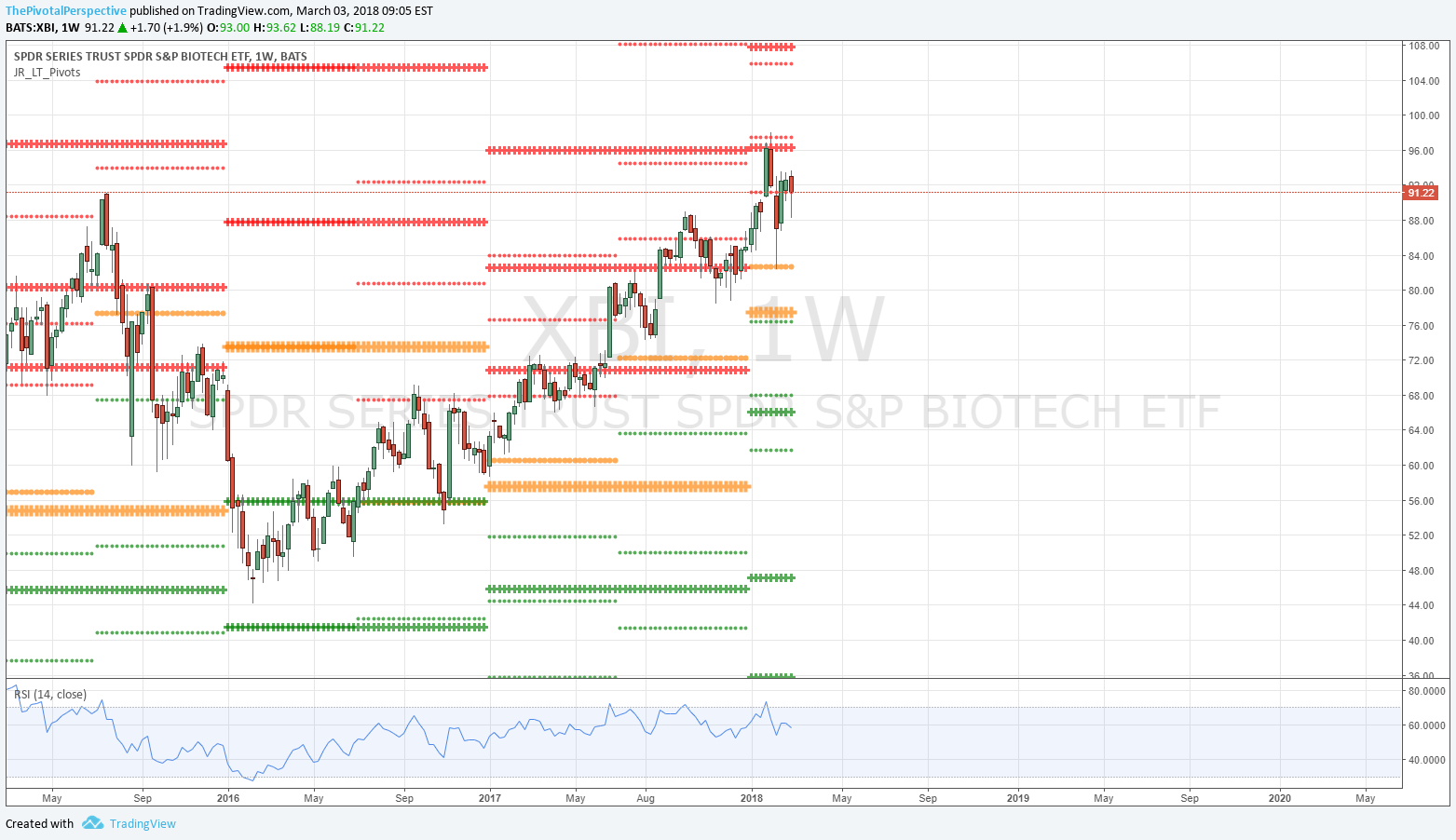

XBI

W: Also rallying above 2015 top for the 3rd time after a several weeks of struggle.

D: 2 previous highs at HR2 YR1 cluster. Fast move up from recent low looks more likely to breakout above.

XLF

D: Well under QP, above JunP but if below that and D200MA would be easier short.

XLE

D: Power move when changed status above HP and then above YP 4/10-11 and straight up to YR1 followed by sharp pullback.