REVIEW

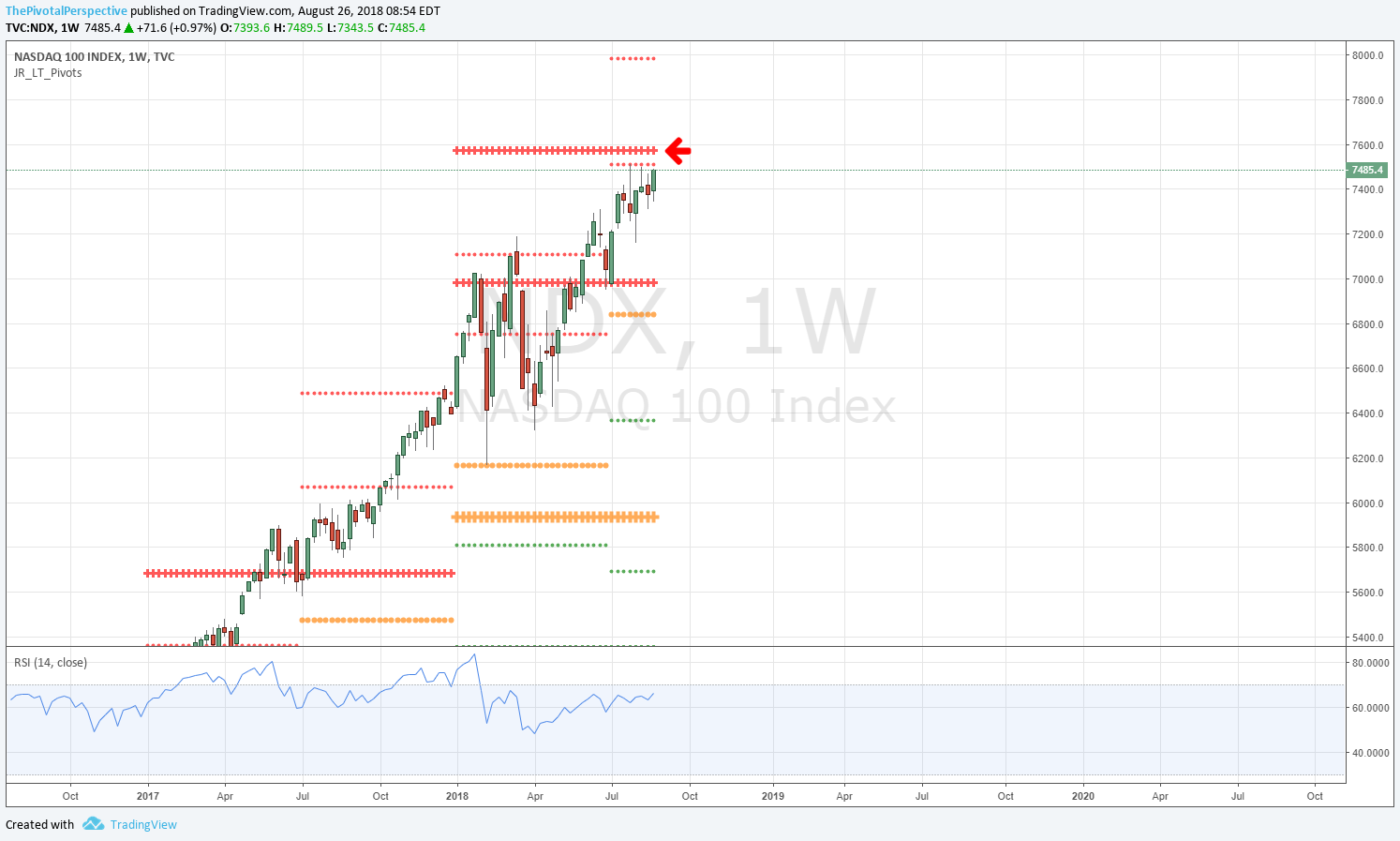

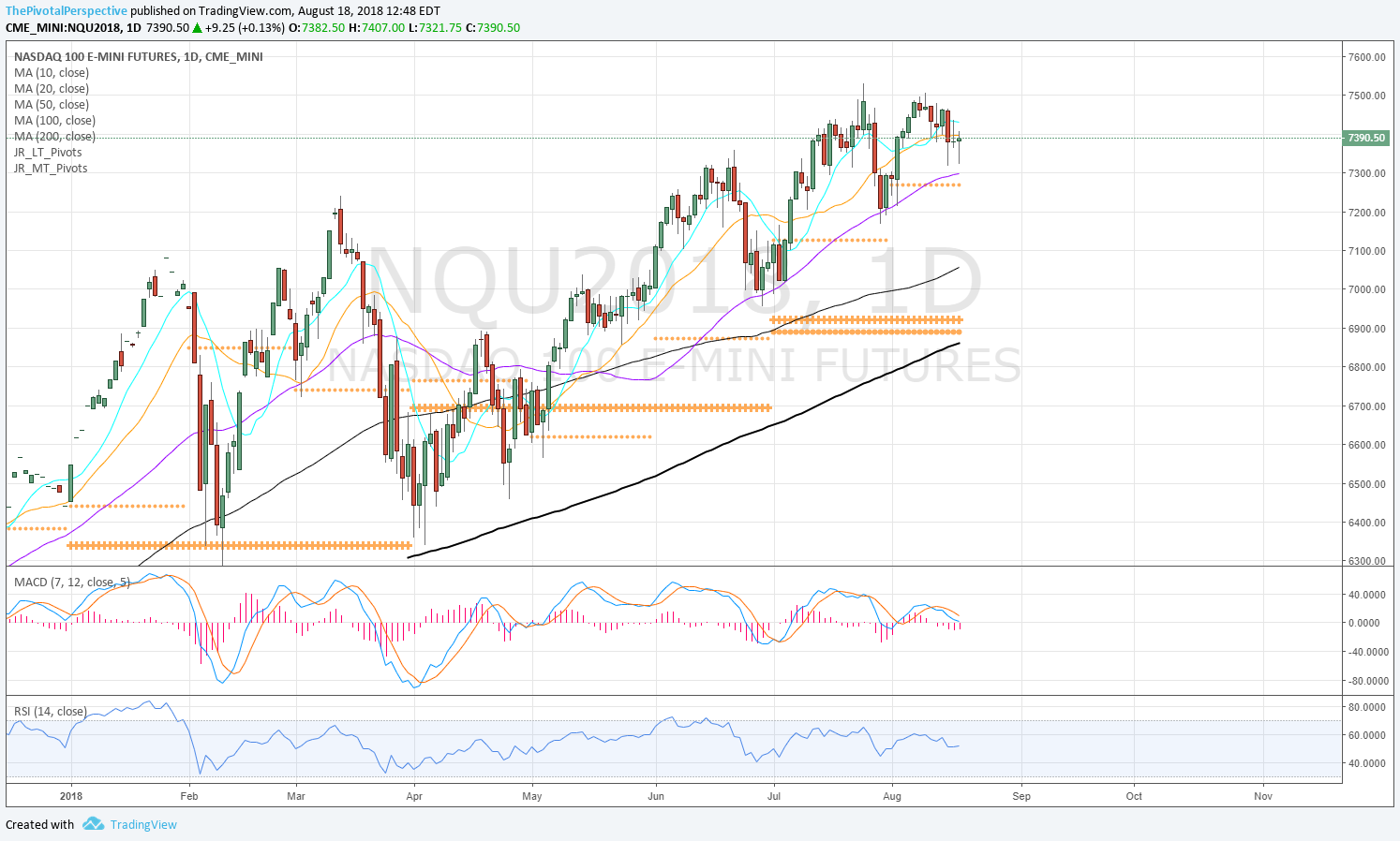

8/26/2018 Total market view: "Bottom line - The Pivotal Perspective has been bullish since early July, and anticipated a minor shuffle from the 7/25 high. Adding back into small caps worked very well last week, so mostly in monitoring phase. While I would like to see SPX clear its HR1, I'm not sure that NDX will blast through its YR2 on the first try.

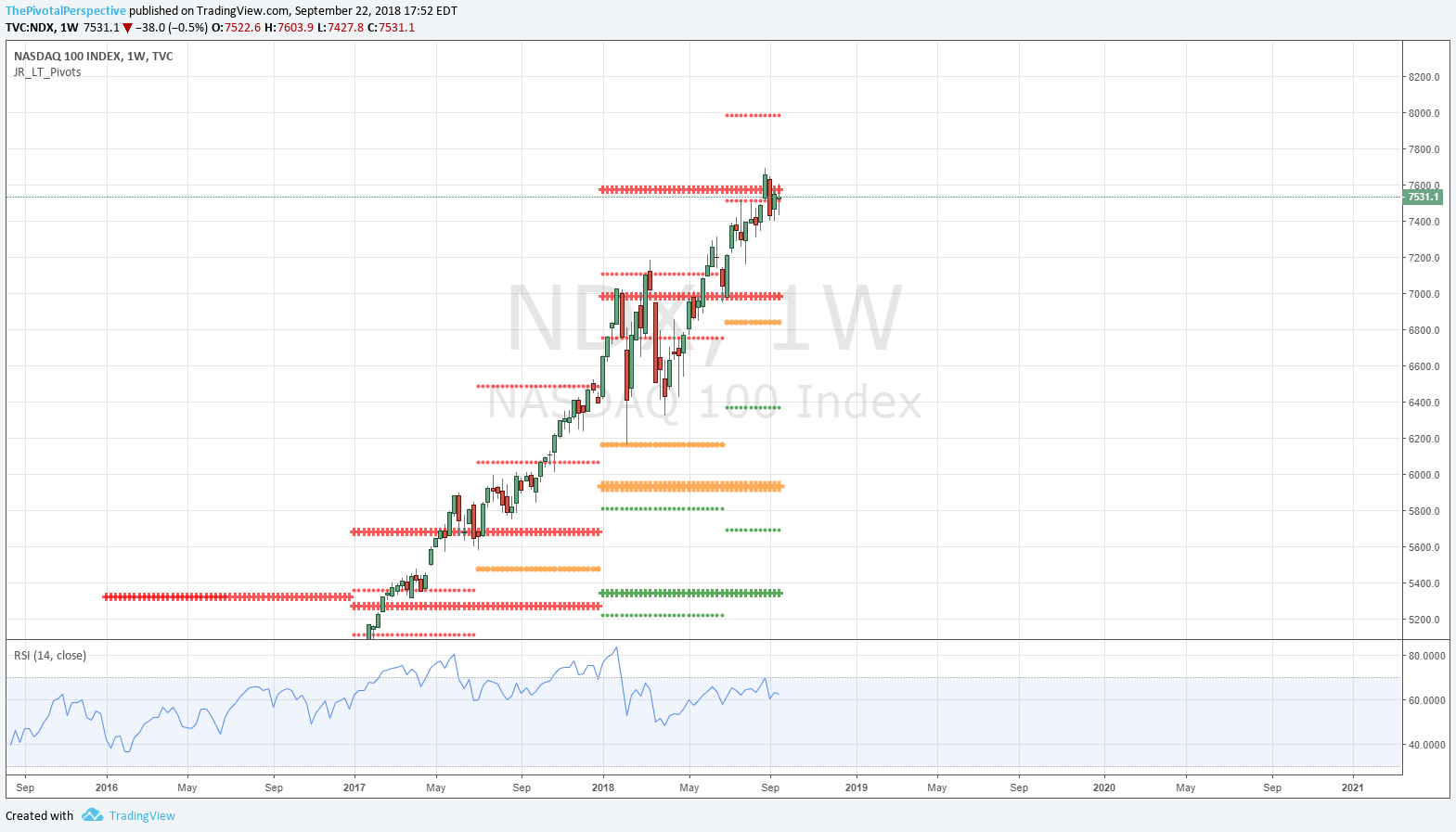

8/28 Daily comment: "In the latest Total market view on the blog, I thought SPX would rally above HR1 2883 but didn't think NDX would crack YR2 7572 on the first try. Due to strength, yesterday I said less sure that YR2 stops the rally. That is still the case. ... In sum no sign of rejection from NDX YR2 level yet. Long and strong. Bit concerned about VIX but so far no stock index exit / hedge / short signal."

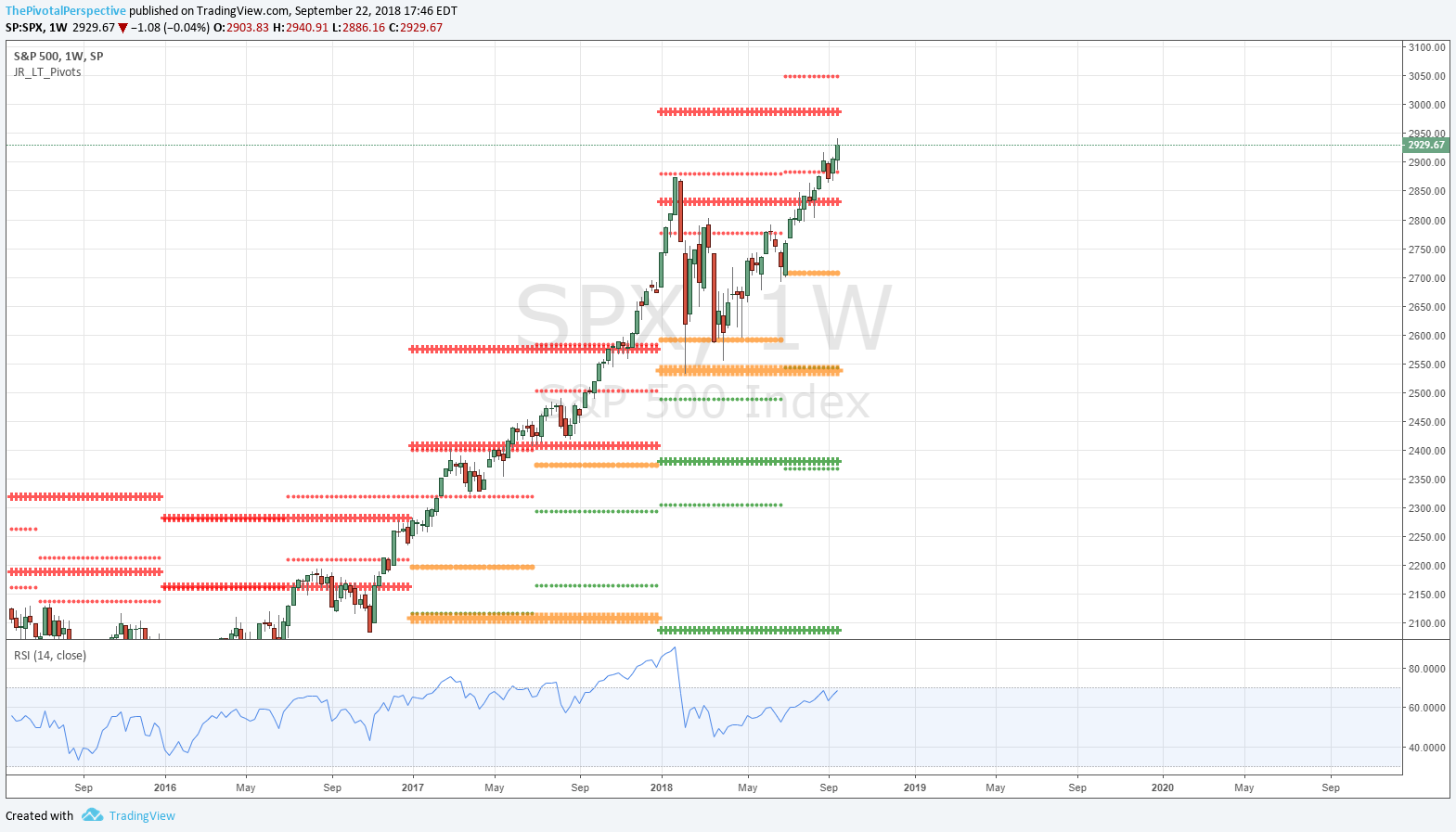

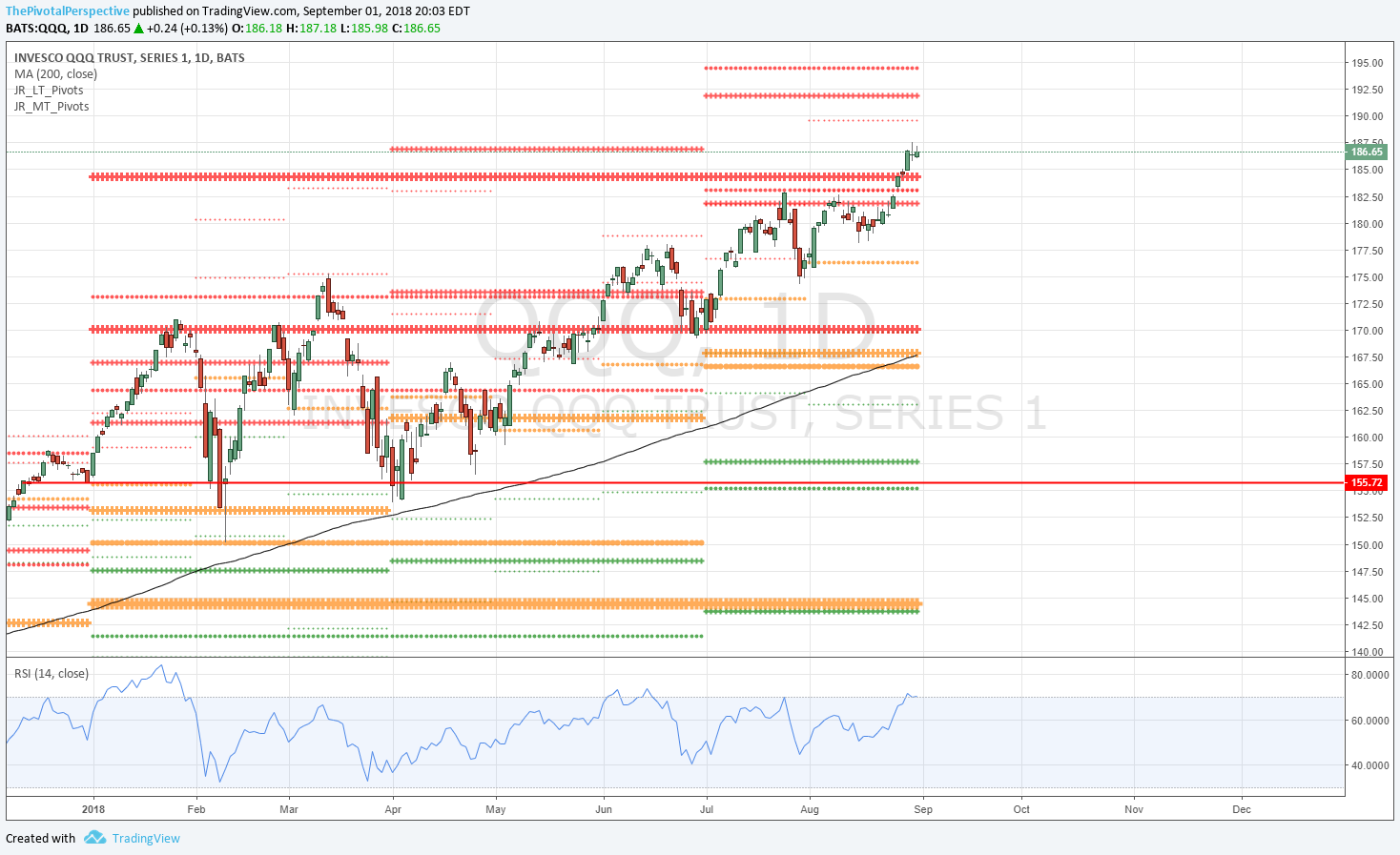

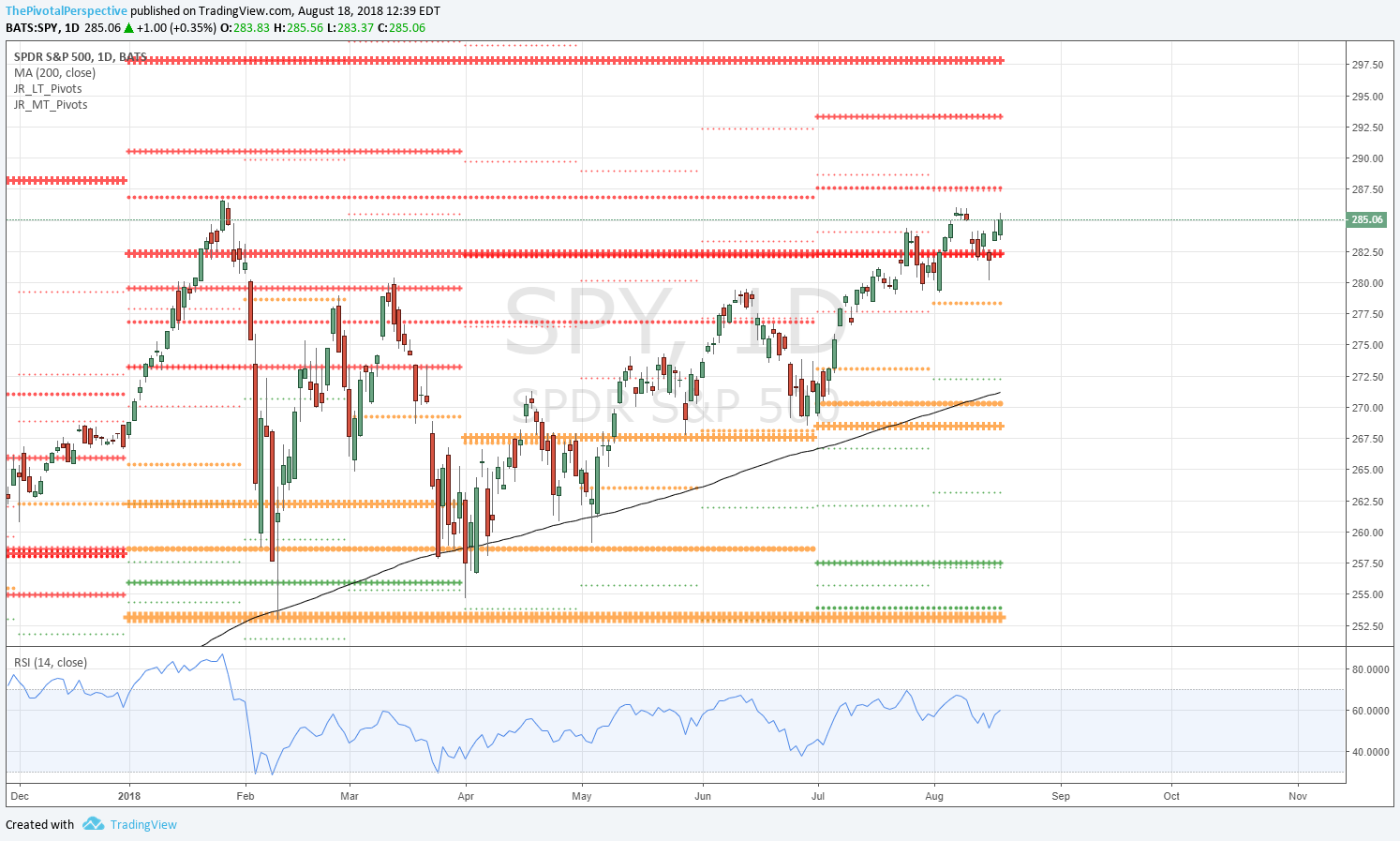

Result - SPX cleared HR1 to start the week, then contrary to initial expectations but in line with daily assessments, NDX cleared YR2.

SUM

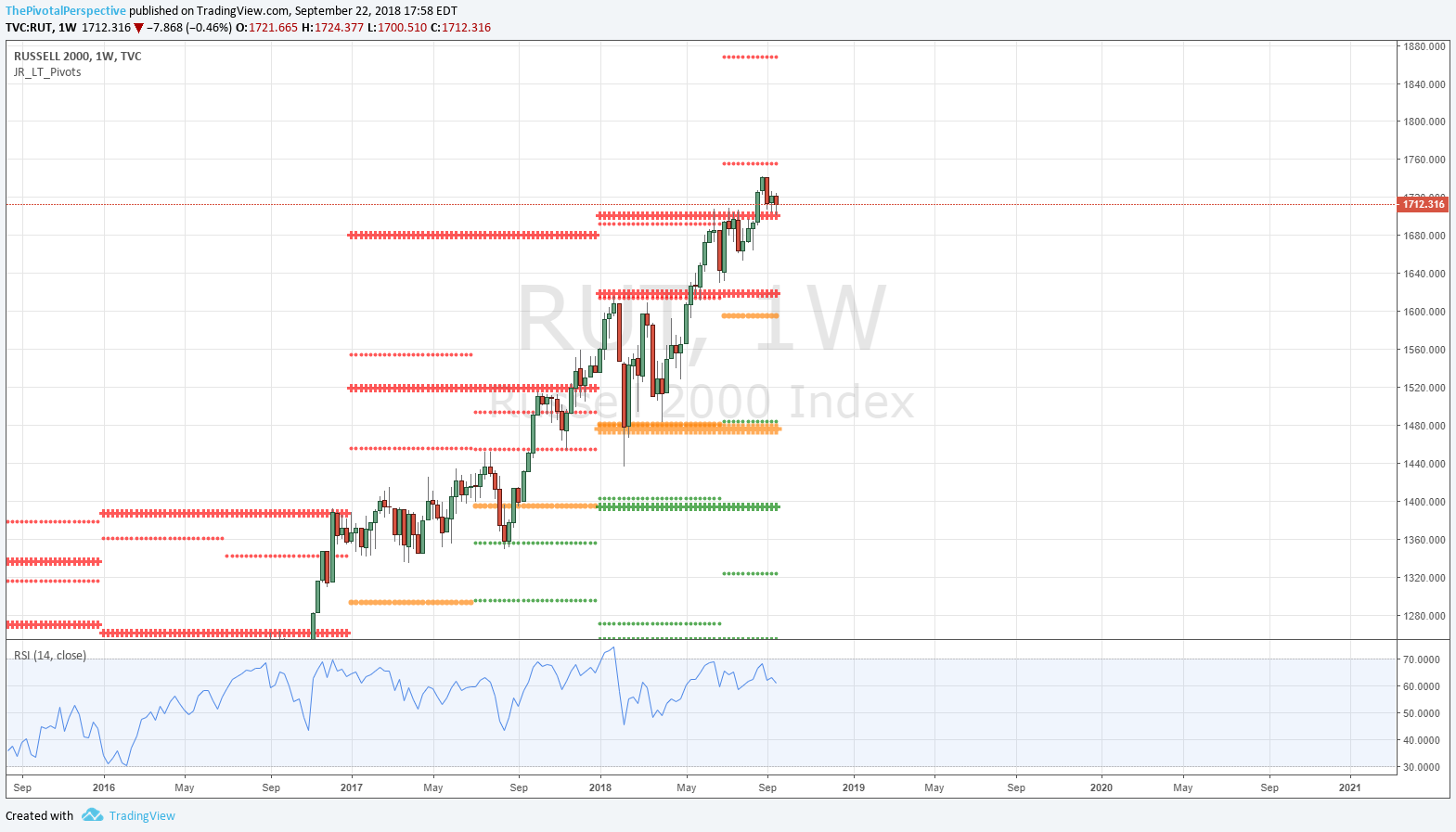

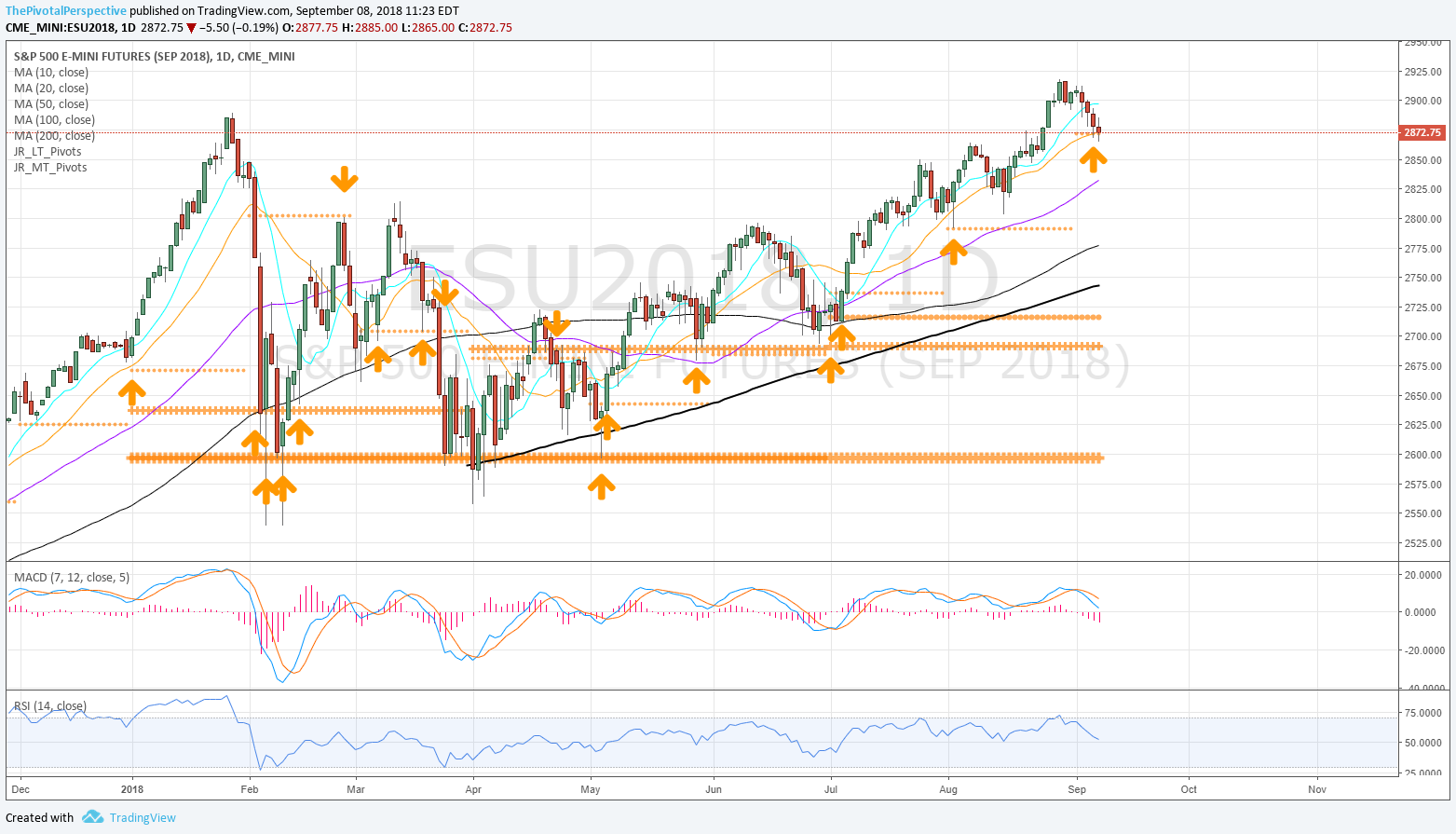

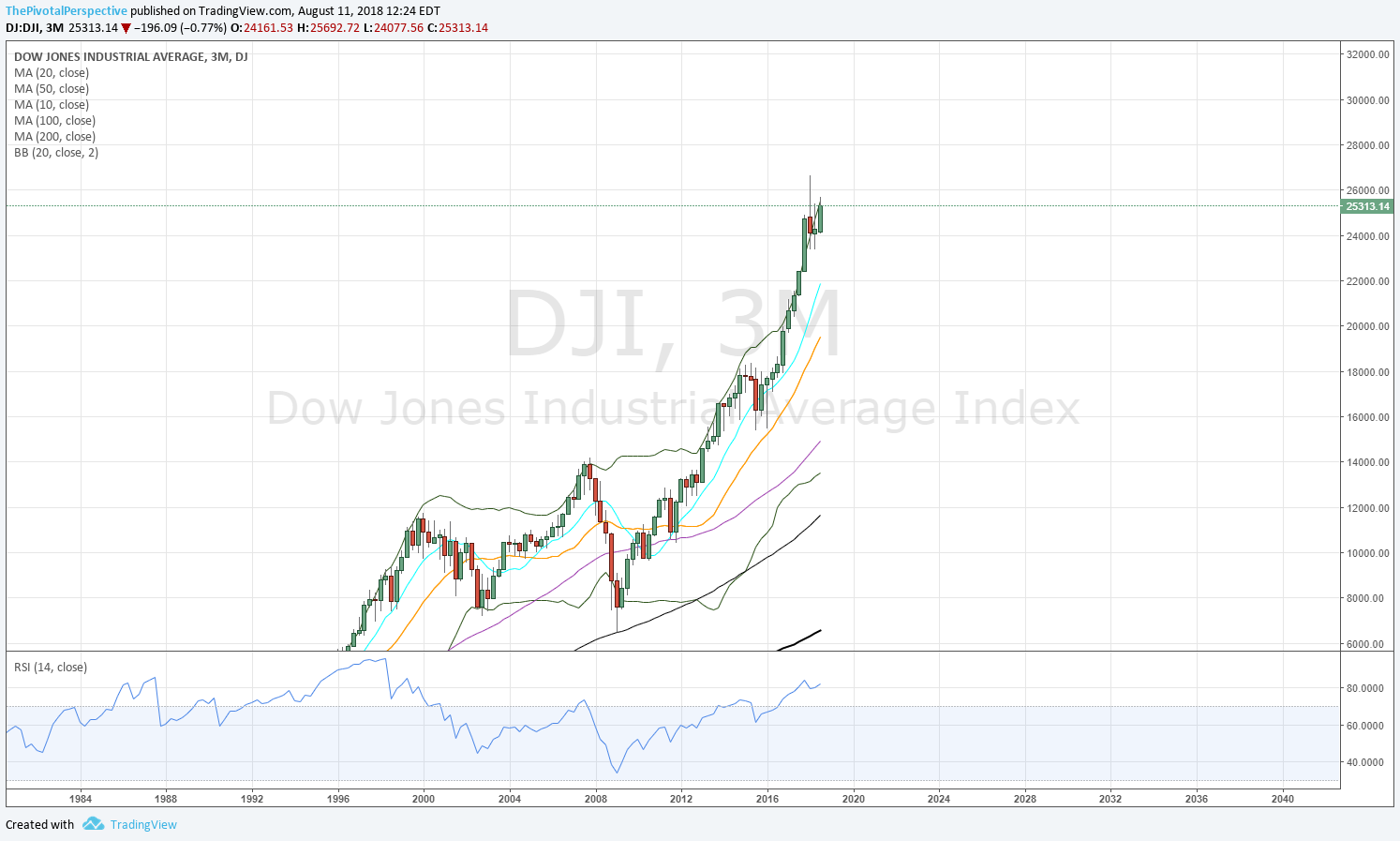

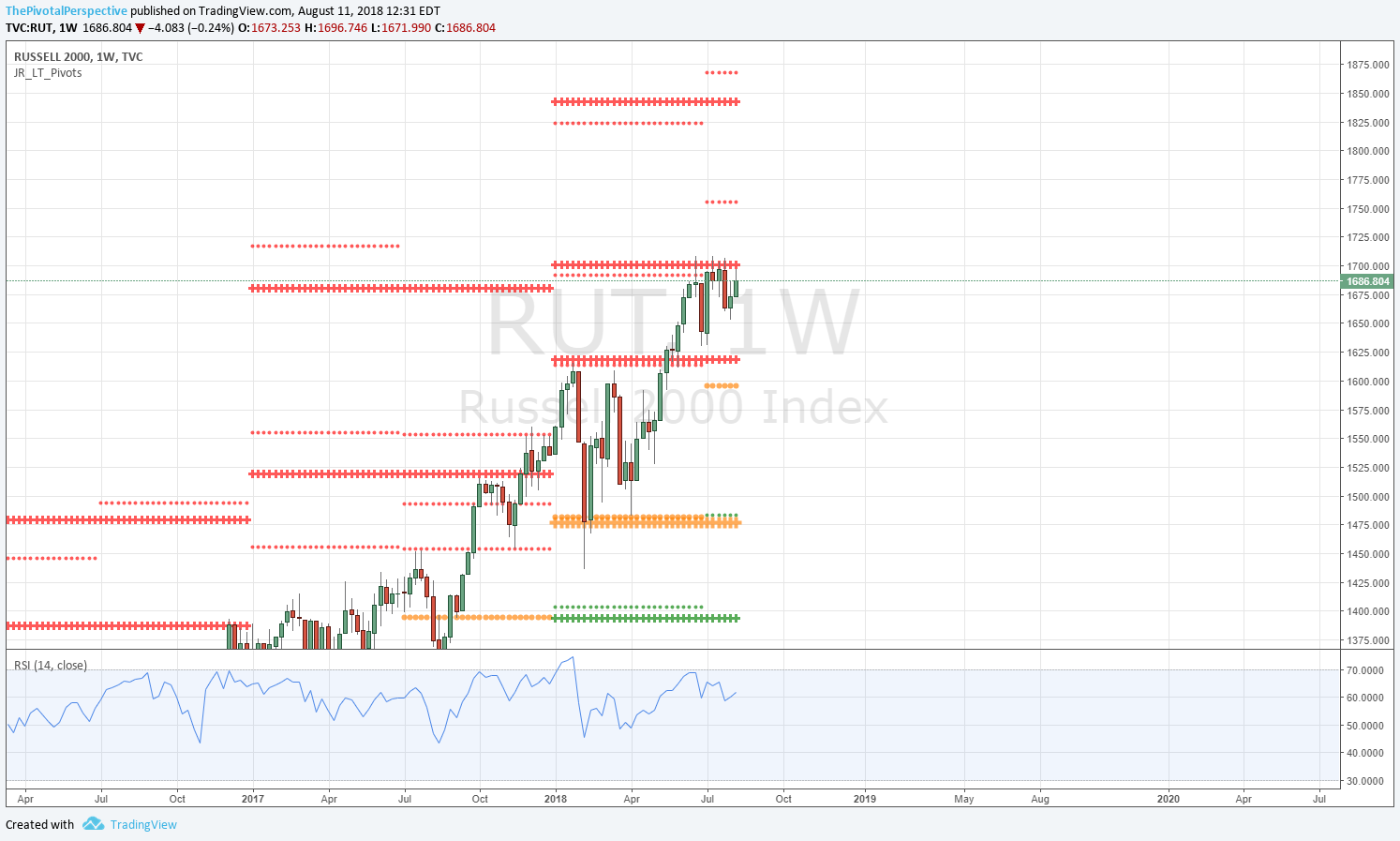

Playing the long side on USA equities from Q3 had had an easy 2 months of gains for the best trending period of the year so far. Touches of monthly pivots have been key entries or hold points, as what happens in a healthy up market. In early July, early August and then most recently mid August multiple USA mains either cleared their monthly pivot (July) or test and held (both times in August).

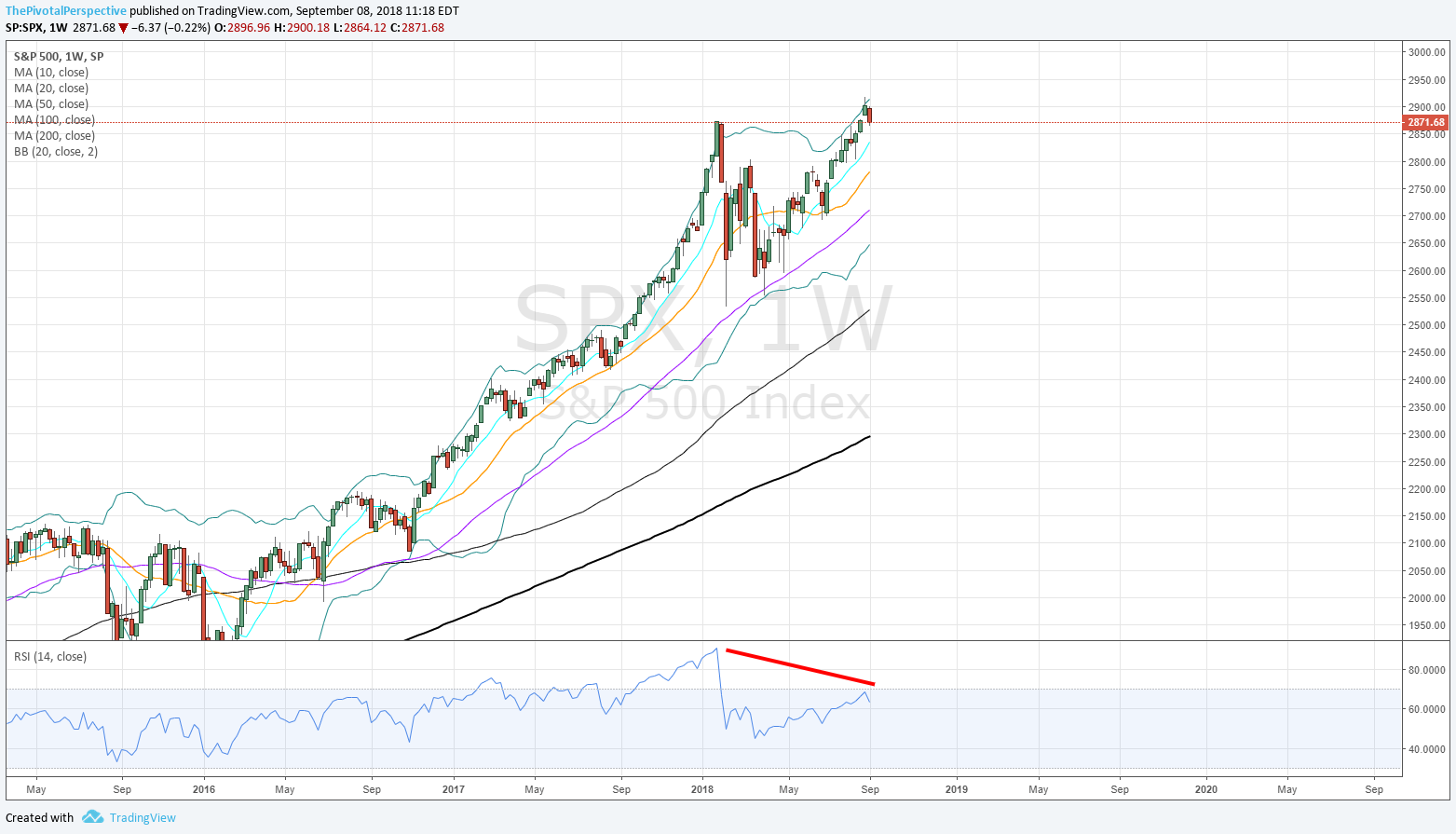

Last week 2 main indexes cleared major resistance - SPX above HR1 2883, which as long as that maintains, points to the chance of YR2 at 2987. Similarly NDX cleared YR2, and as big turns can happen at major levels it is more bullish for the market for the index leading in gains to be above resistance.

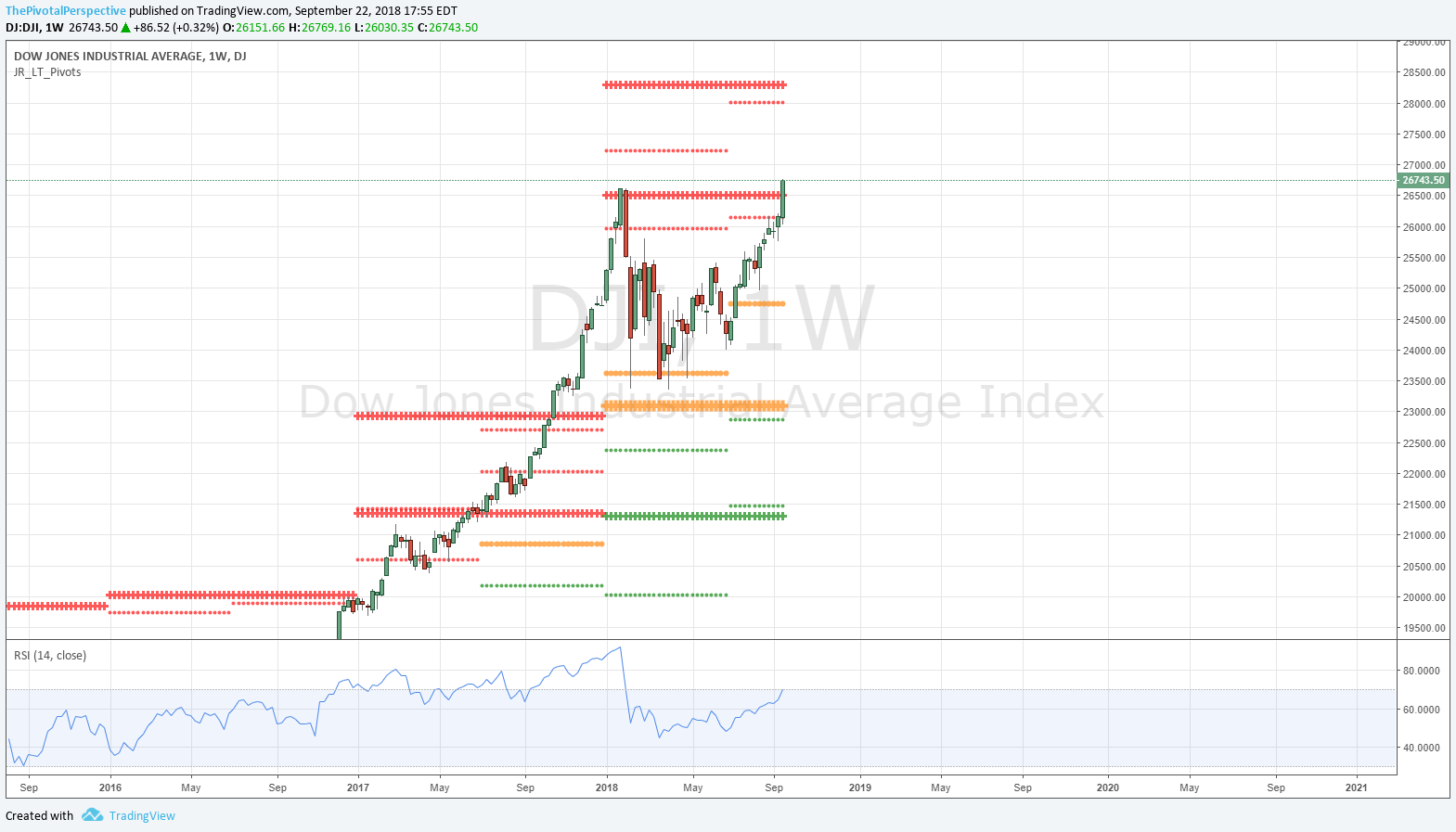

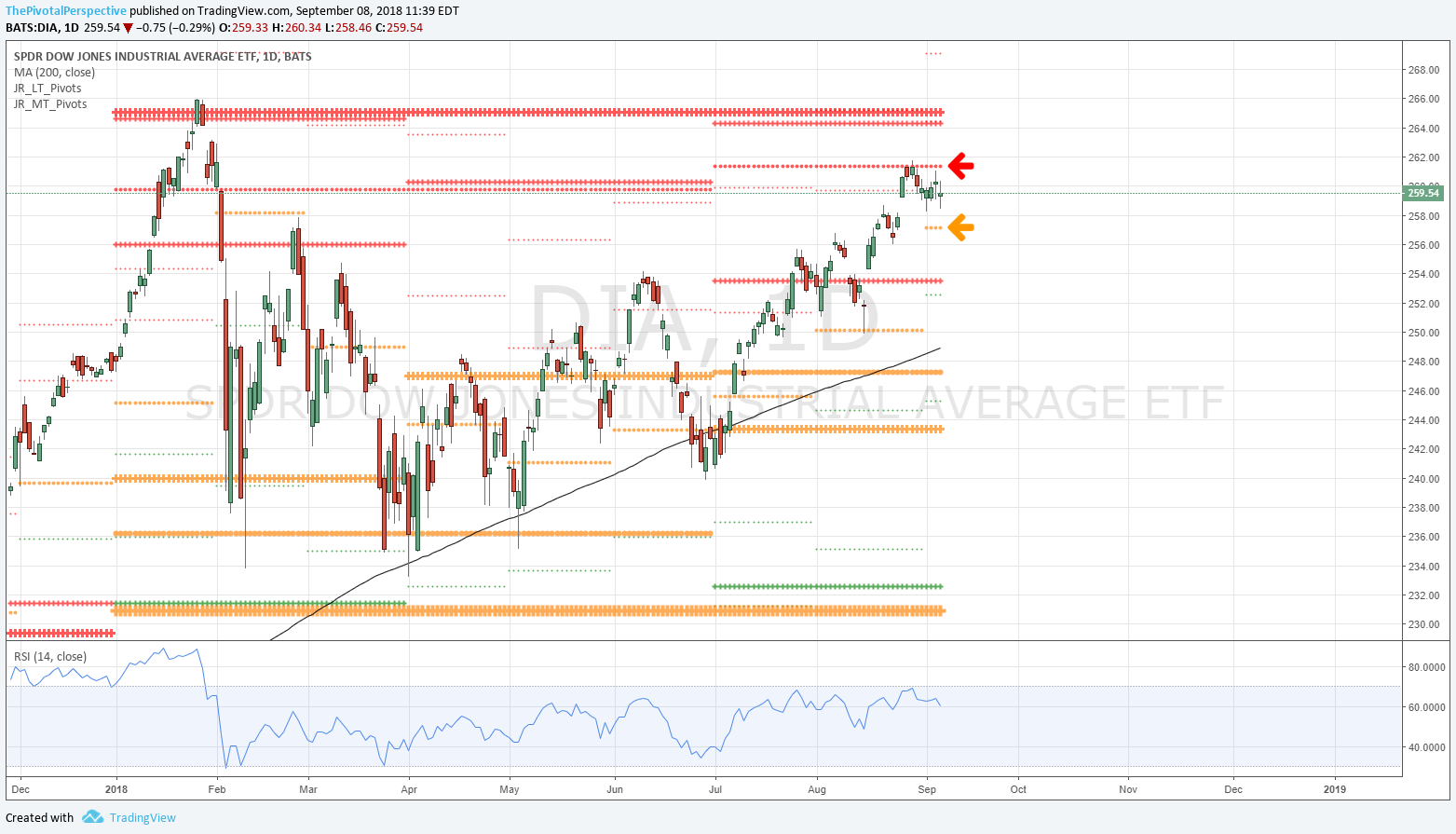

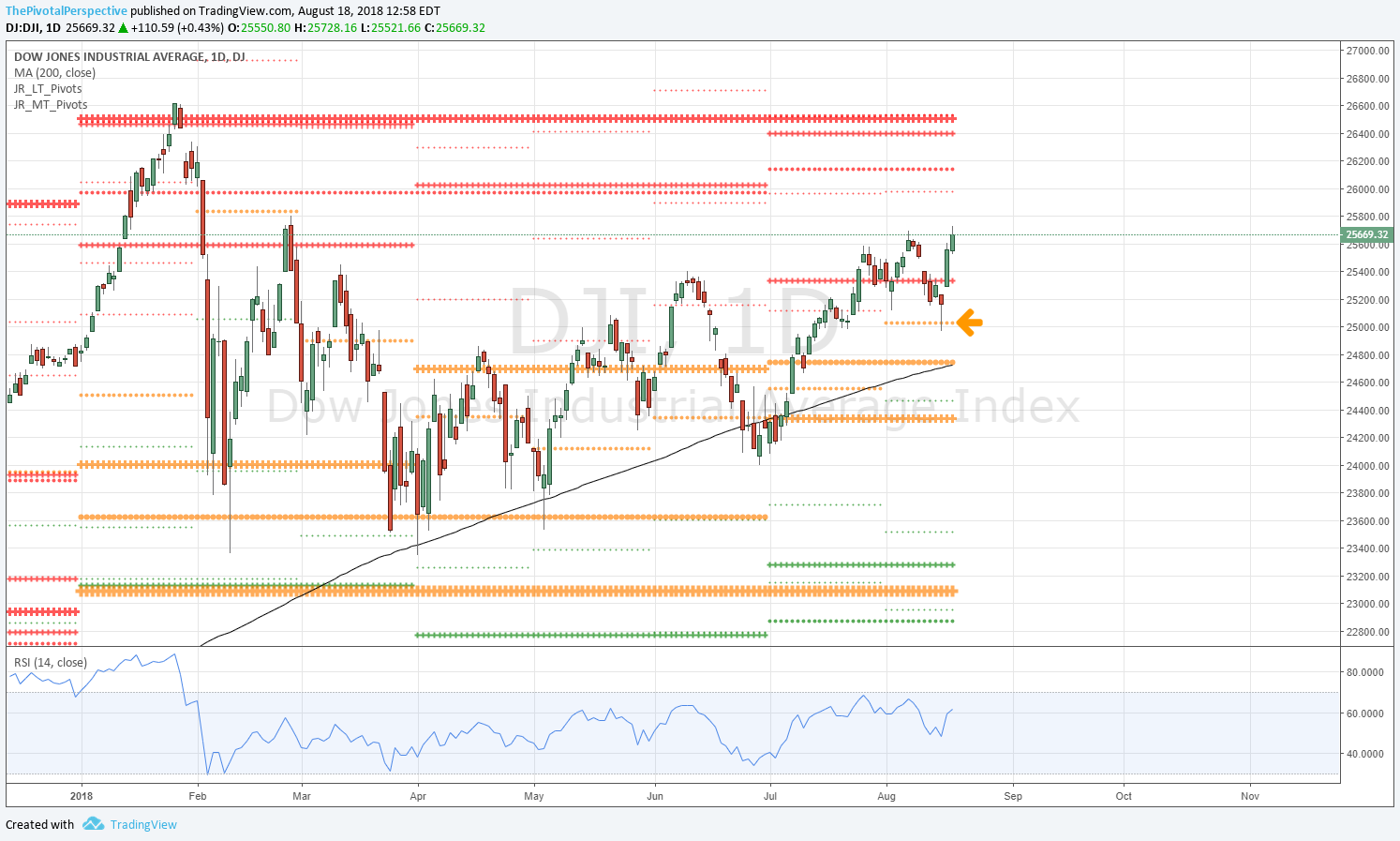

However, DJI stopped bang on its HR1, and RUT is testing QR1. Indexes are overbought or nearly so across timeframes (Q M W D), and a pause or small pullback week would be normal at this stage.

As usual it is international trouble that is leading the way lower, with all 3 China related ETFs, FXI EEM KWEB, trying and failing to recover yearly pivots on the weekly close.

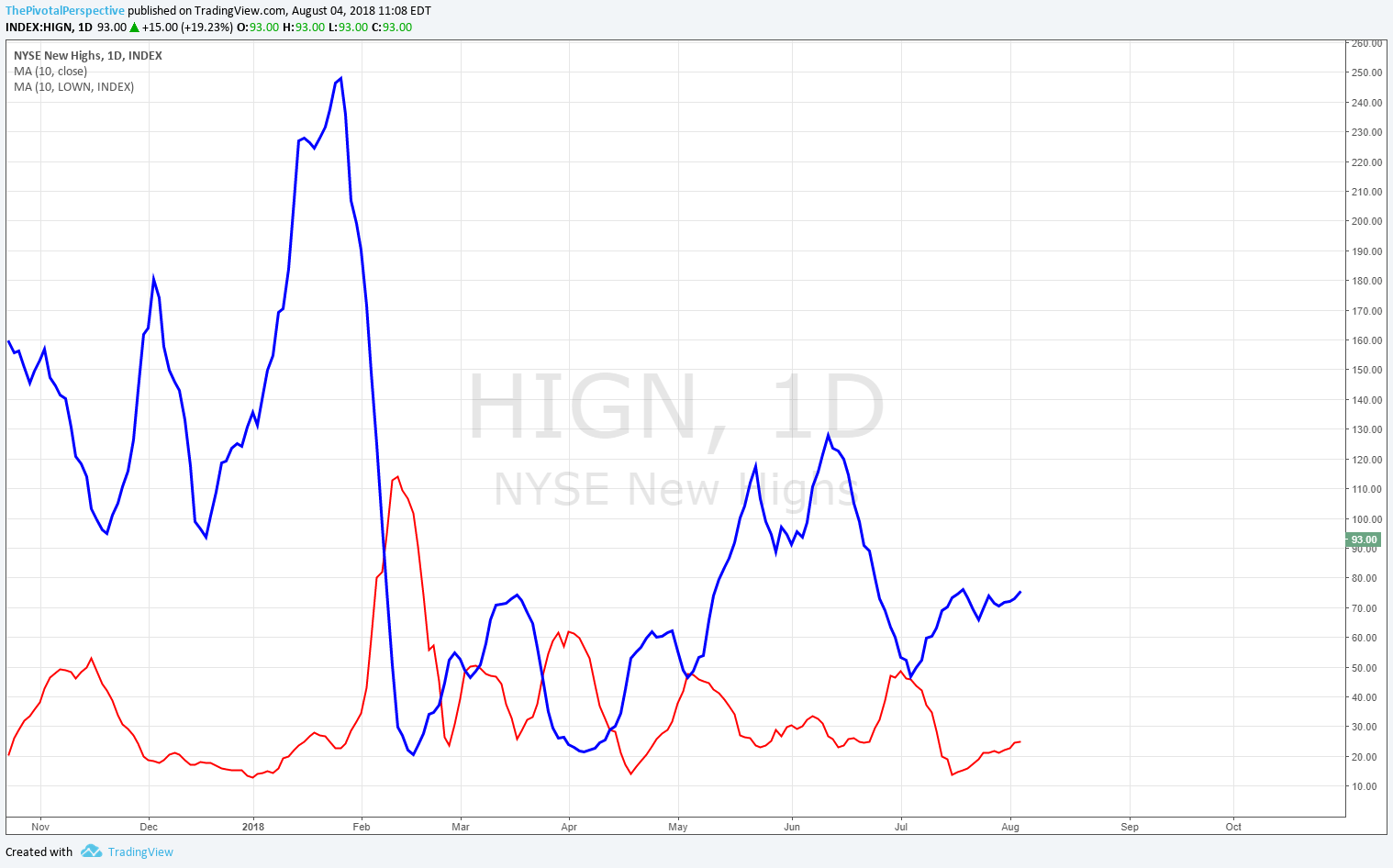

In addition, sentiment while not extreme is starting to be more of a headwind than tailwind, with PC and PCE dropping down to lower end of 2018 ranges. Other indexes like AAII bull bear spread is the 3rd highest since Q2.

Recent long focus has been: SPX, NDX, RUT, XBI, SMH, INDA, USO. If indexes do suggest weakness then hedges could be DJI short, TLT long should it rally back above HP again, or FXI short with maximum risk a daily close under the YP. While not threatening, VIX and VXX have not made lower lows on the recent move higher in indexes, which is some sign that smart money is starting to play for a fade.

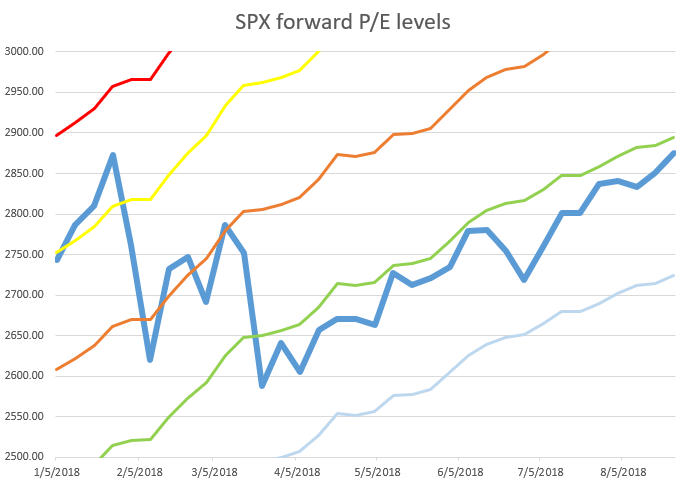

Due to strength of NDX and SPX I do not expect a major top here, but if NDX fails back under its YR2 then the configuration could be more threatening. Until that happens market in buy the dip mode as I think pros are eyeing SPX 3000 area, which is well under 18X forward earnings and very doable.

Bottom line - Often DJI pivots give the definitive tells. The market just stopped at DJI HR1 so taking steps to lock in some gains, or play for a bit of downside while holding longs, should work or will have low cost at worst. In addition, September is known for weakness followed by a strong Q4 especially in bull markets, so a strategy for near term weakness but likely higher highs seems to fit the market here.

PIVOTS

USA main indexes - SPX and NDX cleared long term resistance levels but DJI did not. (RUT had already cleared the prior week.)

Sectors of note - XBI and SMH both recently held key support, and noting this helped the tech trade.

Developed - DAX has had several weekly closes below its YP this year, but what has started to happen is that the weekly 50MA has been starting to roll over with downward slope. Um, this is my technical definition of a bear market. USA may ignore this for a while but not forever. Nikkei is above all pivots and participated in the recent rally but not above January highs yet.

Emerging - As noted above, FXI, EEM and KWEB briefly recovered YPs but failed on weekly close. EWZ and RSX are of course well under YPs. This leaves only ACWI (index but not really trading vehicle) and INDA in any bullish condition, and both above all pivots.

Safe havens - VIX jumped back above its YP last week, but held the MP as support. I'll be watching the new monthly pivot very carefully because VIX above would further confirm to play defense for a bit. TLT has been testing its HP. Rally above, fail, another attempt above and fail. This is a crowded short so may work in a risk off situation. Not sure if metals have bottomed. GLD is above YS1 but GDX has had a very weak bounce and already back near lows, and the same for SLV.

Commodities - Just off the oil lows I noted that it might have been it and bam 2 weeks later back near highs. This has been a strong move and helped risk on sentiment. Big jump came on recovery of HP and then after holding its MP another strong advance.

Currency - Not sure what to make of DXY here. Monthly bar looks bearish, weekly looks ready to rally. YP resistance, so we'll see where the SepP falls.

Cryptos - BTCUSD again testing QP from underneath so a 2nd move above would be bullish and noted by smart money as D200MA is starting to flatten and slope upward. For now edge to bulls as it is above SepP.

OTHER TECHNICALS

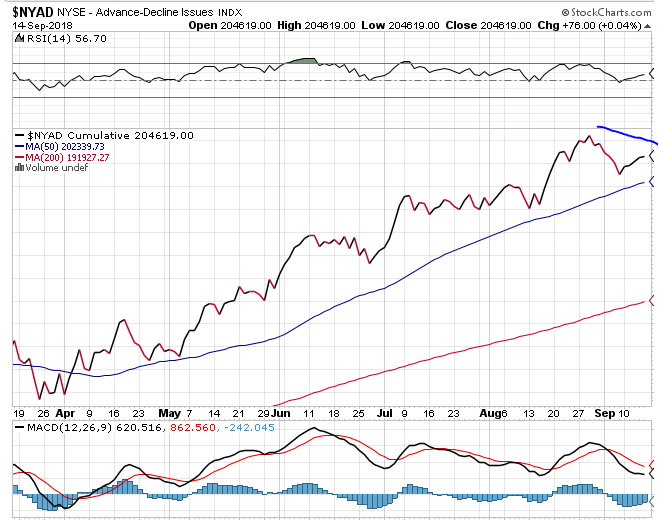

Overbought across the board would mean Q M W D and 2H session ETF charts. This condition there or nearly so on quite a lot of USA main indexes recently.

VALUATION

SPX tagging 17X forward earnings on moving average basis. (Green line 10 week avg of 17X forward earnings, blue line SPX weekly close). Valuation levels still trending up nicely which means rising profits. 18X currently 3075.