I tend to mention sentiment when it is doing something interesting. In the last few weeks, there was one massive ISEE spike high, but at the time, other readings were subdued. As of the end of last week they have finally been convinced of the bull side.

This increases the chance of a decline as the next move.

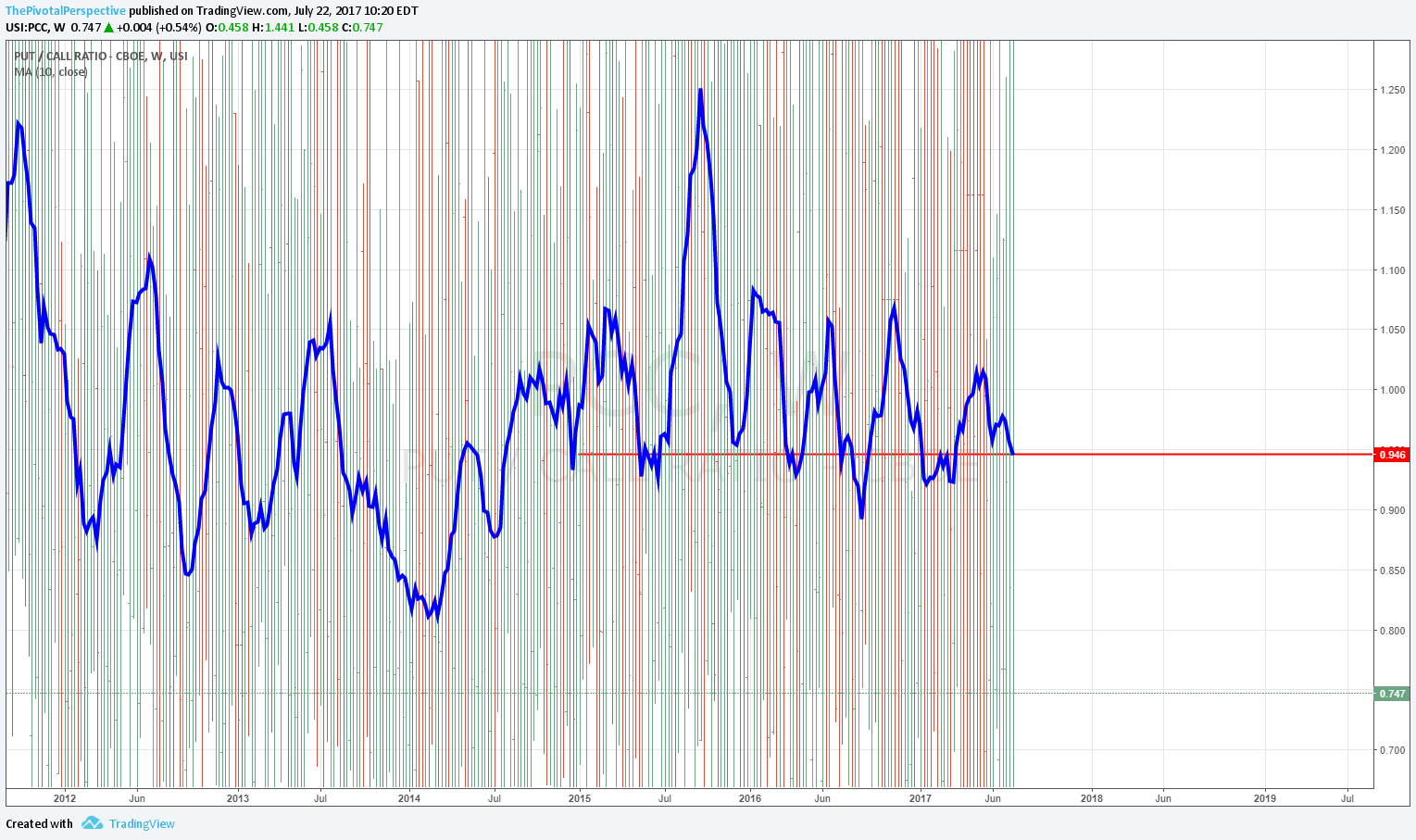

Put-call W

On the lower side, especially when viewed from 2015+. 2013 abnormal QE year.

Put-call D

Near lowest levels of past 1.5 years.

4/25/2016 - near trading top of 4/20.

7/20/2016 - SPY higher but not by much for several weeks then correction into November.

12/15/2016 - Trading top for dip into year end.

2/27/2016 - Decent trading top 3/1.

6/8/2016 - Top for NDX, -5% followed.

And now.

ISEE

3 recent spike high readings, the highest one was the 3rd highest this decade. 10 day moving average at highs for the year.

AAII

While levels not extreme for the decade, for 2017, 7/20 readings were:

2nd lowest in bears

3rd highest in bull-bear spread

NAAIM

Elevated 5/24 and 6/28, but faded a bit since then. No extremes here.