Sum

Per pivots, the usually reliable VIX is undisturbed, below all pivots despite several chances to move above its 2HP / Q3P again last week. That said, 3 of 4 days last week looked like D200MA was starting to act as support, an interesting development.

But every other safe haven points to concerns for risk. XIV, bearish divergence to VIX, below its monthly pivot from 8/10 on and remained below its SepP from 9/1 on. TLT above all pivots with convincing hold of YP 9/1-5. AGG a great tell, above all pivots from 8/1 on. HYG, often doing a good job leading down before stocks, Q3P and SepP rejection on 9/8.

GLD exploding higher and has been huge win for TPP, with a decent size buy rec on 7/11 and no exit suggestion thus far. Special metals post on 8/23 pointed out strength of GDX, which has gotten in gear for a 9%+ rally since that close. SLV bringing up rear, but also above all pivots from 8/28 on. While stocks have gone largely sideways, GLD, TLT and GDX have been great trades (in addition to the fast XIV short).

Bottom line here is that safe havens have been speaking very loudly in August and continue to indicate concern for risk assets in September. If VIX moves above its 2HP / Q3P again at 12.28 and then above SepP 12.46, then they all shout together - reduce stock risk, hedge, or short.

VIX

W: Could have closed above 2HP, but didn't.

D: No fear here, still below all pivots.

D: D200MA starting to act as support!

VIX sum: Still below all pivots gives points to bulls & risk assets. But interesting to see D200MA looking like support 3 of last 4 trading days.

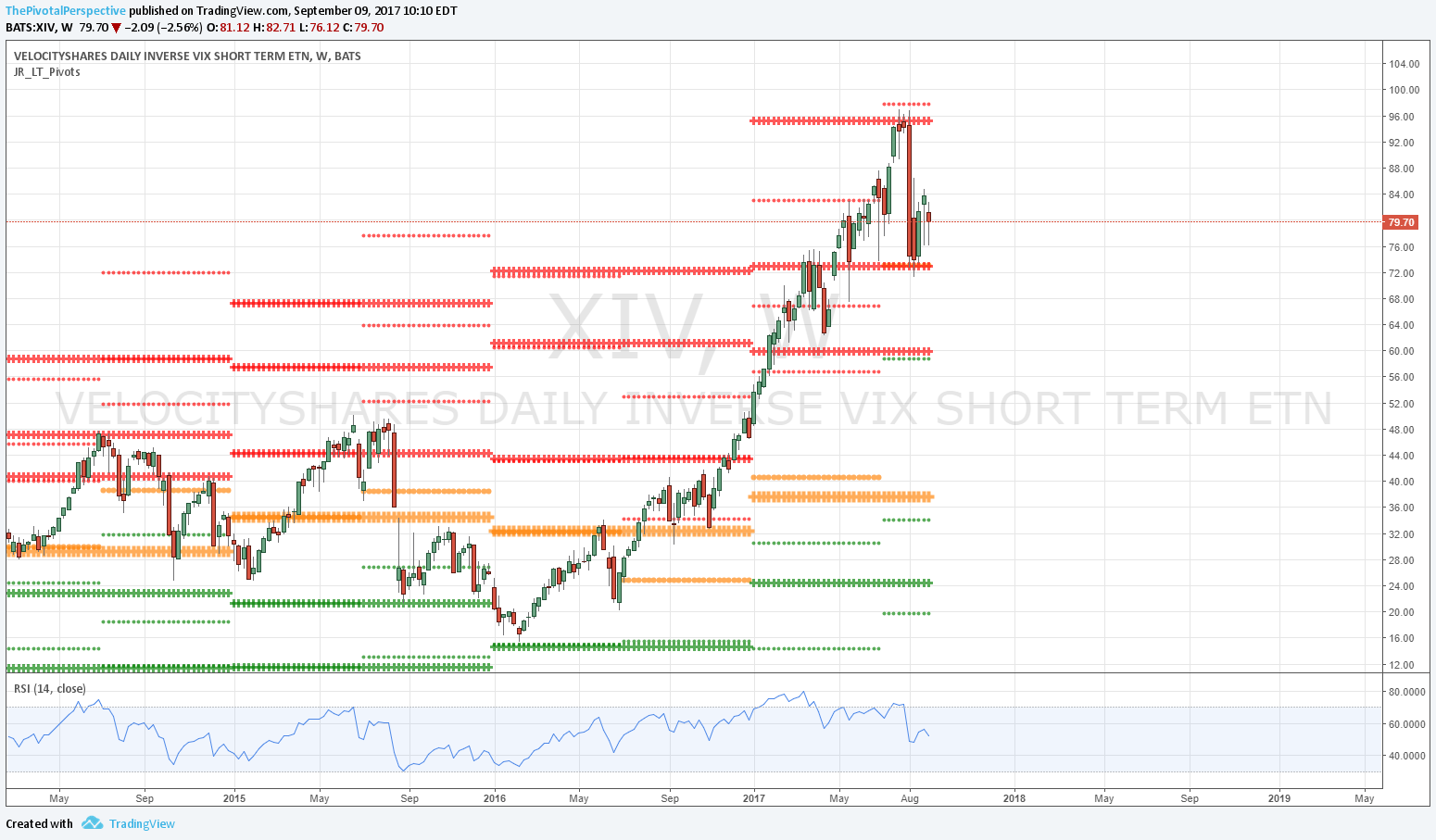

XIV

W: Those levels look after the fact, but that's the whole thing. They aren't. From YR3 to YR2.

D: XIV closed slightly under SepP on Friday 9/1, a bearish divergence compared to VIX. So far XIV winning. Still above Q3P, holding on several tests since 8/22.

D: After so many months of amazing up, below falling 10, falling 20, falling 50 and still slightly rising 100MA. This is what "rolling over" looks like on the daily 50MA.

TLT

W: Breaking out up. If higher, 50% from high to low in play at 130.15.

D: From late July, TLT showed clear buying on its 2HP and from there rallied above Q3P. Aug low bang on AugP, then to YP. After brief drop it tried again to clear the YP and did. 1 day slight pause, then higher, then a drop that held on 9/1, then soaring. TLT above all pivots! 2HR1 also 130 and change.

D: Adding moving averages and pivots only for clarity of trend - held 2HP and rising 100MA late July, then started to hold 10, 20 and 50MAs; slight break of YP but bang on rising 10MA; YP hold and rising 20MA on 9/1 low. This has been a partial buy from late July and potential add from August.

AGG

Part of the tell here, above all pivots from 8/1 on.

HYG

Often a good job at leading down, and stocks tend to follow. Note warning below SepP and Q3P, though recovered 2HP and still above that.

GLD

W: Big breakout up.

W: Cleared YR1 with ease.

D: After some sideways shuffle hear Q3R1, 8/25 definitive day holding D20, D10 and clearing the level. From there rocket up - no trouble at 2HR1, no rejection from YR1 and pivots have made this and daily hold from buy rec of 7/11. 5 daily bars from August outside the daily BB is sign of strength. We may start to see divergence highs this week.

GDX

D: After months of lagging gold, got going in a big way in last few weeks. Special blog post pointed out strength of metals 8/23. Currently above 2HR1.